How Do Whole Life Insurance Commissions Work Q A Thursdays

How Do Whole Life Insurance Commissions Work Q A Thursdays Ibc Subscribe for more ️ bit.ly ibcsubscribebecome an innovator ️ c ibcglobalinc joinfree policy designer ️ bit.ly 2ri. But typically, life insurance agents receive as commission 60% to 80% of the premiums you pay in the first year. they collect smaller commissions in subsequent years. added up, 5% to 10% of all.

What Is Whole Life Insurance Financial Expert Policy type: agents often receive higher commissions for complex policies such as whole life or universal life insurance due to their longer term nature and additional features. 2. premium amount: commissions are usually calculated as a percentage of the premium paid. For 2019, the net premium written totaled $678.7 billion or an increase of 13%. there are three main classifications of commission structures. 1. a heaped commission structure is designed in such. Whole life premiums generally have the highest commissions; usually, more than 100% of the first year premium and the exact percentage may change depending on the age of the insured. so if an agent sells you a policy with a first year premium of $3,600, it’s likely the insurance company will pay at least that much for a first year commission. Life insurance agent commissions can have an impact on the cost of life insurance policies for consumers. when you purchase a life insurance policy through an agent, the insurer typically pays the agent a commission as compensation for their services. this commission is usually a percentage of the premium you pay for the policy.

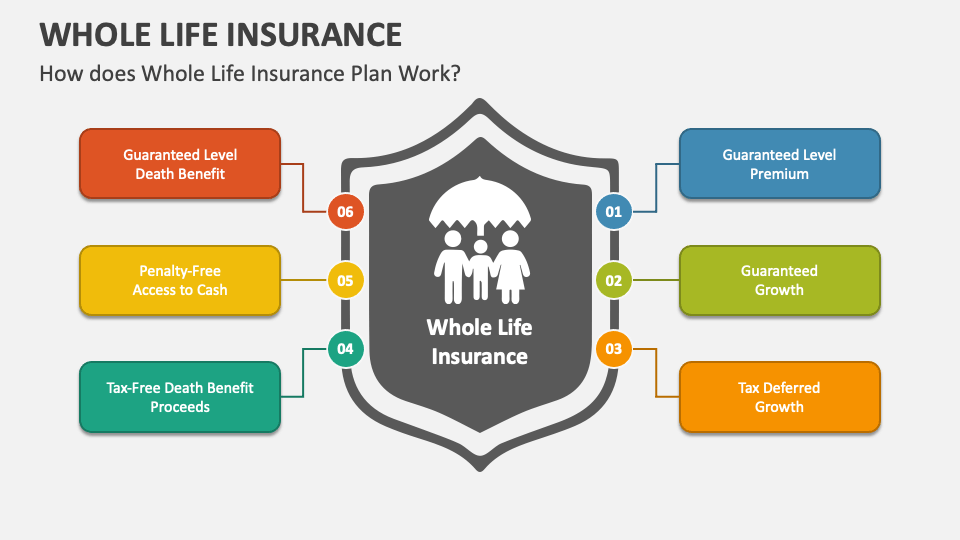

Whole Life Insurance Powerpoint And Google Slides Template Ppt Slides Whole life premiums generally have the highest commissions; usually, more than 100% of the first year premium and the exact percentage may change depending on the age of the insured. so if an agent sells you a policy with a first year premium of $3,600, it’s likely the insurance company will pay at least that much for a first year commission. Life insurance agent commissions can have an impact on the cost of life insurance policies for consumers. when you purchase a life insurance policy through an agent, the insurer typically pays the agent a commission as compensation for their services. this commission is usually a percentage of the premium you pay for the policy. Whole life insurance is a type of permanent life insurance that doesn’t expire. no matter when you die, your loved ones will receive a guaranteed tax free payout in exchange for your premium payments. whole life also includes cash value, a tax deferred savings account you can use to withdraw or borrow funds. Sellers typically receive more than 5% commissions each time they sell one. that doesn't mean most life insurance reps make massive incomes. according to the bureau of labor statistics, the 2021.

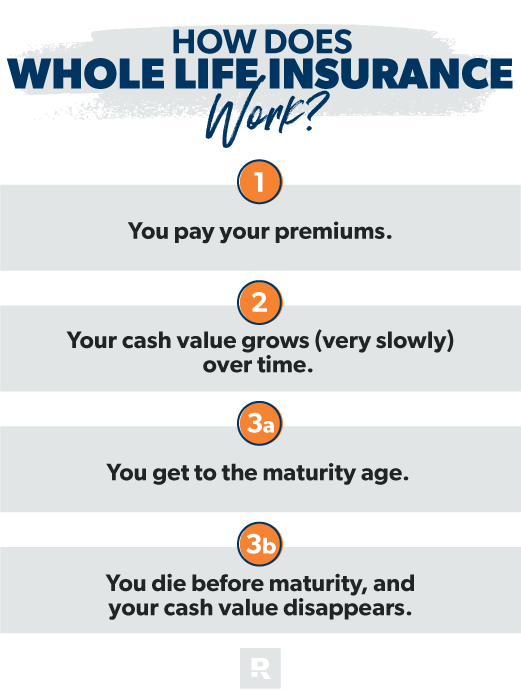

How Does Whole Life Insurance Work Smc Insurance Whole life insurance is a type of permanent life insurance that doesn’t expire. no matter when you die, your loved ones will receive a guaranteed tax free payout in exchange for your premium payments. whole life also includes cash value, a tax deferred savings account you can use to withdraw or borrow funds. Sellers typically receive more than 5% commissions each time they sell one. that doesn't mean most life insurance reps make massive incomes. according to the bureau of labor statistics, the 2021.

Comments are closed.