How To Calculate Depreciation Straight Line Method Depreciation

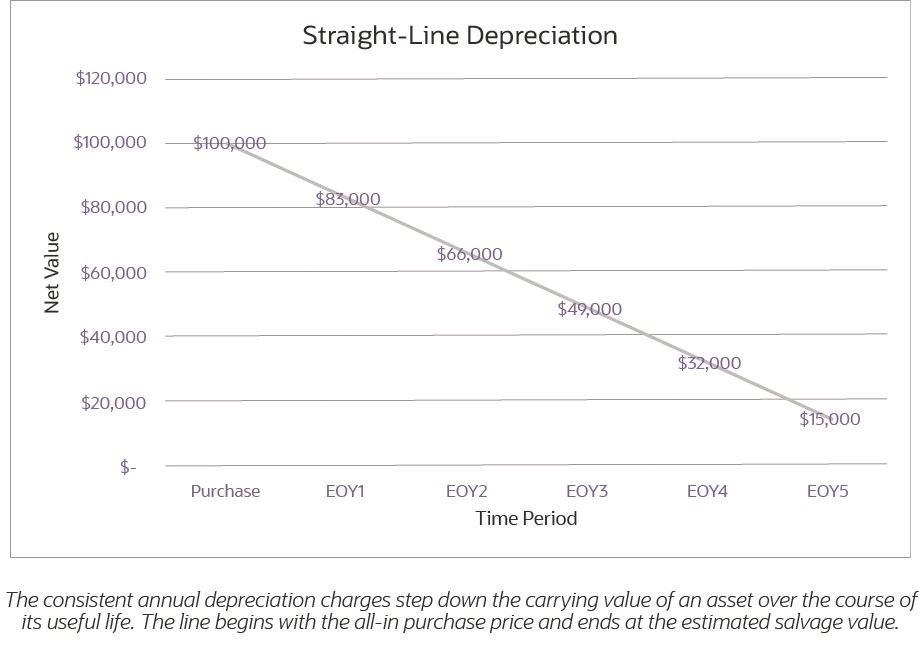

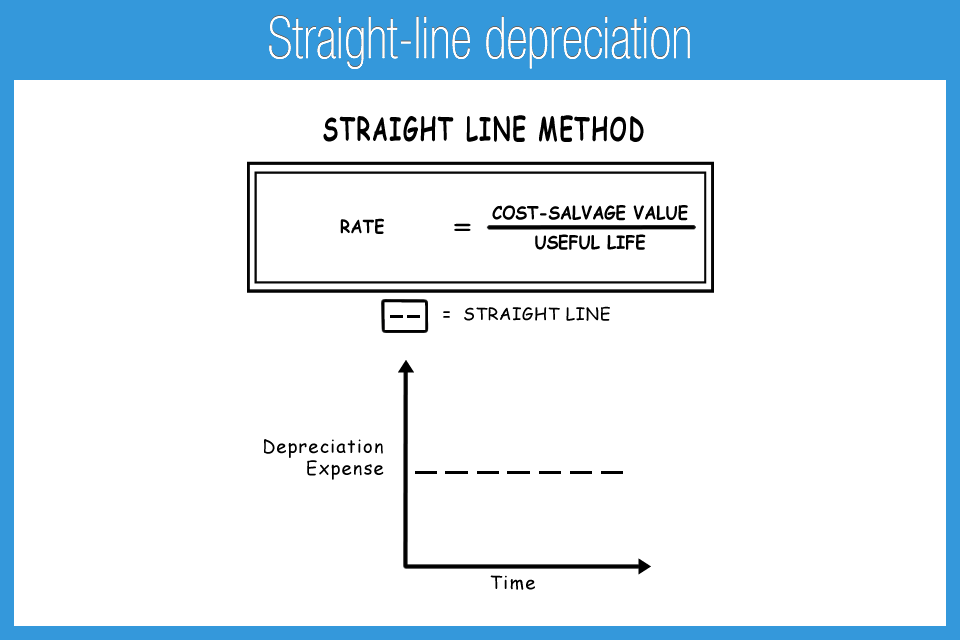

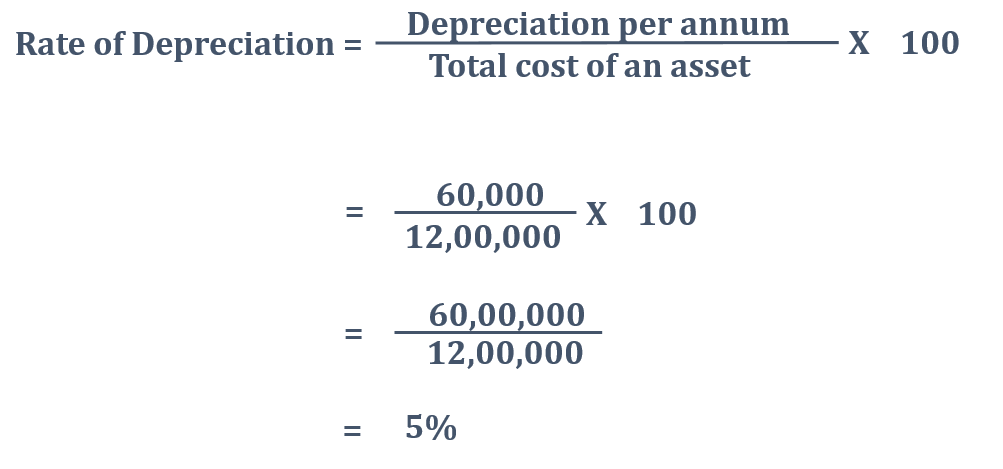

Straight Line Method Of Depreciation Example Arronlillianna The straight-line method is the most basic way to record depreciation It reports an equal depreciation expense each year throughout the entire useful life of the asset until the asset is Real estate depreciation is a method used to deduct market value loss and expenses for each rental property on the appropriate line of Schedule E when you file your annual tax return

What Is Straight Line Depreciation Guide Formula Netsuite Workers need to understand their longevity to ensure they save enough for retirement Life expectancy calculators can help people make an educated estimate of how long they will live People The gap between the depreciated value and what it costs to replace the item is the value of the recoverable depreciation How To Calculate Recoverable Depreciation As an example, let’s consider If you’re completely new to Microsoft Word, you’re probably wondering where to begin You’ve come to the right place because we’ll get you started From what you see in the Word window to In order to work with gradients and straight lines successfully, a good understanding of coordinates and linear graphs is needed The gradient of a line is calculated by dividing the difference in

How To Calculate Book Value With Salvage Value Haiper If you’re completely new to Microsoft Word, you’re probably wondering where to begin You’ve come to the right place because we’ll get you started From what you see in the Word window to In order to work with gradients and straight lines successfully, a good understanding of coordinates and linear graphs is needed The gradient of a line is calculated by dividing the difference in We include products we think are useful for our readers If you buy through links on this page, we may earn a small commission Here’s our process If you’re considering therapy — whether to Property depreciation is typically calculated using the straight-line method, which divides the Accelerated Cost Recovery System (MACRS) to calculate depreciation for residential rental

How To Calculate Depreciation Macroeconomics Haiper We include products we think are useful for our readers If you buy through links on this page, we may earn a small commission Here’s our process If you’re considering therapy — whether to Property depreciation is typically calculated using the straight-line method, which divides the Accelerated Cost Recovery System (MACRS) to calculate depreciation for residential rental

Comments are closed.