How To Calculate Income Tax Step By Step In Tamil а µа аїѓа а ѕа а µа а ї

How To Calculate Income Tax Step By Step In Tamil а µа аїѓа а ѕа How to calculate income tax in a step by step manner?income tax computation has been a daunting task for common people. so, we aim to explain the income tax. Click the link incometaxindia.gov.in pages tools income tax calculator.aspx incometax calculator website this video will be useful for tax assess.

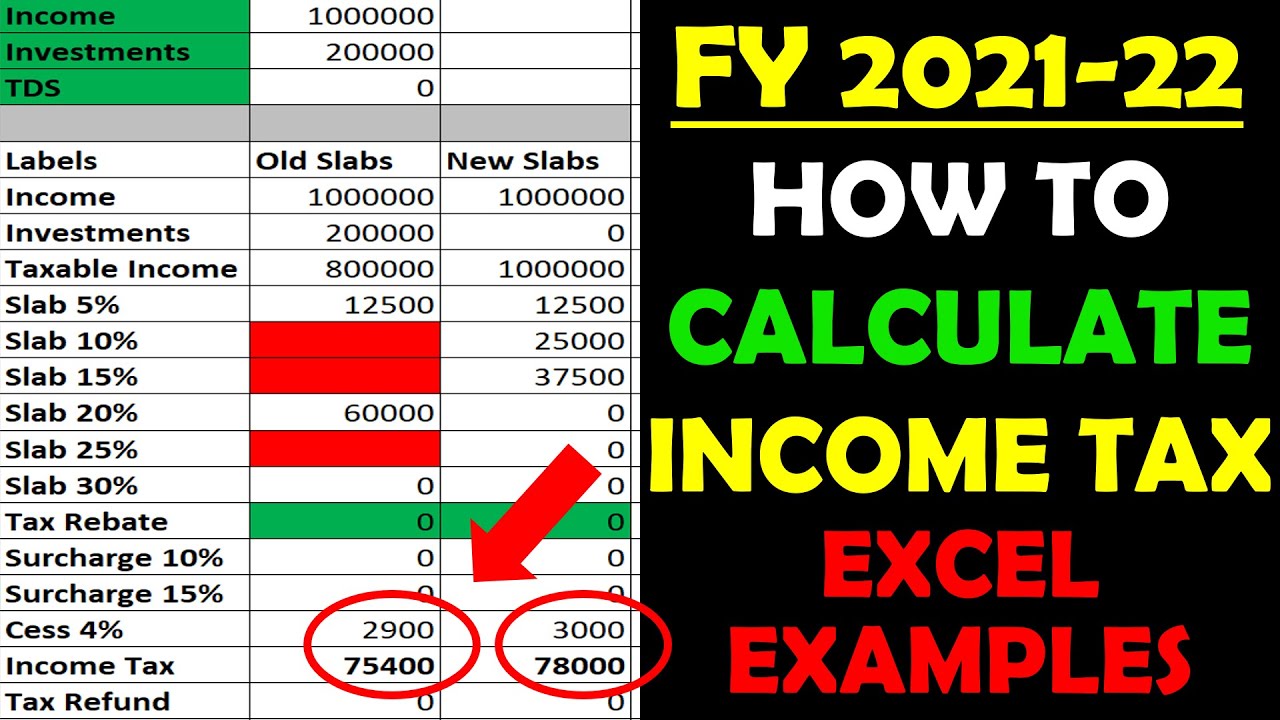

How To Calculate Your Income Tax Step By Step Guide For Income о Following are the steps to use the tax calculator: 1. choose the financial year for which you want your taxes to be calculated. 2. select your age accordingly. tax liability in india differs based on the age groups. 3. click on 'go to next step'. 4. Figuring out how your income tax gets calculated is the first step in finding out how to reduce it.in this video, we tell you the 5 steps that you go through. 0 3 lakh rupees nil tax. 3 7 lakh rupees 5% tax. 7 10 lakh rupees 10% tax. 10 12 lakh rupees 15% tax. 12 15 lakh rupees 20% tax. above 15 lakh rupees 30% tax. as a result of these changes, a salaried employee in the new tax regime stands to save up to rs 17,500 in income tax. B. calculate the tax payable on the total income, excluding additional salary in the year it is received. c. calculate the difference between step 1 and step 2. d. calculate the tax payable on the total income of the year to which the arrears relate, excluding arrears. e.

Excel Sheet For Tax Calculation 0 3 lakh rupees nil tax. 3 7 lakh rupees 5% tax. 7 10 lakh rupees 10% tax. 10 12 lakh rupees 15% tax. 12 15 lakh rupees 20% tax. above 15 lakh rupees 30% tax. as a result of these changes, a salaried employee in the new tax regime stands to save up to rs 17,500 in income tax. B. calculate the tax payable on the total income, excluding additional salary in the year it is received. c. calculate the difference between step 1 and step 2. d. calculate the tax payable on the total income of the year to which the arrears relate, excluding arrears. e. Income tax calculator: easily calculate your taxes online for assessment year 2025 26, fy 2024 25, fy 2023 24 & fy 2022 23 with goodreturns income tax calculator. now it is very easy to. Step 1: calculate your gross income. first, write down the annual gross salary you get. this will include all the components of your salary, including house rent allowance (hra), leave travel allowance (lta), and special allowances, like food coupons and mobile reimbursements. next, take out the exemptions provided on the salary components.

Comments are closed.