How To Calculate Inflation Rate Based On Cpi Haiper

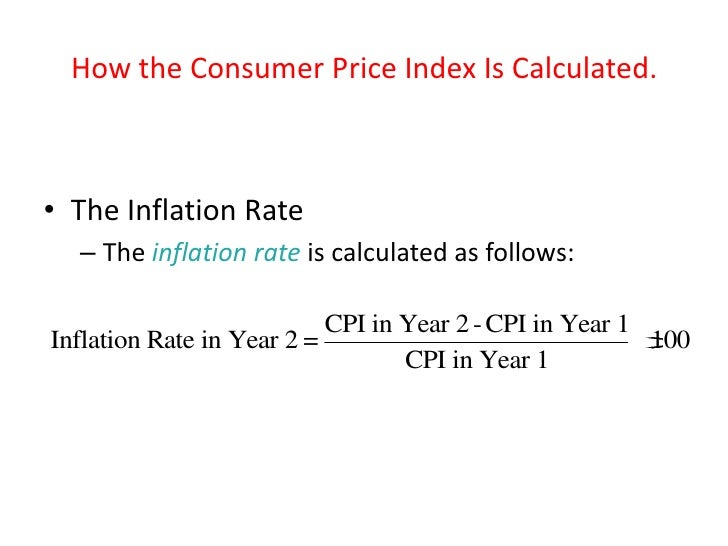

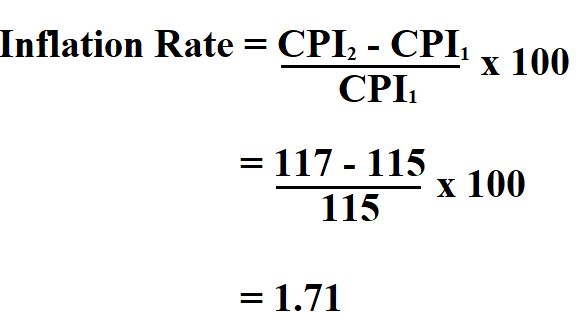

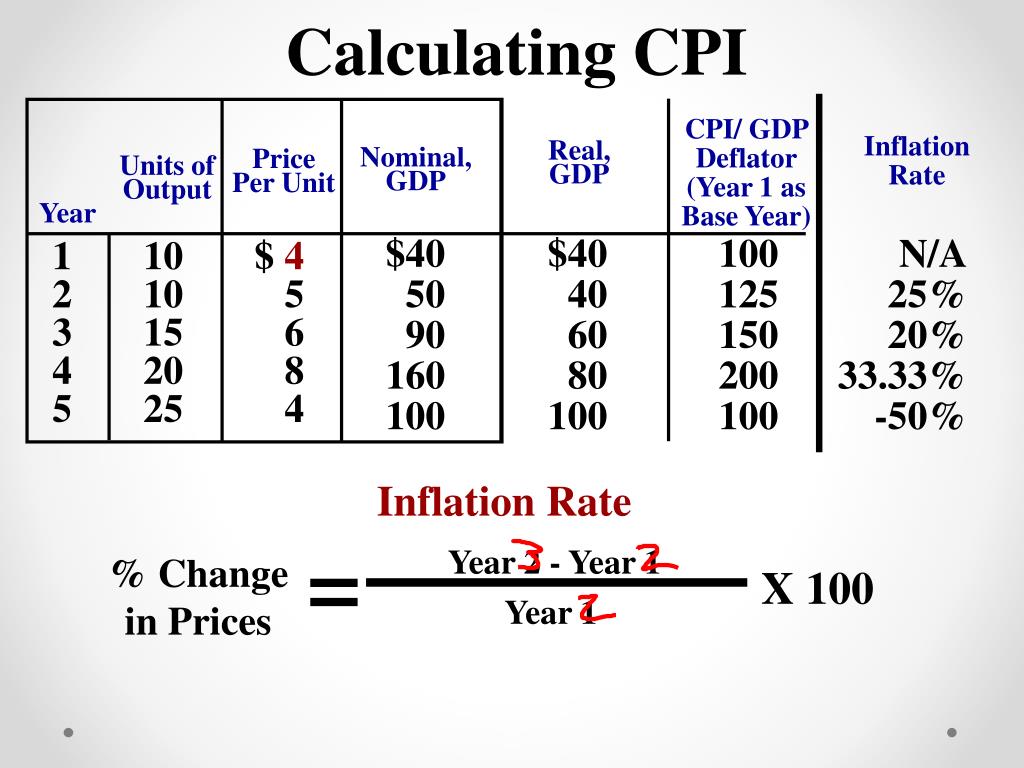

How To Calculate Inflation Rate Based On Cpi Haiper The year-over-year inflation rate was 29% in July 2024 29% of the US population The CPI weighs certain spending categories more than others, based on what people are spending their Miranda is based in Idaho item has seen an inflation rate of 75% since 2000 Use the same principle to calculate the overall inflation rate The Consumer Price Index (CPI) calculates the

How To Calculate Inflation Rate Through Cpi Haiper See how we rate COLAs are based on increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)," the website states The CPI, as a proxy for inflation, can Your "heart rate zones" might be completely wrong Not only are zones defined differently in different apps, they are also usually calculated based on your maximum heart rate And that maximum But even though your unique circumstances may affect the rate you receive, average loan rates across the country tend to rise and fall with inflation This means even the most well-qualified 11 The CPI for September will be released Oct 10 The formula used to calculate the inflation adjustment each year is based on monthly changes for July, August and September for the Consumer

How To Calculate Inflation Rate Using Price Level Haiper But even though your unique circumstances may affect the rate you receive, average loan rates across the country tend to rise and fall with inflation This means even the most well-qualified 11 The CPI for September will be released Oct 10 The formula used to calculate the inflation adjustment each year is based on monthly changes for July, August and September for the Consumer July 2024 CPI inflation: According to MoSPI data, the provisional inflation rate stands at 354% for the entire country, with rural areas experiencing a higher rate of 410% compared to 298% in Though persistent inflation in the US economy has heightened APRs, you could qualify for a lower rate based on your credit scores If you have excellent credit, you may even qualify for a rate If the Federal Reserve is successful in bringing inflation down, it might decide to begin lowering the federal funds rate at some point — and interest rates on consumer products will follow Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term

How To Calculate Inflation Rate In Macroeconomics Haiper July 2024 CPI inflation: According to MoSPI data, the provisional inflation rate stands at 354% for the entire country, with rural areas experiencing a higher rate of 410% compared to 298% in Though persistent inflation in the US economy has heightened APRs, you could qualify for a lower rate based on your credit scores If you have excellent credit, you may even qualify for a rate If the Federal Reserve is successful in bringing inflation down, it might decide to begin lowering the federal funds rate at some point — and interest rates on consumer products will follow Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term

How To Find Inflation Rate In Statistics Haiper If the Federal Reserve is successful in bringing inflation down, it might decide to begin lowering the federal funds rate at some point — and interest rates on consumer products will follow Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term

Comments are closed.