How To Calculate Labor Cost A Full Guide

How To Calculate Labor Cost A Full Guide How to calculate labor cost: a full guide. Paid time off: 2 weeks (80 hours) total annual employee cost = $50,000 $4,000 $6,000 $5,000 = $65,000 total annual hours worked = (40 hours × 50 weeks) = 2,000 hours. hourly labor cost = $65,000 ÷ 2,000 hours = $32.50 per hour. infographic illustrating the steps to calculate hourly labor cost.

How To Calculate Labor Cost A Full Guide Labor cost percentage. labor cost percentage shows your total labor costs as a percentage of total revenue. the formula for calculating labor cost percentage is: labor cost percentage = (total labor cost gross revenue) x 100. aim for a result between 20% and 30%. Labor cost calculator. The ultimate guide to calculating labor cost. Step 3: calculate direct labor cost. once you have both the regular labor costs and additional costs for each employee, you can calculate the direct labor cost for the project. graphic designer: $1,442.31 (regular wages) $207.69 (additional labor costs) = $1,650. copywriter: $1,442.31 (regular wages) $207.69 (additional labor costs) = $1,650.

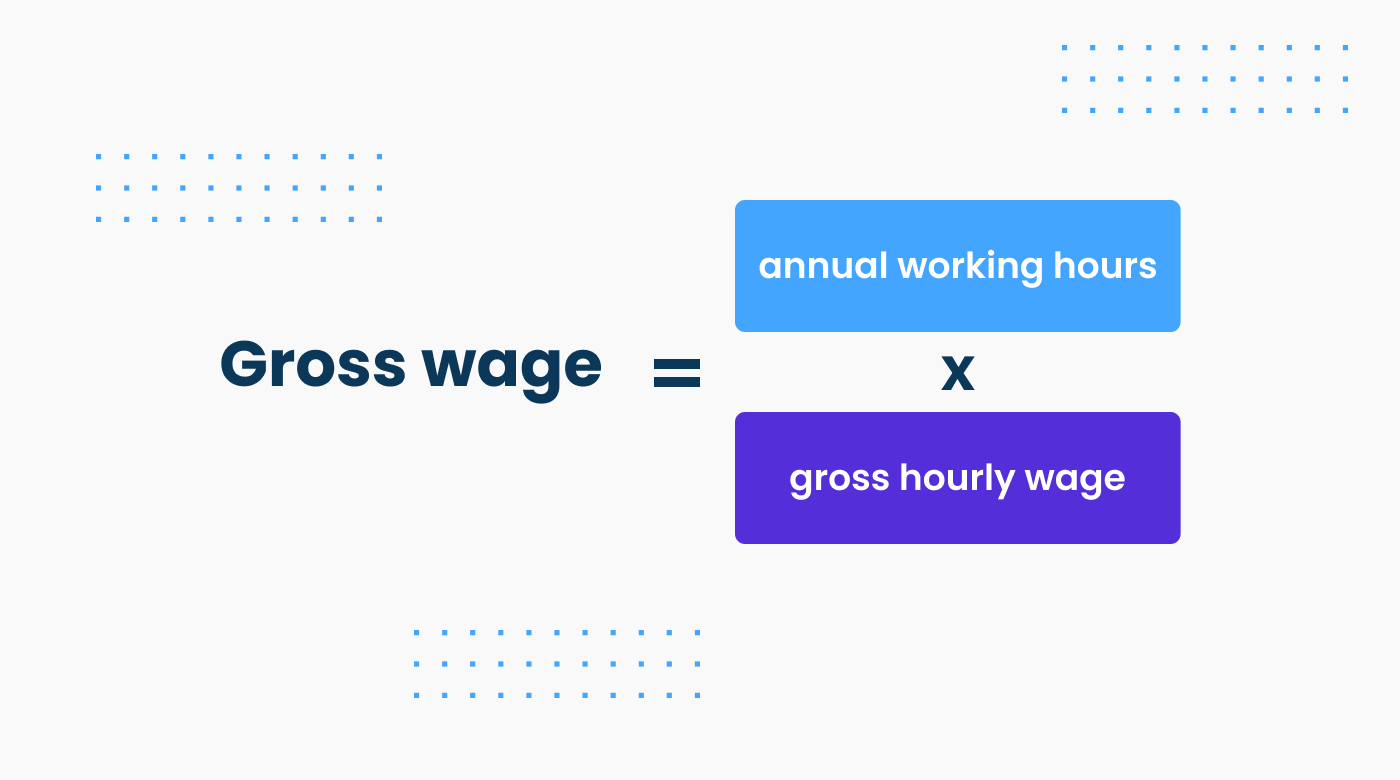

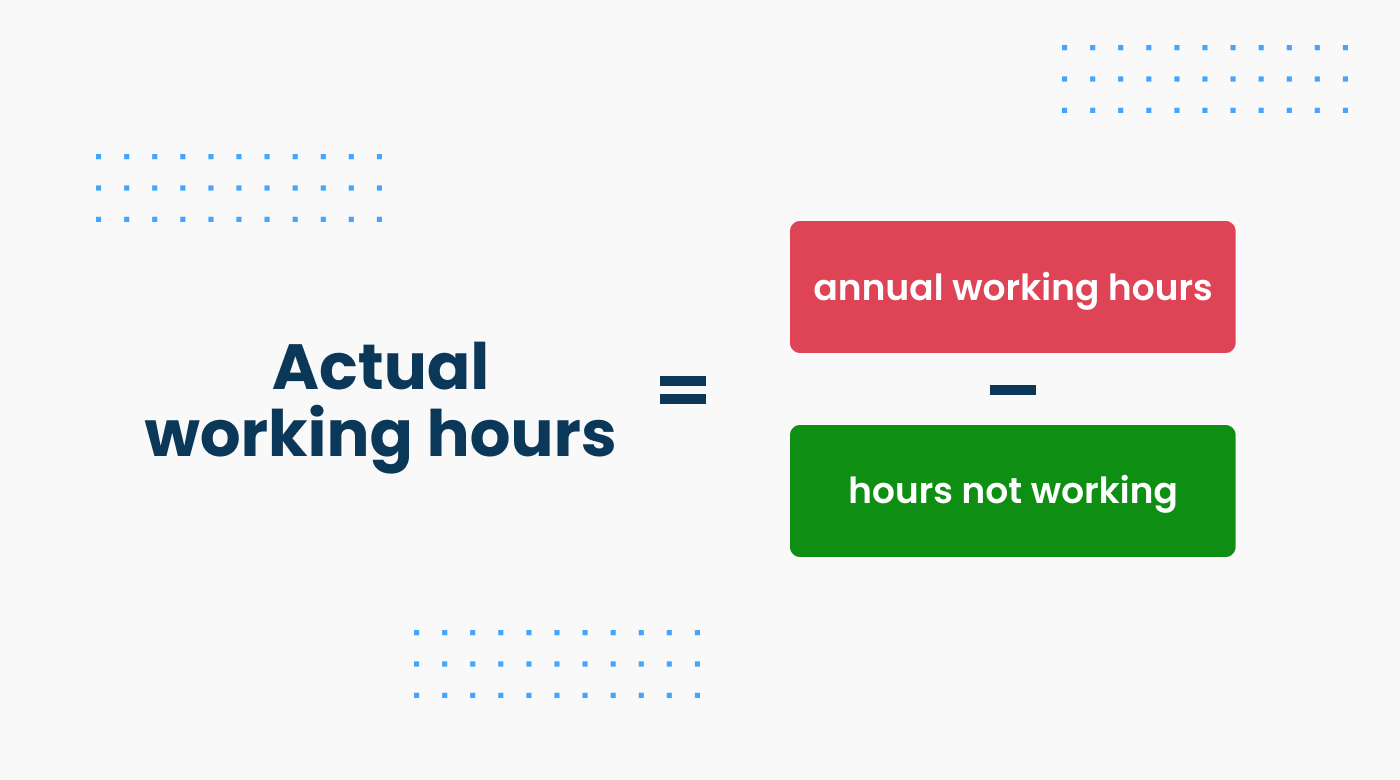

How To Calculate Labor Cost A Full Guide The ultimate guide to calculating labor cost. Step 3: calculate direct labor cost. once you have both the regular labor costs and additional costs for each employee, you can calculate the direct labor cost for the project. graphic designer: $1,442.31 (regular wages) $207.69 (additional labor costs) = $1,650. copywriter: $1,442.31 (regular wages) $207.69 (additional labor costs) = $1,650. Labor cost per hour = (gross pay all annual costs) actual worked hours per year. let’s break down each of these calculations into steps. we’ll use a hypothetical employee, maria, as an example. she is an hourly, non exempt employee, who works full time in a company in california with more than 26 employees. she gets the minimum wage of $13. Calculate direct labor costs. approximately 69% of direct labor costs come from each employee’s total gross pay, which makes them easier to estimate than indirect labor costs. total direct labor costs = total gross payroll all direct, fixed expenses all direct, variable expenses.

How To Calculate Labor Cost A Full Guide Labor cost per hour = (gross pay all annual costs) actual worked hours per year. let’s break down each of these calculations into steps. we’ll use a hypothetical employee, maria, as an example. she is an hourly, non exempt employee, who works full time in a company in california with more than 26 employees. she gets the minimum wage of $13. Calculate direct labor costs. approximately 69% of direct labor costs come from each employee’s total gross pay, which makes them easier to estimate than indirect labor costs. total direct labor costs = total gross payroll all direct, fixed expenses all direct, variable expenses.

How To Calculate Labor Cost A Full Guide

Comments are closed.