How To Calculate Leverage In Forex For Beginners

Trading Forex Leverage For Beginners Your 5 Steps Guide вђў Fx Tech Lab Your margin will be 1% of $100,000, which is $1,000. calculate your margin based leverage by dividing the total transaction by the required margin ($100,000 $1,000). your leverage ratio will be. Forex leverage is a tool that allows traders to open positions that are significantly larger than their initial investment. it is expressed as a ratio, such as 1:50 or 1:100. for example, with a leverage ratio of 1:50, a trader can control a position that is 50 times larger than their capital. this means that for every $1 invested, they can.

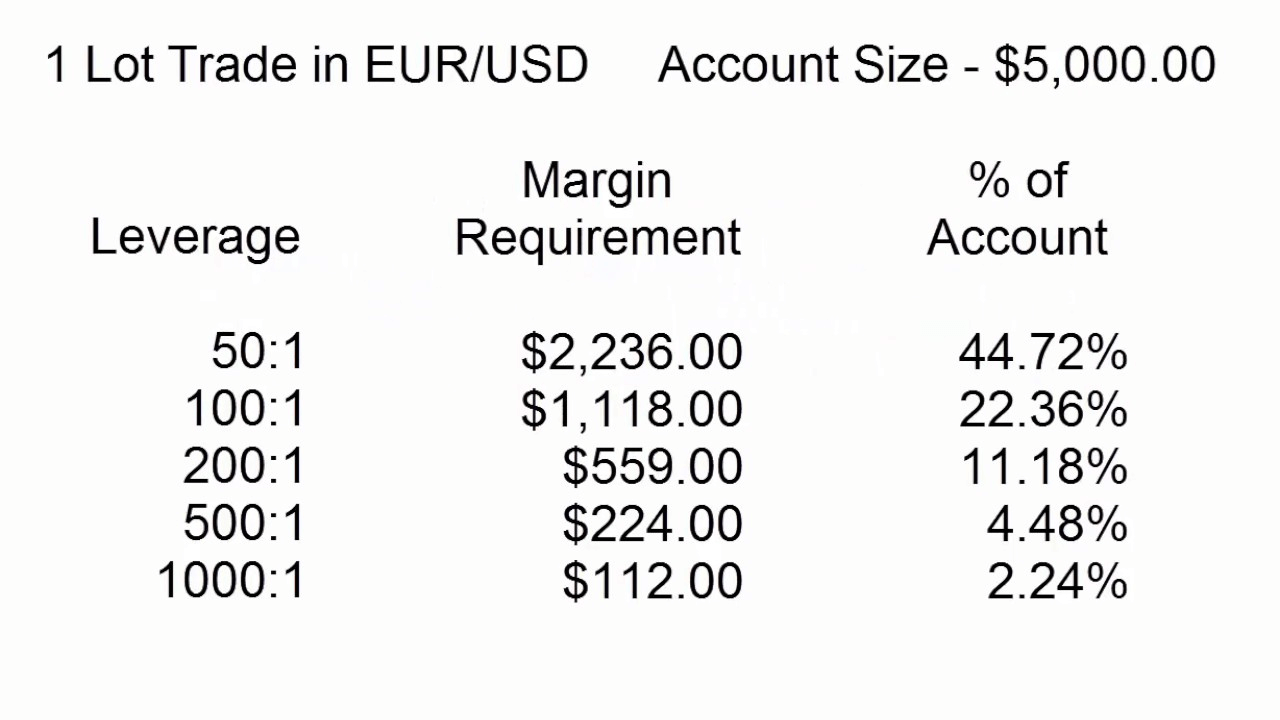

What Is The Leverage In Forex Tradingonlineguide Step 1: determine the leverage ratio. the first step in calculating leverage is to determine the leverage ratio provided by your broker. this information is usually provided in the account opening documents or on the broker’s website. leverage ratios can vary significantly between brokers, so it’s important to choose a ratio that suits your. Leverage is a tool used by traders that enables them to control a large amount of capital by putting down a much smaller amount. unlike traditional investing, where you must tie up the full value of your position, with leveraged trading you only have to put up a smaller portion, known as margin. in the case of 50:1 leverage, for example, you. The easiest three rules of leverage are as follows: maintain low levels of leverage. use trailing stops to reduce downside and protect capital. limit capital to 1% to 2% of total trading capital. Tmafx forex leverage is a great tool for beginners in forex trading to understand. in this video i will explain everything you need to know about.

Comments are closed.