How To Calculate Overtime Earnings From Hourly Pay Rate Formula For Calculating Overtime Pay

How To Calculate Overtime Earnings From Hourly Pay Rate Formu In this video we discuss how to calculate overtime earnings for employees earning an hourly wage rate. we go through the typical time and a half pay and do. Use the following steps to calculate your overtime pay with this scenario: 1. calculate your regular hourly rate. start by dividing your weekly salary by the total number of hours you worked. perform the following calculation: weekly salary total hours worked = regular hourly rate $600 60 hours = $10 per hour. 2.

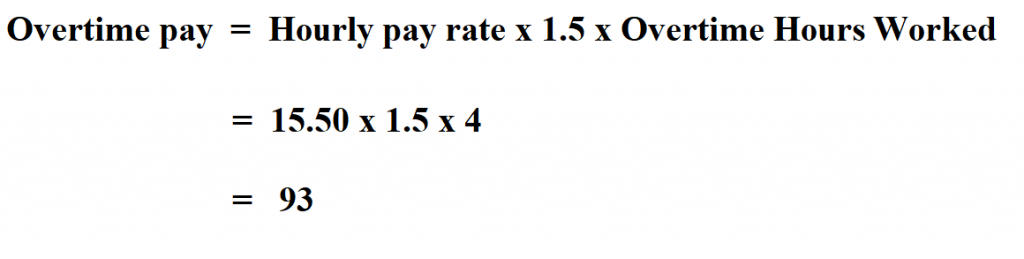

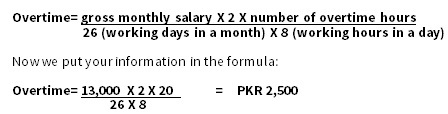

How To Calculate Overtime Pay The basic overtime formula is (hourly rate) × (overtime multiplier) × (number of overtime hours worked in a particular week). the overtime calculator uses the following formulae: regular pay per period (rp) = regular hourly pay rate × standard work week. overtime pay rate (otr) = regular hourly pay rate × overtime multiplier. To find this number: calculate the product of the overtime monthly hours and the pay multiplier: 10 × 1.5 = 15. divide the result by your regular monthly hours: 15 160 = 0.0938. to find your pay, multiply the result by your monthly salary. the result corresponds to 9.38% of that amount. The employee’s total pay due, including the overtime premium, for the workweek can be calculated as follows: $1,200 40 hours = $30 regular rate of pay. $30 x 1.5 = $45 overtime premium rate of pay. $45 x 2 overtime hours = $90 overtime premium pay. $1,200 $90 = $1,290 total pay due. Step 1: because the tip credit was taken, use the full minimum wage to calculate the overtime rate. $7.25 x 1.5 = $10.88. step 2: subtract the appropriate tip credit from the overtime rate to achieve the adjusted overtime rate and multiply by the number of overtime hours worked that week.

How To Calculate Overtime Pay Quickbooks The employee’s total pay due, including the overtime premium, for the workweek can be calculated as follows: $1,200 40 hours = $30 regular rate of pay. $30 x 1.5 = $45 overtime premium rate of pay. $45 x 2 overtime hours = $90 overtime premium pay. $1,200 $90 = $1,290 total pay due. Step 1: because the tip credit was taken, use the full minimum wage to calculate the overtime rate. $7.25 x 1.5 = $10.88. step 2: subtract the appropriate tip credit from the overtime rate to achieve the adjusted overtime rate and multiply by the number of overtime hours worked that week. Overtime is the additional work an employee performs beyond their regular working hours, which are often set at 40 hours per week in many countries.this extra time is typically compensated at a higher rate than the standard pay, commonly at time and a half, or 1.5 times the regular hourly rate. Calculate overtime pay for an hourly employee. the paper company paid tom a production bonus of $200. he worked 48 hours this week and is paid a $9 hourly rate. regular earnings: 48 (all hours worked) x $9 (the hourly rate) = $432; $432 (regular earnings) 200 bonus; $632 total gross earnings; overtime pay. $632 ÷ 48 hours = regular rate of $13.17.

Formula For Calculating Overtime Pay Overtime is the additional work an employee performs beyond their regular working hours, which are often set at 40 hours per week in many countries.this extra time is typically compensated at a higher rate than the standard pay, commonly at time and a half, or 1.5 times the regular hourly rate. Calculate overtime pay for an hourly employee. the paper company paid tom a production bonus of $200. he worked 48 hours this week and is paid a $9 hourly rate. regular earnings: 48 (all hours worked) x $9 (the hourly rate) = $432; $432 (regular earnings) 200 bonus; $632 total gross earnings; overtime pay. $632 ÷ 48 hours = regular rate of $13.17.

Comments are closed.