How To Calculate Position Sizing And Risk Management Per Trade

How To Calculate Position Sizing What Is The Best Way Proper position sizing is key to managing risk and to avoid blowing out your account on a single trade. with a few simple inputs, our position size calculator will help you find the approximate amount of currency units to buy or sell to control your maximum risk per position. to use the position size calculator, enter the currency pair you are. If you buy a stock at 50, your stop triggers at 46 or 46.50. next, determine your position size. simply divide your dollars risked by your risk percentage. that gives you a position size of.

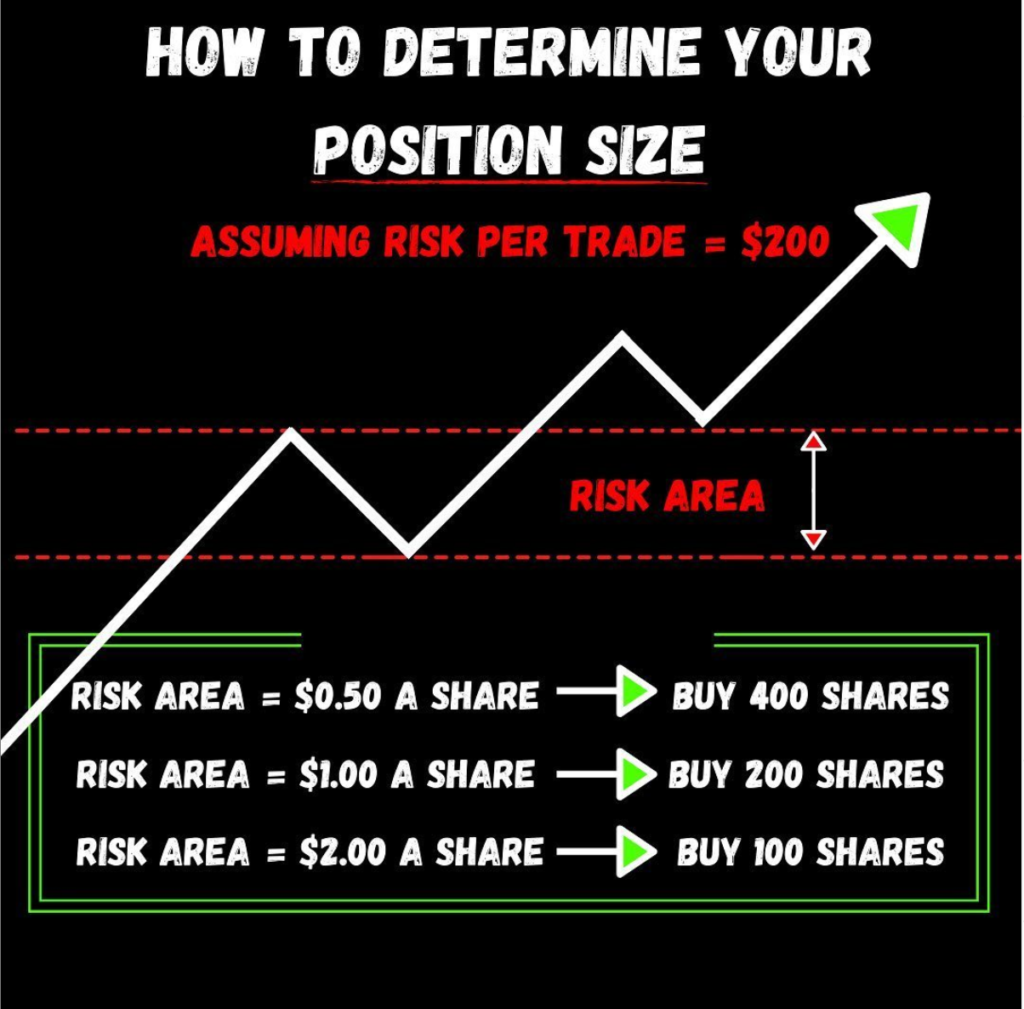

Position Sizing For Your Stock Trades Position Size Formula Example Position size = (account value x risk per trade) pips at risk) pip value per standard lot. example of position size calculation. demonstrating the principle of position sizing, consider a trader who has an account balance of $10,000 and is comfortable risking 1% per trade. this means that for any given trade, they would be putting $100 at risk. The fixed risk per trade approach removes this risk by setting a cap on the maximum portfolio risk. 4. the kelly criterion. the kelly criterion is a formula that was developed by john l. kelly and is widely used by traders and gamblers to determine the position size for each trade bet. the formula is as follows: kelly formula . where. For example, assume you are using a 1% risk per trade position sizing model, and you’ve got $100,000 allocated to the trading system. the risk you want to take on the next trade is 1% of $100,000 or $1,000. if your target entry price is $20 share and your stop loss is at $18 share then your risk is $2 per share. Step 1: determine your risk per trade. decide how much of your total capital you’re willing to risk on a single trade. for instance, if your portfolio is $50,000 and you’re willing to risk 1%, your risk per trade would be $500. step 2: calculate the risk per share. subtract the stop loss from the entry price for a long position, or subtract.

The Art Of Position Sizing Read This Before Your Next Trade Bulls On For example, assume you are using a 1% risk per trade position sizing model, and you’ve got $100,000 allocated to the trading system. the risk you want to take on the next trade is 1% of $100,000 or $1,000. if your target entry price is $20 share and your stop loss is at $18 share then your risk is $2 per share. Step 1: determine your risk per trade. decide how much of your total capital you’re willing to risk on a single trade. for instance, if your portfolio is $50,000 and you’re willing to risk 1%, your risk per trade would be $500. step 2: calculate the risk per share. subtract the stop loss from the entry price for a long position, or subtract. For example, if an investor has a $25,000 account and decides to set their maximum account risk at 2%, they cannot risk more than $500 per trade (2% x $25,000). Position sizing is vital to managing risk and avoiding the destruction of your portfolio with a single trade. our position size calculator will help you figure out the proper number of shares to buy or sell in order to maximize your return and limit your risk. the oxford club (the publisher of investment u) recommends putting no more than 4% of.

Comments are closed.