How To Draft An Answer To A Debt Collection Lawsuit 2021 Update

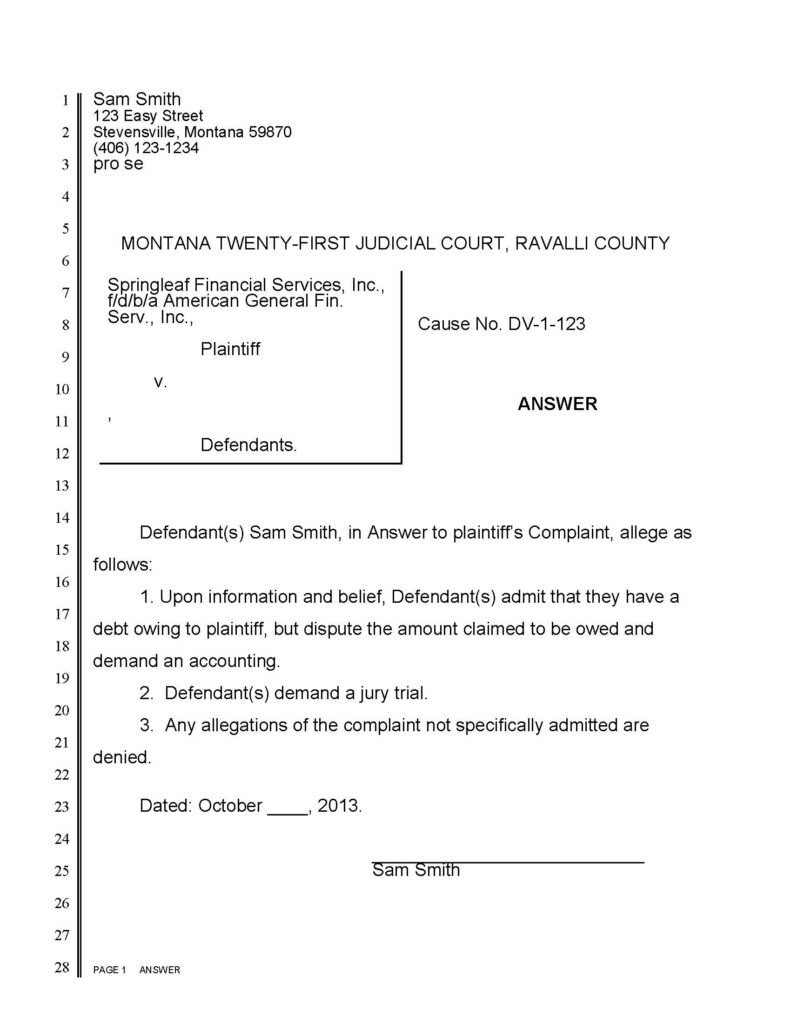

How To Draft An Answer To A Debt Collection Lawsuit 2021 Update Youtube Step by step instructions on how to draft an answer to a debt collection lawsuit.🌟 are you ready to break free from the chains of debt?🚀 take control of yo. Step 1 – the caption. part of being able to draft an answer is simply understanding exactly how the document is set up and what it needs to look like. below is an example of what is known as the caption of the answer: this caption is an example from a local court here in arizona. however, the caption for most courts look similar.

Answer To Debt Collection Lawsuit Template Most people get around 20 to 30 days to file their written answer to the lawsuit with the appropriate court. you’ll also have to hand deliver or mail a copy to the plaintiff’s lawyer. in the answer, you have to respond to the allegations that the plaintiff made in the complaint by: admitting the allegations you believe are true. Fortunately, you can respond to a debt collection lawsuit and avoid a protracted legal battle. here’s how to respond to the lawsuit and settle before going to court. 1. file an answer with the court. you may have as little as two weeks to file an answer with the court, depending on your state’s deadline to file. Court papers to you), you have 20 days to file your answer. you have 30 days if you received them any other way (for example, if you received the. in the mail or they were left with someone you live with). you must go to the clerk’s office in. e civil courthouse in the county where the case was filed. this can be found at the top of the. An answer helps you to retain your rights in the case and allows you to stay informed of any further or future litigation surrounding it. in a proper answer to a debt collection lawsuit complaint and summons, you should type or clearly write your response. the common responses are that you either admit, deny, or lack knowledge of the statements.

How To Draft An Answer To A Debt Collection Lawsuit Youtube Court papers to you), you have 20 days to file your answer. you have 30 days if you received them any other way (for example, if you received the. in the mail or they were left with someone you live with). you must go to the clerk’s office in. e civil courthouse in the county where the case was filed. this can be found at the top of the. An answer helps you to retain your rights in the case and allows you to stay informed of any further or future litigation surrounding it. in a proper answer to a debt collection lawsuit complaint and summons, you should type or clearly write your response. the common responses are that you either admit, deny, or lack knowledge of the statements. Go here to win your lawsuit by settling: bit.ly 3id41g2respond to your debt lawsuit: bit.ly 3tvv4ywquestions? ask here for fastest response:. So, this may be a good time to offer a substantially reduced payment in full settlement of the debt. settling will save the debt collector time, court costs, and uncertainty. so, a settlement can be a win win. the debt was discharged in bankruptcy. ideally, the debt will have been listed in your bankruptcy schedules.

6 Tips For Drafting The Answer In A Debt Collection Lawsuit Youtube Go here to win your lawsuit by settling: bit.ly 3id41g2respond to your debt lawsuit: bit.ly 3tvv4ywquestions? ask here for fastest response:. So, this may be a good time to offer a substantially reduced payment in full settlement of the debt. settling will save the debt collector time, court costs, and uncertainty. so, a settlement can be a win win. the debt was discharged in bankruptcy. ideally, the debt will have been listed in your bankruptcy schedules.

Comments are closed.