How To Fill Form 15g Form 15g For Pf Withdrawal And Also Upload A Cheque Photo

How To Fill Form 15g For Pf Withdrawal If you are wondering how to fill out form 15g for pf withdrawal, follow the steps given below: firstly, log in to the epfo uan portal. then, select ‘online services’ and click on ‘claim’. for verification, enter your bank account number and click on ‘verify’. press on ‘upload form 15g’ below the ‘i want to apply for’ option. Step 1: log in to the epfo uan portal, click on the ‘online services’ option and select ‘claim’. step 2: now, you need to enter the last 4 digits of your registered bank account for verification. step 3: search for the “upload form 15g” option to obtain the form downloaded on your desktop or mobile.

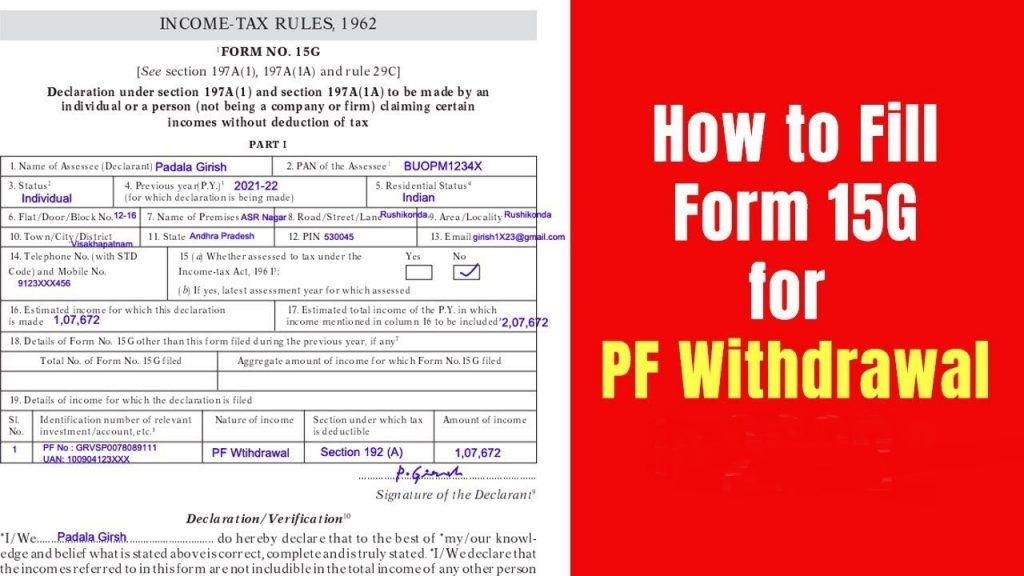

Sample Filled Form 15g For Pf Withdrawal In 2022 The first part is meant for individuals who want to claim no deduction of tds on certain incomes. the following are the fields you need to fill out in the first segment of form 15g: field (1) name of the assessee (declarant) – name as mentioned on your pan card. field (2) pan of the assessee: valid pan card is mandatory to file form 15g. Once you fill out the 15g form, you must upload the pre filled form 15g for pf withdrawal pdf on the online portal of epfo uan. pf withdrawals: is form 15g a mandatory requirement? if you intend to withdraw your pf amount, it is compulsory to submit form 15g for pf withdrawal. this ensures no tds deduction occurs on the amount being withdrawn. Form 15g is mandatory if you want to avoid deduction from the pf withdrawal amount. according to section 192a of the finance act 2015, pf withdrawal attracts tds if the withdrawal amount exceeds rs.50,000, and your employment tenure is less than 5 years. The employee provident fund (epf) form 15 g is a special variation of form 15g that is used for withdrawals from the epf. epf members can declare that their entire income, including interest from epf, is below the taxable threshold set by the income tax department by filling out this form.

How To Fill New Form 15g Or Form 15h For Pf Withdrawal Form 15g is mandatory if you want to avoid deduction from the pf withdrawal amount. according to section 192a of the finance act 2015, pf withdrawal attracts tds if the withdrawal amount exceeds rs.50,000, and your employment tenure is less than 5 years. The employee provident fund (epf) form 15 g is a special variation of form 15g that is used for withdrawals from the epf. epf members can declare that their entire income, including interest from epf, is below the taxable threshold set by the income tax department by filling out this form. Step 5: download form 15g from here. step 6: fill the form 15g and verify the details. step 7: convert the form into pdf. step 8: complete the process by uploading the pdf format of the form. instructions to fill out the form 15g. form 15g has two sections. Form 15g for provident fund (pf) withdrawal is a self declaration form which ensures the applicant that there will be no deduction of tds (tax deduction at source), if they withdraw their.

Comments are closed.