How To Fill Out Schedule Se Irs Form 1040

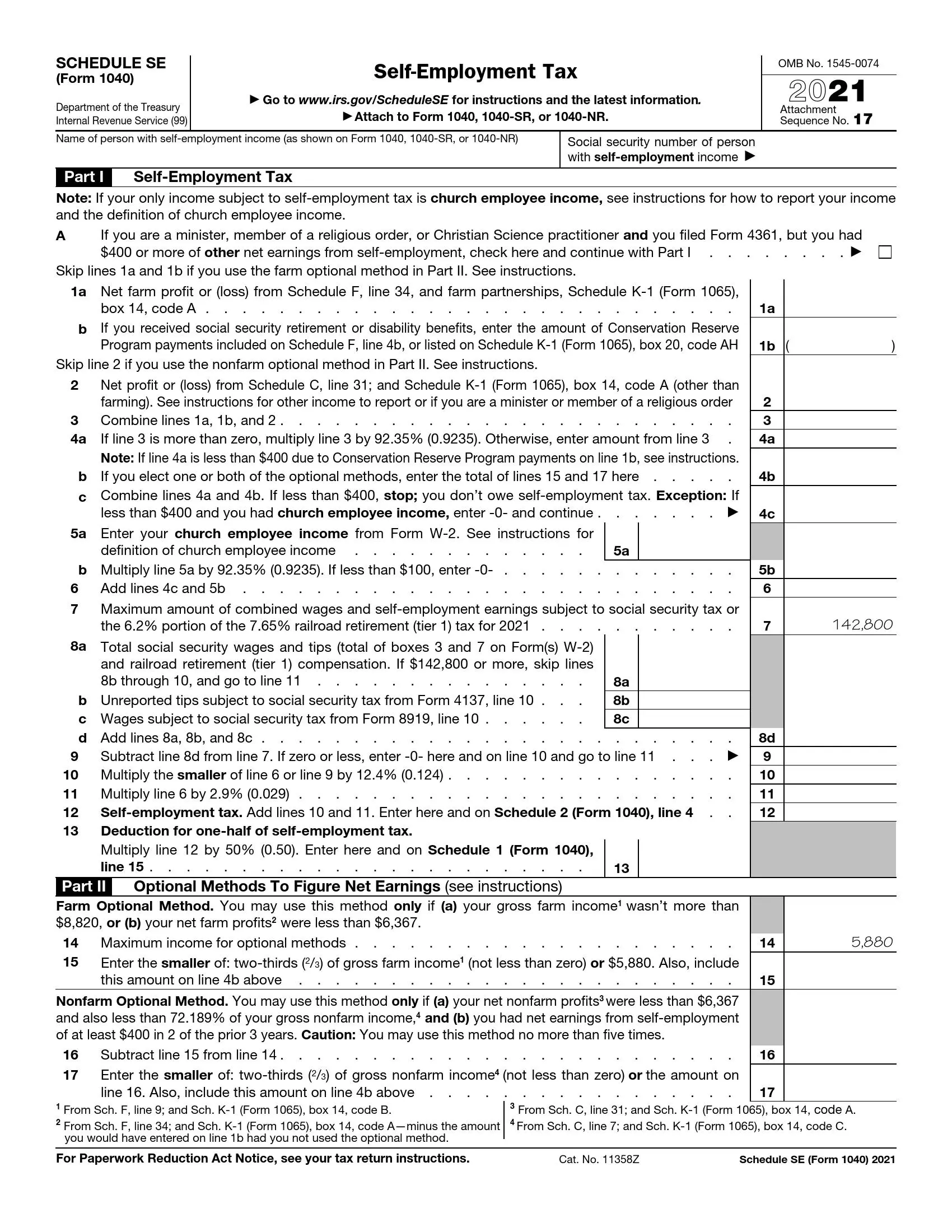

юааirsюаб юааscheduleюаб юааseюаб юааformюаб юаа1040юаб тйб юааfillюаб юааoutюаб Printable Pdf Forms If the total of lines 1a and 2 is $434 or more, file schedule se (completed through line 4c) with your tax return. enter 0 on schedule 2 (form 1040), line 4.*. if the total of lines 1a and 2 is less than $434, don’t file schedule se unless you choose to use an optional method to figure your se tax. Learn how to fill out schedule se in this video. schedule se—also known as irs form 1040—is how self employed individuals pay payroll, medicare, and social s.

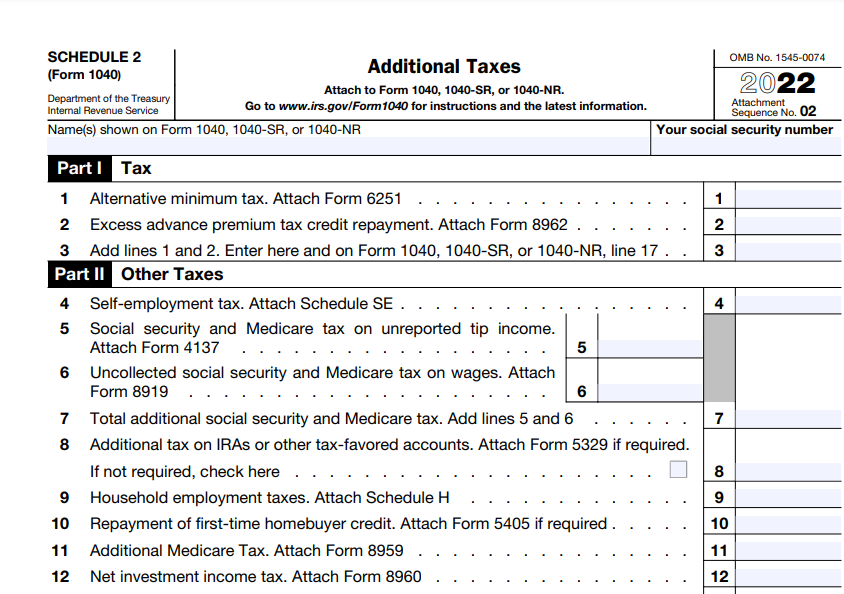

Fillable Schedule Se Form Printable Forms Free Online Español. use schedule se (form 1040) to figure the tax due on net earnings from self employment. the social security administration uses the information from schedule se to figure your benefits under the social security program. this tax applies no matter how old you are and even if you are already getting social security or medicare benefits. This form will he if you’re running a side hustle or starting a full business, you need to start filling out irs form 1040 schedule se (self employed taxes). Individuals use irs schedule se to figure out how much self employment tax they owe. schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. you use it to calculate your total self employment tax, which you must report on another schedule of form 1040— schedule 2 (part ii, line 4). For 2023, the maximum amount of self employment income subject to social security tax is $160,200. form 1040 ss, part v and part vi, have been replaced. for 2023, schedule se (form 1040) is available to be filed with form 1040 ss, if applicable. for additional information, see the instructions for form 1040 ss.

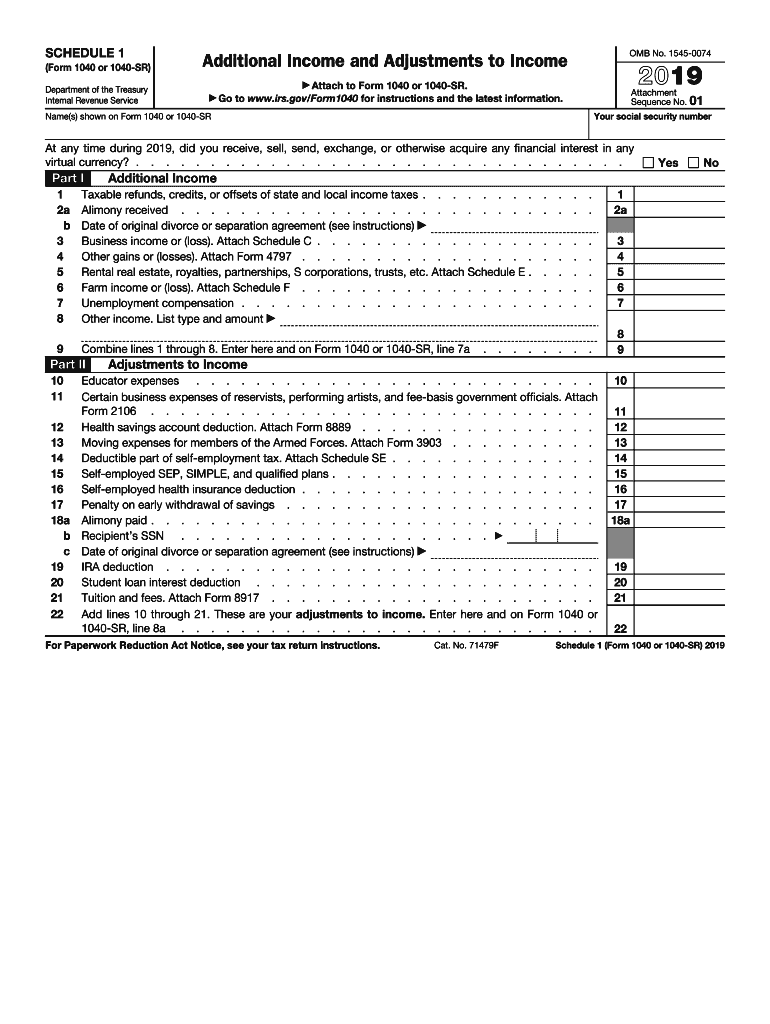

юааirsюаб юааformюаб юаа1040юаб Nr тйб юааfillюаб юааoutюаб Printable Pdf Forms Online 47 Off Individuals use irs schedule se to figure out how much self employment tax they owe. schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. you use it to calculate your total self employment tax, which you must report on another schedule of form 1040— schedule 2 (part ii, line 4). For 2023, the maximum amount of self employment income subject to social security tax is $160,200. form 1040 ss, part v and part vi, have been replaced. for 2023, schedule se (form 1040) is available to be filed with form 1040 ss, if applicable. for additional information, see the instructions for form 1040 ss. Self employment tax is 15.3% of your net earnings. this is made up of 12.4% for social security tax and 2.9% for medicare tax. 3. fill out key self employment tax forms. schedule c (form 1040): reports your self employment income and expenses; schedule se (form 1040): calculates how much you owe in self employment tax. Self employment tax is calculated using schedule se, a part of your personal tax return (form 1040 1040 sr). self employment tax is based on your business income. the amount you must pay for self employment tax depends on the profit or loss of your business for the tax year.

Irs 1040 Schedule 1 2019 Fill And Sign Printable Template Online Self employment tax is 15.3% of your net earnings. this is made up of 12.4% for social security tax and 2.9% for medicare tax. 3. fill out key self employment tax forms. schedule c (form 1040): reports your self employment income and expenses; schedule se (form 1040): calculates how much you owe in self employment tax. Self employment tax is calculated using schedule se, a part of your personal tax return (form 1040 1040 sr). self employment tax is based on your business income. the amount you must pay for self employment tax depends on the profit or loss of your business for the tax year.

Comments are closed.