How To Fill Rtgs Neft On Central Bank Of India Central Bank Rtgs Fo

Rtgs Form Of Central Bank Of India How To Fill Rtgs Neft F Application for funds transfer rtgs neft. Neft central bank of india neft.

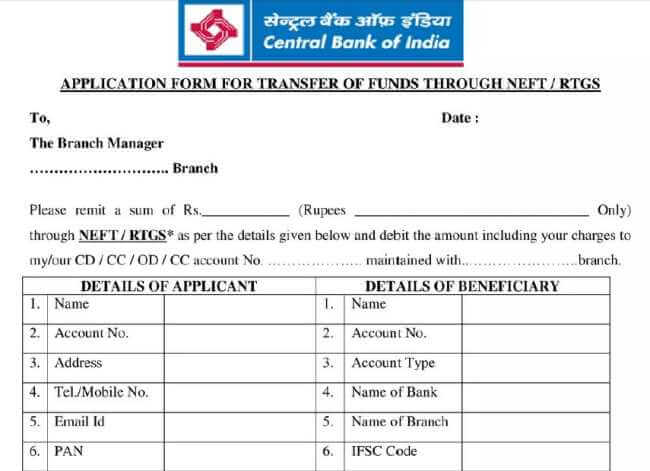

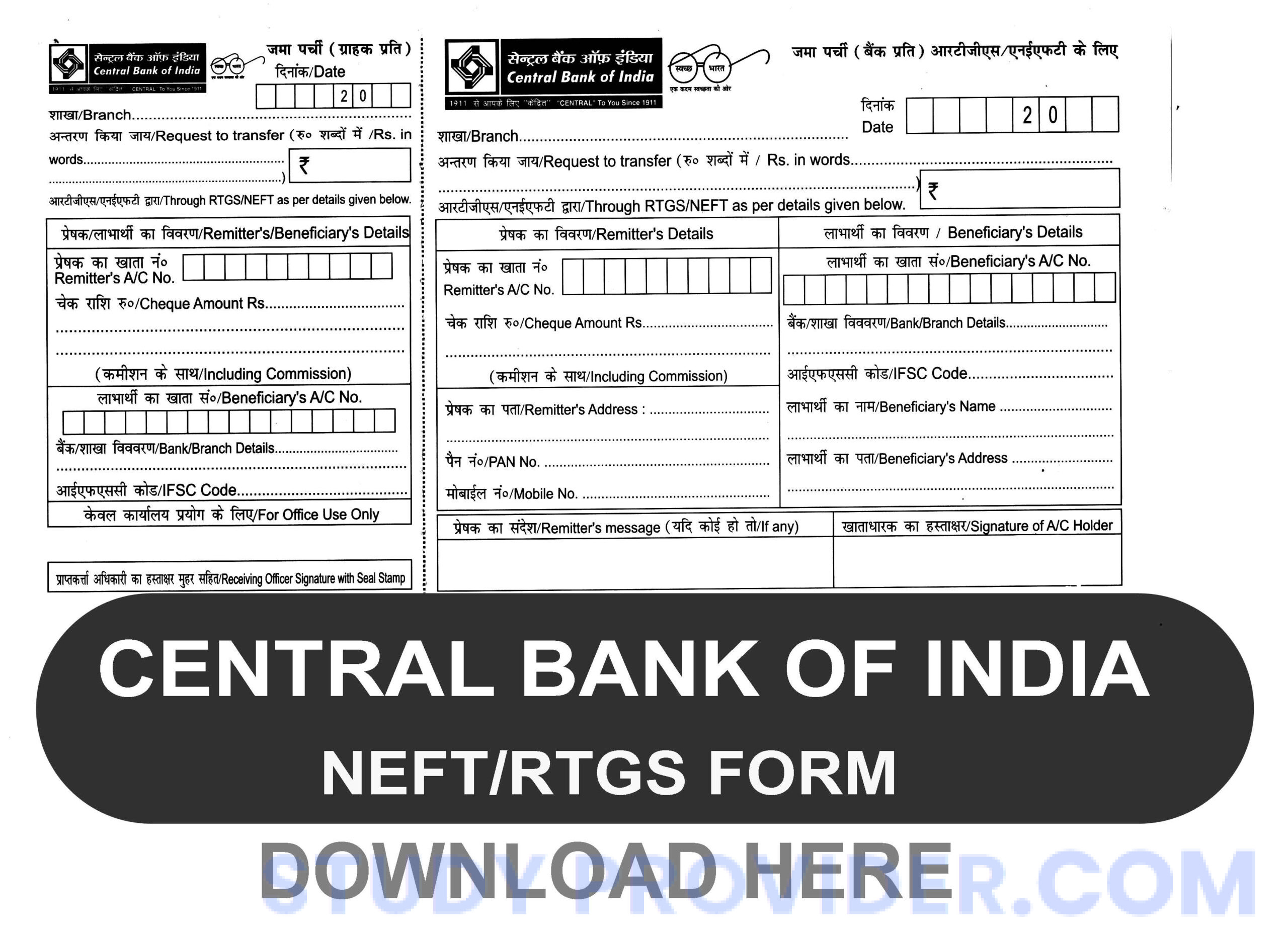

Pdf Neft Rtgs Application Central Bank Of India Neft Form 2023 Simple steps to get rtgs neft form pdf: step 1: visit the official website. step 2: search for rtgs form pdf. step 3: download the form. step 4: take a print out. step 5: fill out all the details. filling out a neft rtgs form is a straightforward process once you understand the required information and steps involved. In order to transfer money through rtgs or neft in central bank of india online, you need to follow below mentioned step by step process to transfer money through rtgs or neft online: visit the official website of central bank of india. log on to your account using your user name (customer id) and password (ipin). What is rtgs. rtgs or real time gross settlement is a system where the funds transfer requests from one savings account to another are processed in real time, i.e., as soon as they are received from the remitting bank. unlike in neft, the fund transfer instructions under rtgs are processed individually on an order basis. For fund transfer mode select rtgs as fund transfer type. following are the details required to fill offline form: name and account number of the beneficiary. name of the beneficiary bank and branch. amount to be remitted. ifsc (indian financial system code) of the beneficiary bank branch. remitter’s account number which is to be debited.

How To Fill Central Bank Of India Neft Rtgs Form In 2024 Youtube What is rtgs. rtgs or real time gross settlement is a system where the funds transfer requests from one savings account to another are processed in real time, i.e., as soon as they are received from the remitting bank. unlike in neft, the fund transfer instructions under rtgs are processed individually on an order basis. For fund transfer mode select rtgs as fund transfer type. following are the details required to fill offline form: name and account number of the beneficiary. name of the beneficiary bank and branch. amount to be remitted. ifsc (indian financial system code) of the beneficiary bank branch. remitter’s account number which is to be debited. Settlement time: rtgs transactions are processed on a one to one basis and settled immediately, ensuring real time transfer of funds. transfer timings: like neft, you can initiate rtgs transactions at any time of the day, all year round, using both online and offline modes. charges: banks levy nominal charges on rtgs fund transfer, ranging from. To fill the rtgs form of central bank of india, you have to enter the details of applicant includes: your name, account number, address, mobile number, email id, pan card number etc and the details of beneficiary beneficiary like beneficiary name, account number, account type, name of bank, and branch beneficiary ifsc code etc.

Comments are closed.