How To Improve Your Credit Score Quickly In Canada Simple Rate

How To Improve Your Credit Score Quickly In Canada Simple Rate 8 ways to increase your credit score in canada. follow these eight simple steps to start raising your credit score today: 1. inspect your credit report and score. as per the federal trade commission, about 1 in 5 consumers have errors in their credit reports that negatively impact their credit score. Borrowing more than the authorized limit on a credit card may lower your credit score. try to use less than 30% of your available credit. it’s better to have a higher credit limit and use less of it each month. for example, suppose you have a credit card with a $5,000 limit and an average borrowing amount of $1,000.

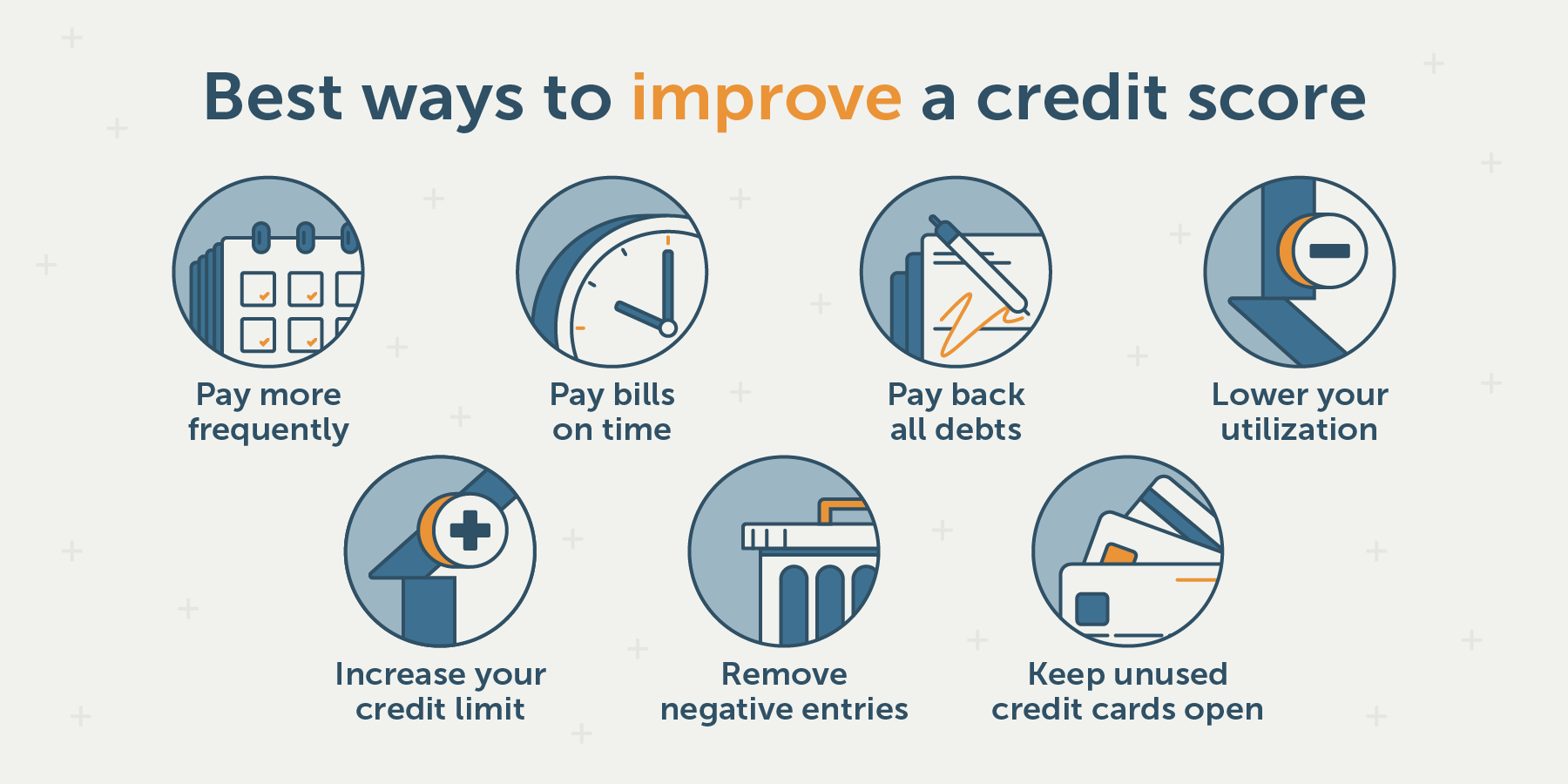

7 Tips To Increase Your Credit Score Infographic And just like any other organization they make plenty of mistakes. 2. pay your debt on time. by far the most important thing you can do to increase your credit score is to pay your debt on time. it’s better to pay the minimum interest of your debt on time than to pay the debt off in full a week late. As a newcomer to canada, here are five tips to help boost your credit score in canada:u003cbru003e1. start off with one credit card (avoid applying for several credit cards).u003cbru003e2. pay bills on time – ideally, you should pay your bill balance in full each month.u003cbru003e3. To raise your credit score by 100 points, paying your bills on time is critical because it prevents your credit score from decreasing, especially if you struggle with making payments before the due date. 2. keep unused credit cards open. to raise your credit score by 100 points, do not be quick to close old or unused credit accounts. 1. borrowell – best free app. borrowell's free credit score. sign up to borrowell to get your credit score and credit report for free! get it now. borrowell's free credit score. borrowell is the go to credit score app in canada, serving over a million people by providing free credit reports at the touch of a button.

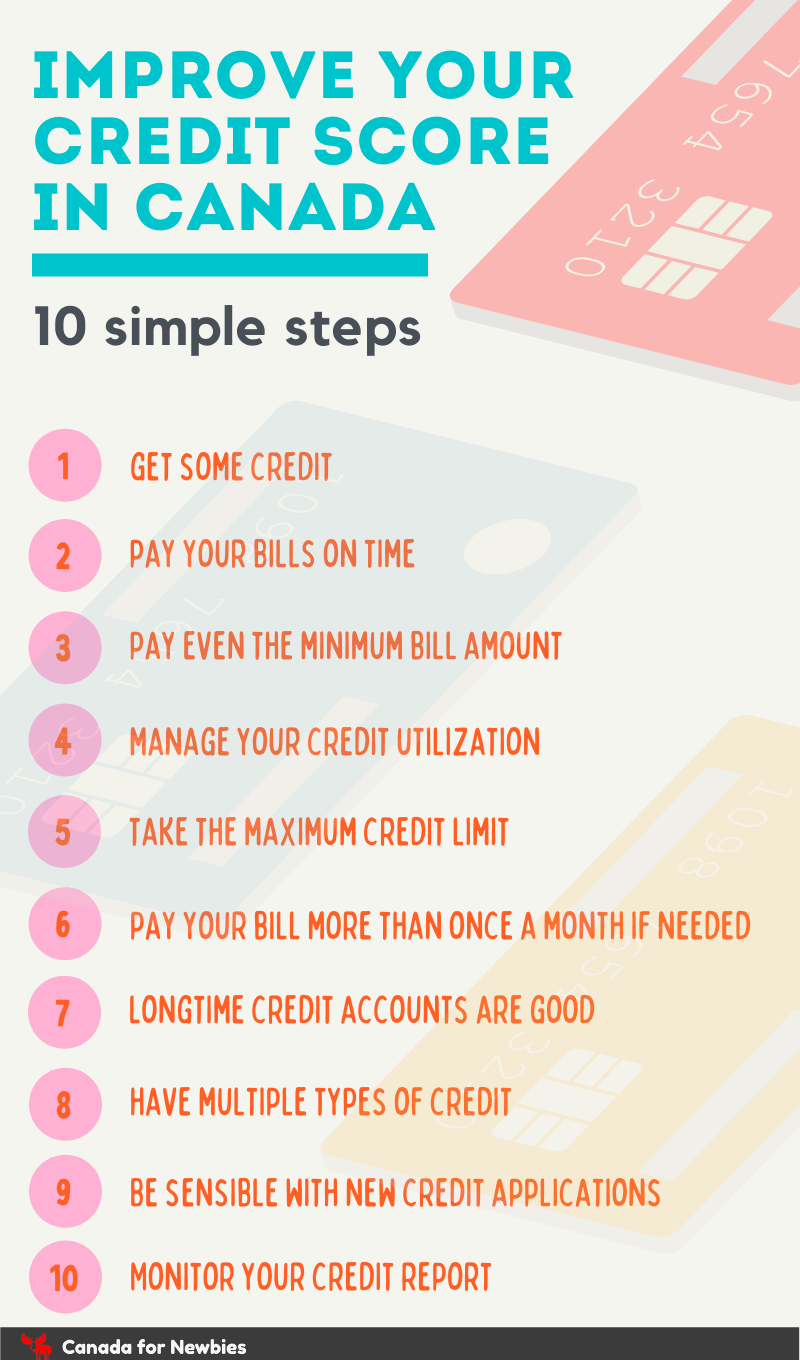

How To Improve Your Credit Score 10 Step Guide Canada For Newbies To raise your credit score by 100 points, paying your bills on time is critical because it prevents your credit score from decreasing, especially if you struggle with making payments before the due date. 2. keep unused credit cards open. to raise your credit score by 100 points, do not be quick to close old or unused credit accounts. 1. borrowell – best free app. borrowell's free credit score. sign up to borrowell to get your credit score and credit report for free! get it now. borrowell's free credit score. borrowell is the go to credit score app in canada, serving over a million people by providing free credit reports at the touch of a button. Canada operates with a credit score range between 300 and 900. the lower your score, the less likely you are to be approved for a credit card or loan. if you do manage to qualify for a credit card. Pay on time. one of the best things you can do to improve your credit scores is to pay your debts on time. payment history makes up a significant chunk of your credit scores, so it's important to avoid late payments. if you struggle with on time payments, consider using automatic payments for your accounts or setting up alerts so you are.

How To Improve Credit Score Quickly Knowyourcreditscore Net Canada operates with a credit score range between 300 and 900. the lower your score, the less likely you are to be approved for a credit card or loan. if you do manage to qualify for a credit card. Pay on time. one of the best things you can do to improve your credit scores is to pay your debts on time. payment history makes up a significant chunk of your credit scores, so it's important to avoid late payments. if you struggle with on time payments, consider using automatic payments for your accounts or setting up alerts so you are.

How To Improve Credit Score In Canada 9 Fast Simple Ways

Comments are closed.