How To Invest 5 Effective Investing Principles

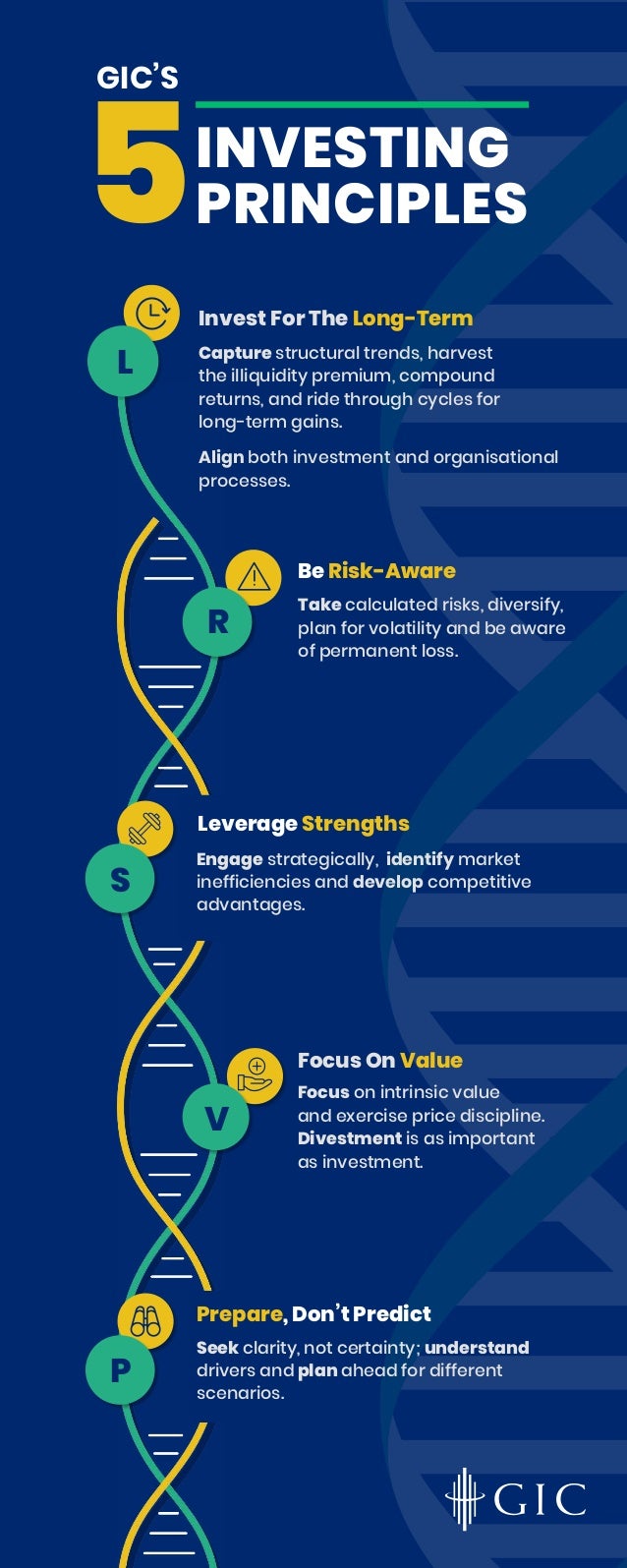

5 Investing Principles Lrsvp The moderate allocation is 35% large cap stocks, 10% small cap stocks, 15% international stocks, 35% bonds, and 5% cash investments. 5 the 60 40 portfolio is a hypothetical portfolio consisting of 60% s&p 500 index stocks and 40% bloomberg barclays u.s. aggregate bond index bonds. the portfolio is rebalanced annually. One of the most common questions we get is: “how do i get started investing?”it’s understandable – the stock market is confusing (and volatile!), and the fin.

Investment Principles 4 key investment strategies to learn before trading. Five principles of successful investing. Principles of successful investing 1 invest early getting an early start on investing is one of the best ways to build wealth. investing for a longer period of time is largely recognized as a more effective strategy than waiting until you have a large amount of savings or cash flow to invest. this is due to the power of compounding. But the principles of successful investing are quite simple. the five tried and true investment principles outlined in this guide can collectively serve as a blueprint for building an effective long term portfolio designed to achieve your financial goals. 1. invest early 2. invest regularly 3. invest enough 4. diversify your portfolio 5. have a.

How To Invest 5 Effective Investing Principles Investing Making Principles of successful investing 1 invest early getting an early start on investing is one of the best ways to build wealth. investing for a longer period of time is largely recognized as a more effective strategy than waiting until you have a large amount of savings or cash flow to invest. this is due to the power of compounding. But the principles of successful investing are quite simple. the five tried and true investment principles outlined in this guide can collectively serve as a blueprint for building an effective long term portfolio designed to achieve your financial goals. 1. invest early 2. invest regularly 3. invest enough 4. diversify your portfolio 5. have a. Principle #2: be risk intelligent, not risk averse. historically, the markets have created value for investors over time. risk and return generally go hand in hand. seek to manage risk, not avoid it. stocks, bonds and cash all have a place in a well diversifi ed portfolio. dsp of ers built in risk management to help deliver a smoother journey. Benjamin graham's timeless investment principles.

Investing Principles Powerpoint Presentation Slides Ppt Template Principle #2: be risk intelligent, not risk averse. historically, the markets have created value for investors over time. risk and return generally go hand in hand. seek to manage risk, not avoid it. stocks, bonds and cash all have a place in a well diversifi ed portfolio. dsp of ers built in risk management to help deliver a smoother journey. Benjamin graham's timeless investment principles.

5 Principles Of Successful Investing

Comments are closed.