How To Invest In Invoice Discounting Bill Discounting How To Use

What Is The Bill Discounting Procedure Example And Formula First, the buyer (importer) receives a payment invoice from the seller (exporter). this invoice is a promise that the buyer will pay the seller at a future date for the goods they are buying. 2. submitting the invoice. next, the exporter submits this invoice to a financial institution or a discounting company. The process of bill discounting is relatively simple. a seller sends an invoice to their buyer for goods or services, and the buyer agrees to pay a certain amount within a specified timeframe, usually 30 to 90 days. the seller can then sell the invoice to a bank or financial institution at a discounted rate, receiving immediate cash instead of.

How To Offer A Discount On An Invoice With Invoice Home Here are the major benefits for exporters: improved cash flow. bill discounting significantly improves cash flow for exporters by providing them with immediate access to funds. instead of waiting for customers to settle invoices, exporters can receive a portion of the invoice value upfront from the financial institution. Cons. can be expensive. fees for invoice discounting are generally 1% 5% of the value of the invoice you’re advancing per week. for example, for a $100,000 invoice on which you receive a 90%. Even though both bill discounting and factoring provide similar short term financing solutions, bill discounting acts as an advance of sorts against a bill owed. invoice factoring on the other hand, involves the outright purchase of trade debt. you may lose quite a bit of cash when utilizing invoice factoring, at a rate of about 60% to 95% of. How bill discounting works. the process of bill discounting typically involves the following steps: invoice issuance: a business sells goods or services to its customer and issues an invoice with a credit term, usually 30 to 90 days. bill discounting application: the business approaches a financial institution or a discounting platform to.

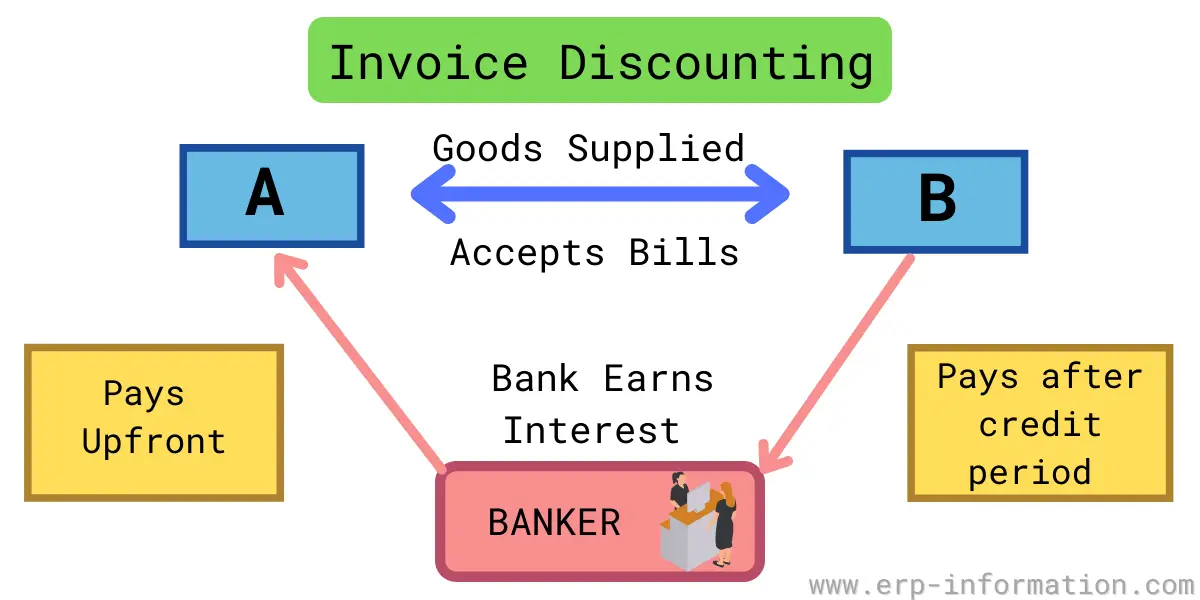

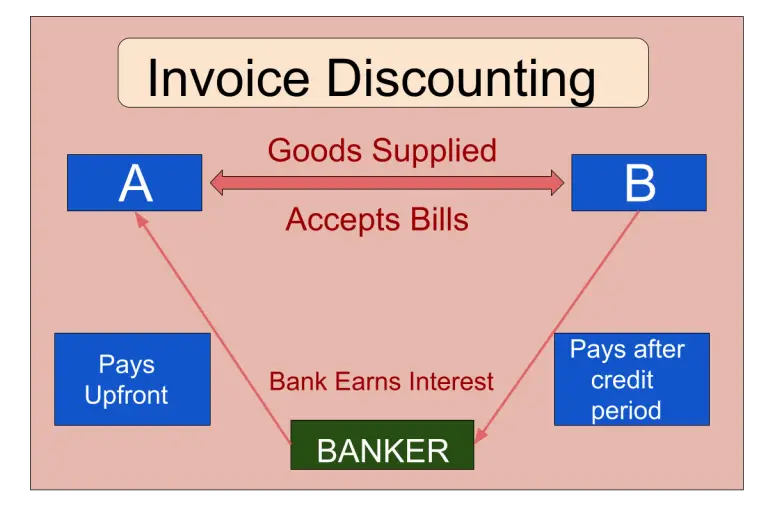

Invoice Discounting Or Bill Discounting Or Purchasing Bills Even though both bill discounting and factoring provide similar short term financing solutions, bill discounting acts as an advance of sorts against a bill owed. invoice factoring on the other hand, involves the outright purchase of trade debt. you may lose quite a bit of cash when utilizing invoice factoring, at a rate of about 60% to 95% of. How bill discounting works. the process of bill discounting typically involves the following steps: invoice issuance: a business sells goods or services to its customer and issues an invoice with a credit term, usually 30 to 90 days. bill discounting application: the business approaches a financial institution or a discounting platform to. Below are some of the advantages of invoice discounting: availability of cash by using this type of financing, one can easily avail funds within 72 hours of applying. it is beneficial for businesses generating high value invoices. a single unpaid invoice keeps a huge fund tied up. Meaning of bill discounting. bill discounting is a type of invoice financing in which funds are issued against unpaid sale invoices. the financial institutions issue an advance to the seller at discounted rates. the business is not required to pledge any asset as collateral. the loan is advanced based on unpaid sale invoices.

What Is The Bill Discounting Procedure Example And Formula Below are some of the advantages of invoice discounting: availability of cash by using this type of financing, one can easily avail funds within 72 hours of applying. it is beneficial for businesses generating high value invoices. a single unpaid invoice keeps a huge fund tied up. Meaning of bill discounting. bill discounting is a type of invoice financing in which funds are issued against unpaid sale invoices. the financial institutions issue an advance to the seller at discounted rates. the business is not required to pledge any asset as collateral. the loan is advanced based on unpaid sale invoices.

Comments are closed.