How To Make A Budget For Saving Money Hewqme

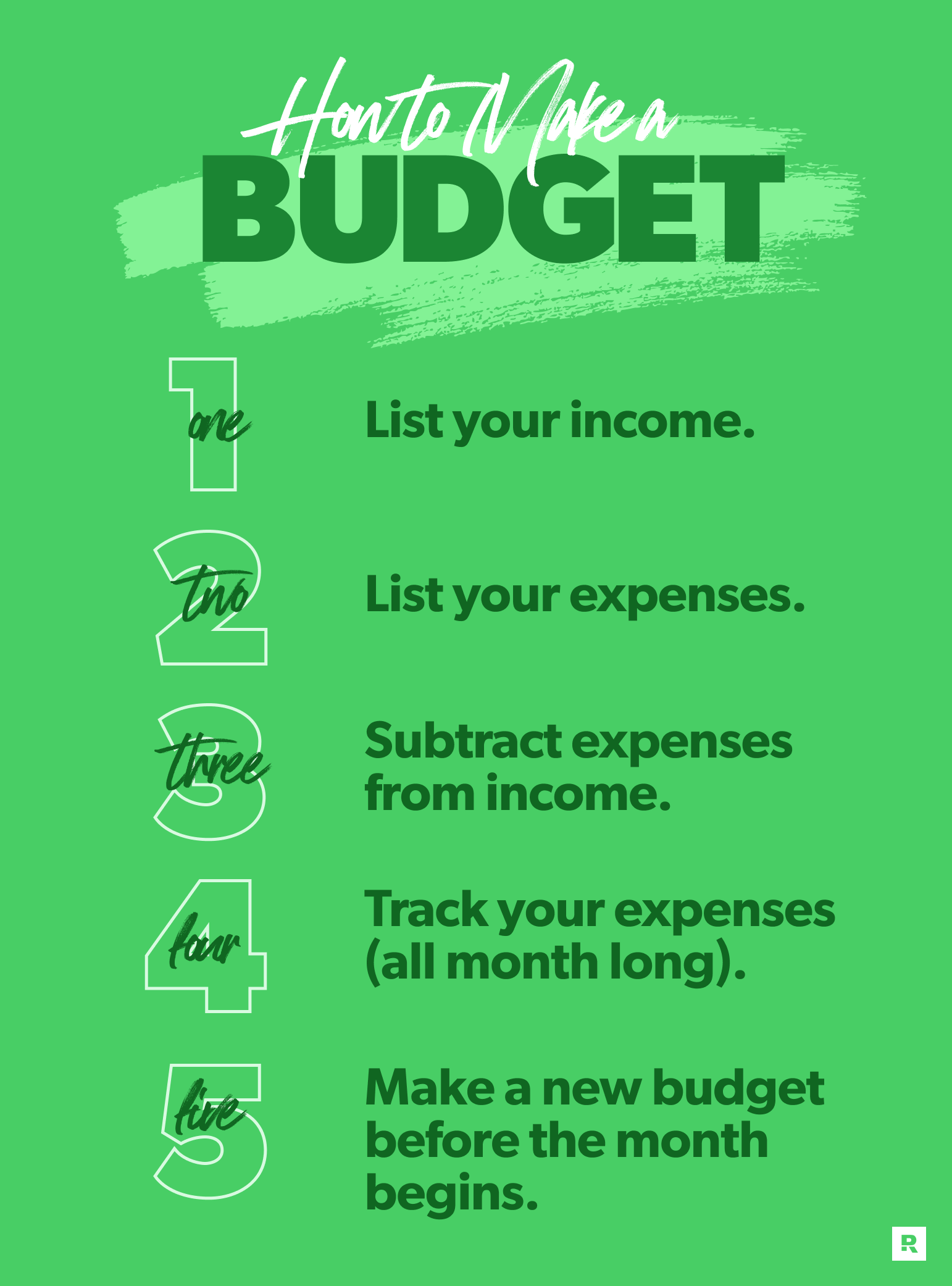

How To Make A Budget For Saving Money Hewqme Here are five steps to learn how to make a budget plan: 1. establish your savings goals. determine which of your life goals require money and how much you realistically need to meet them. start with 3–5 financial goals and prioritize them by what you want to achieve first. here are some examples of financial goals:. Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money.

How To Make A Budget Your Step By Step Guide Smartpro Financial Llc See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management. Step 4: make a plan. this is where everything comes together: what you’re actually spending vs. what you want to spend. use the variable and fixed expenses you compiled to get a sense of what you’ll spend in the coming months. then compare that to your net income and priorities. consider setting specific—and realistic—spending limits. A budget can also help you avoid borrowing money to make ends meet. according to a 2023 debt poll , nine out of 10 people who created a budget said it helped them get out or stay out of debt. It suggests using 50% of your income toward needs, 30% toward wants and 20% toward savings and debt. 5. leave room for surprises. don’t expect your budget to be perfect. surprises will happen.

Save Your Family Money How To Make A Simple Family Budget Root And A budget can also help you avoid borrowing money to make ends meet. according to a 2023 debt poll , nine out of 10 people who created a budget said it helped them get out or stay out of debt. It suggests using 50% of your income toward needs, 30% toward wants and 20% toward savings and debt. 5. leave room for surprises. don’t expect your budget to be perfect. surprises will happen. Step 1. embrace the ongoing process of budgeting. we often tend to think of budgeting as a one and done kind of chore. you sit down with your accounts and receipts. you figure out how much you. Option 2: use a budget app. if you prefer to operate in the 21st century, there are numerous apps to help you track your new budget. personal capital is a good budgeting app for those following the 50 30 30 rule (and it’s free!). it allows you to set a spending target and alerts you to progress throughout the month.

Comments are closed.