How To Open Ppf Account In Sbi

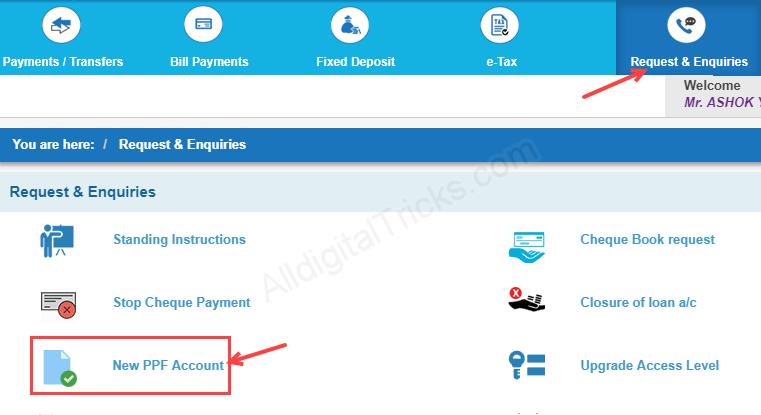

How To Open Ppf Account Online In Sbi Through Net Banking Online retail internet banking ( onlinesbi.sbi) (menu navigation “home page→request & enquiries→online nomination”) rules. investment limits a minimum of rs.500.00 subject to a maximum of rs.1,50,000 per annum may be deposited. original duration is 15 years. thereafter, on application by the subscriber, it can be extended for. Step 2: click on ‘deposits & investment’ and click the ‘public provident fund (ppf)’ option. step 3: click the ‘ppf account opening (without visiting branch)’ option. step 4: read the general instruction, accept the terms and click the ‘proceed’ button. step 5: select the account and click the ‘proceed’ button.

How To Open Ppf Account In Sbi Find answers to common questions about opening, operating and closing a ppf account with sbi. learn about the eligibility, documents, interest, tax benefits, loan facility and more. Learn the step by step process to open a public provident fund (ppf) account with state bank of india (sbi) using online netbanking facility. find out the prerequisites, documents, and branch details required for opening a ppf account with sbi. Learn the step by step process to open a ppf account in sbi using sbi net banking or by submitting a form. also, find out how to transfer, close, or extend your sbi ppf account. The minimum annual investment required to open an sbi ppf account active starts from rs. 500. the maximum investment allowed in the sbi ppf account is rs. 1.5 lakhs annually. the current sbi ppf interest rate is 7.1%. ppf deposits can be made in a lump sum amount or through a maximum of 12 instalments annually.

Comments are closed.