How To Trade Earnings With Options вђ Unbrick Id

Earnings Options Strategy Paper Gains Take The Guessing Out Of Trading Since it is difficult to realize the max profit potential when trading iron butterflies, most traders will try to exit the trade for a profit after the earnings announcement and before expiration. aapl earnings trade example. let’s continue with the aapl example and enter an example earnings trade using one of these options strategies. It’s easy to calculate — just take the value you paid for your option strategy and add it to the long strike of your bullish trade, or subtract it from the long strike of your bearish trade. in the instance shown above, the breakeven of a $100 strike call bought for $5.00 is $105.

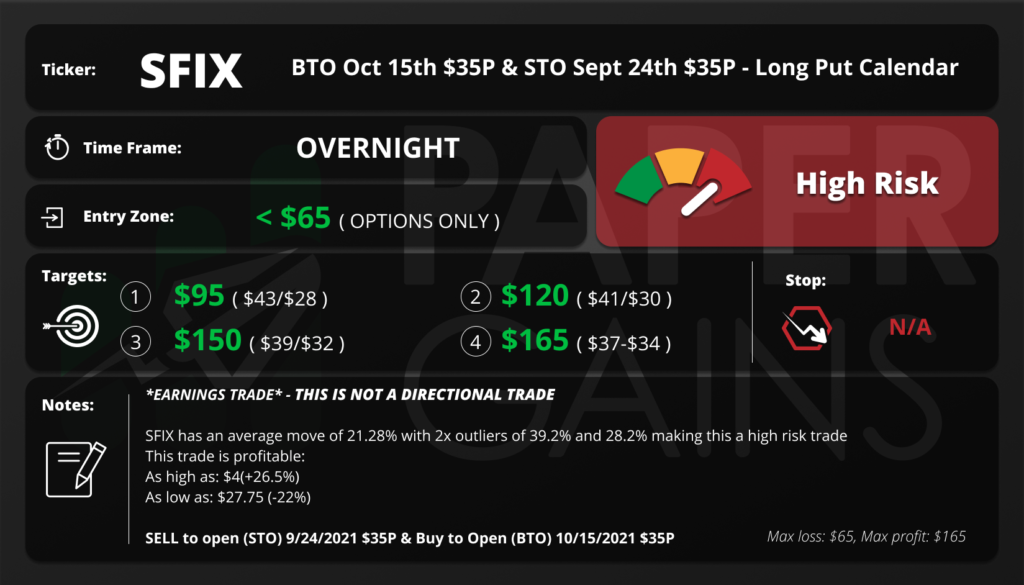

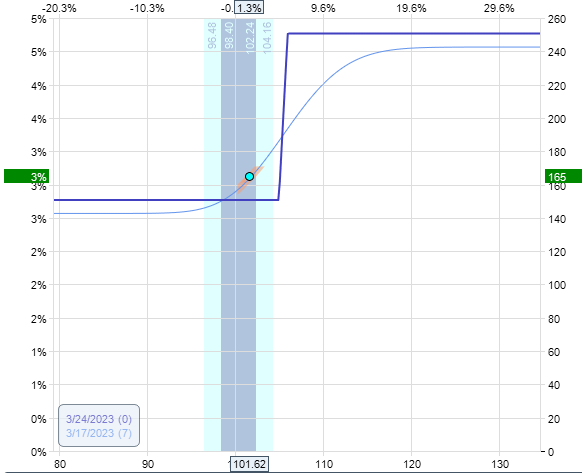

How To Trade Earnings With Options Youtube Trading through earnings announcements usually isn’t a good idea. during earnings, most stocks tend to either increase or decrease significantly in value. predicting the correct direction isn’t more than a 50 50 bet. that’s why i can’t recommend trading stocks through earnings announcements. with options, however, you have many more. In this video, i'll share 3 simple strategies to trade earnings like a pro. download all earnings tools for thinkorswim: tosindicators earningsf. There are many ways to trade earnings with options but in my opinion the best pre earnings option strategy is the diagonal call spread. earnings are when a publicly traded company announces their financial results for a set period of time. in the united states, this occurs every quarter and it is always a busy time in the market and a great. The implied volatility of a stock, or “iv”, uses options to estimate the future volatility of a stock. the iv is of particular importance to those trading options on stocks going into earnings. to see how “iv” increases for near term (or “front month”) option expirations, take a look at the image below (click to enlarge).

Trading Options On Earnings Reports There are many ways to trade earnings with options but in my opinion the best pre earnings option strategy is the diagonal call spread. earnings are when a publicly traded company announces their financial results for a set period of time. in the united states, this occurs every quarter and it is always a busy time in the market and a great. The implied volatility of a stock, or “iv”, uses options to estimate the future volatility of a stock. the iv is of particular importance to those trading options on stocks going into earnings. to see how “iv” increases for near term (or “front month”) option expirations, take a look at the image below (click to enlarge). Step 3: decide on hedging or leveraging. the third and last step in analyzing options to make earnings predictions is to determine the direction of the move. while we only really have access to. For example, suppose a stock is trading at $87.50. to construct a long straddle, you might buy 1 87.50 call for $2.15 and buy 1 87.50 put for $1.85 for a net cost (i.e., maximum loss) of $4.00 per contract (which equates to $400). this stock has unlimited upside potential, with breakeven prices of $83.50 and $91.50.

Comments are closed.