How To Trade Swiss Franc Chf Eurchf Correlations Chf Gold Correlation

How To Trade Swiss Franc Chf Eurchf Correlations Chf Go Many new traders don't know how to trade chf swiss franc in forex. while the swiss franc is well known, it is very unique and traders need to know how to tr. Eurchf currency real time eurchf currency chart and performance. eurchf historical data historical eurchf data selectable by date range and timeframe. eurchf volatility eurchf real time currency volatility analysis.

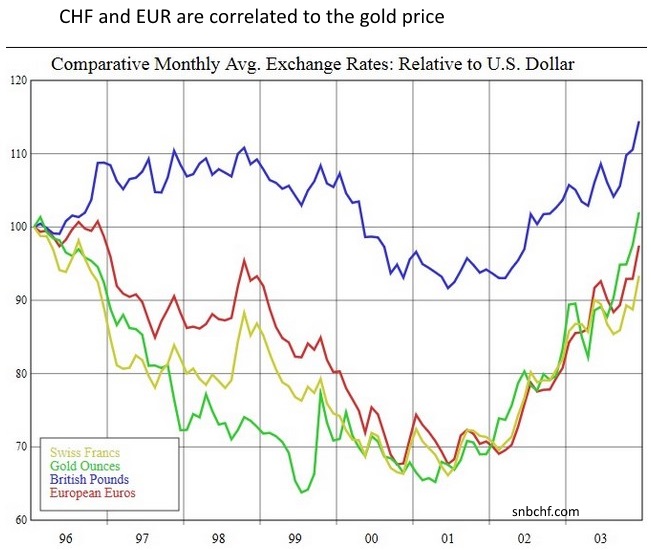

Swiss Franc History The Long Term View And The Comparison With Gold The eur chf (euro swiss franc) currency is driven by the pair of currency pairs—usd chf and eur usd. for two separate and distinct financial instruments, a 92.7% correlation is close to perfect. The rise in the prices of gold through 2020 has been of immense benefit for the swiss franc; proving the close knitted relationship between the two. the second influential factor is the safe haven status enjoyed by the swiss banking system. this is what has influenced the positive correlation between the swiss franc and gold prices. Let’s say you’ve put £10 per point of movement on eur usd. to hedge your exposure, you put £8.50 per point of movement on usd chf and both currency pairs move 10 points. eur usd falls 10 points, resulting in a £100 loss but, given the negative correlation, usd chf rises 10 points for an £85 gain. Nowadays, traders are keen on trading usd chf and eur usd owing to these crosses’ high (95%) negative correlation. eur chf trading the chf. the chf used to be one of the top three most traded currencies, yet due to the correlations with the eur and gold, it has lost its independence in a way. its safety status diminished greatly after.

Comments are closed.