How To Use Irs Form 5498 On A Tax Return Turbotax Tax Tip Video

Irs Form 5498 Instructions For 2021 Line By Line 5498 Instruction Turbotax.intuit did you put money aside for your retirement this year into an ira account? if you did, you may be able to deduct some of those co. With a traditional ira,a certain amount of the contributions you make each year may be tax deductible. however, when you reach retirement age, you must report all ira withdrawals on your tax return and pay the tax on it. with a roth ira it’s the opposite. your contributions aren’t deductible on your tax return, but the tax savings come later.

All About Irs Tax Form 5498 For 2020 Ira For Individuals In most cases, you'll find the info needed for your return on other paperwork, such as a year end summary statement or a form 1099 r. keep form 5498 with your records for future reference when you need to determine the end of year value or your investment basis in non deductible or roth iras. you must sign in to vote. That’s the form that you need to enter into turbotax. here’s another interesting fact: the trustees aren’t required to submit this form to the irs until may 31, well after you file your tax return, so you may or may not receive form 5498 until later. this won’t stop you from filing your tax return, though: you can get all the. The distribution may also be subject to the 10% additional tax under section 72 (t). it is not eligible to be rolled over to an eligible retirement plan nor is it eligible for the 10 year tax option. on form 1099 r, complete the appropriate boxes, including boxes 1 and 2a, and enter code l in box 7. Nerdy takeaways. form 5498 is an annual report of your ira activities (e.g. contributions, rmds, etc.). anyone who contributed to an ira will get one in the mail between january and mid june in.

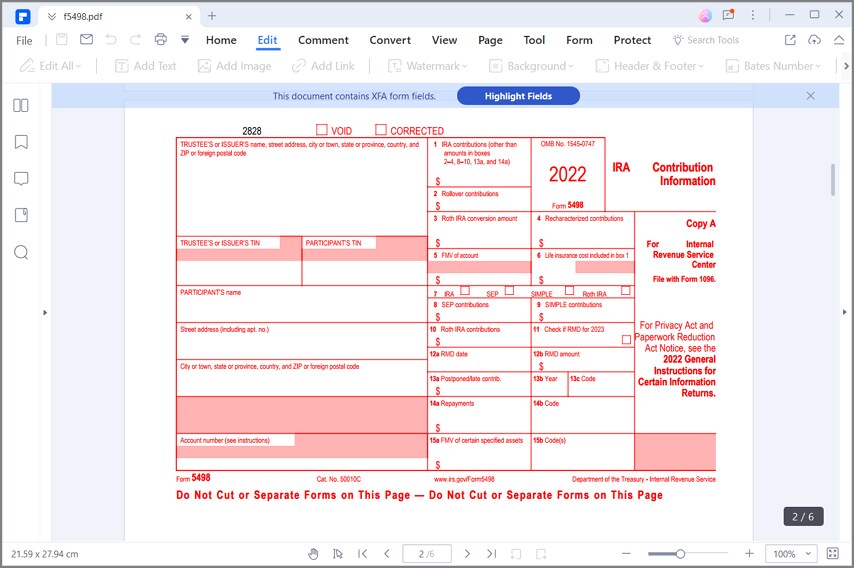

For How To Fill In Irs Form 5498 The distribution may also be subject to the 10% additional tax under section 72 (t). it is not eligible to be rolled over to an eligible retirement plan nor is it eligible for the 10 year tax option. on form 1099 r, complete the appropriate boxes, including boxes 1 and 2a, and enter code l in box 7. Nerdy takeaways. form 5498 is an annual report of your ira activities (e.g. contributions, rmds, etc.). anyone who contributed to an ira will get one in the mail between january and mid june in. Create an account. where does the information on form 5498 go in turbotax? here’s a quick guide: box 1, ira contributions: in the deductions section, choose 10. ira contributions, then mark that you have a traditional ira. enter your total traditional ira contributions for 2005… this amount will appear on line 1 of our ira contributions. Page last reviewed or updated: 15 aug 2024. information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. file this form for each person for whom you maintained any individual retirement arrangement (ira), including a deemed ira under section 408 (q).

Instructions To Fill Out A Tax Form 5498 Step By Step Guide Easeus Create an account. where does the information on form 5498 go in turbotax? here’s a quick guide: box 1, ira contributions: in the deductions section, choose 10. ira contributions, then mark that you have a traditional ira. enter your total traditional ira contributions for 2005… this amount will appear on line 1 of our ira contributions. Page last reviewed or updated: 15 aug 2024. information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. file this form for each person for whom you maintained any individual retirement arrangement (ira), including a deemed ira under section 408 (q).

Comments are closed.