Implied Volatility Basics 3 Minute Tutorial

Implied Volatility Basics Factors Importance Chart Example A basic overview of implied volatility. a concept that will help you increase profits options trading. check out for more information 1.) investo. On february 13th, 2014, aapl was trading at $543, with implied volatility at 22.08%. the march 21st options were 36 days from expiry, so we will use them for this example. the one standard deviation range for aapl between february 13th and march 21st, is as follows: $543 x 0.2208 x (sqrt (36 365)) = $37.65. or.

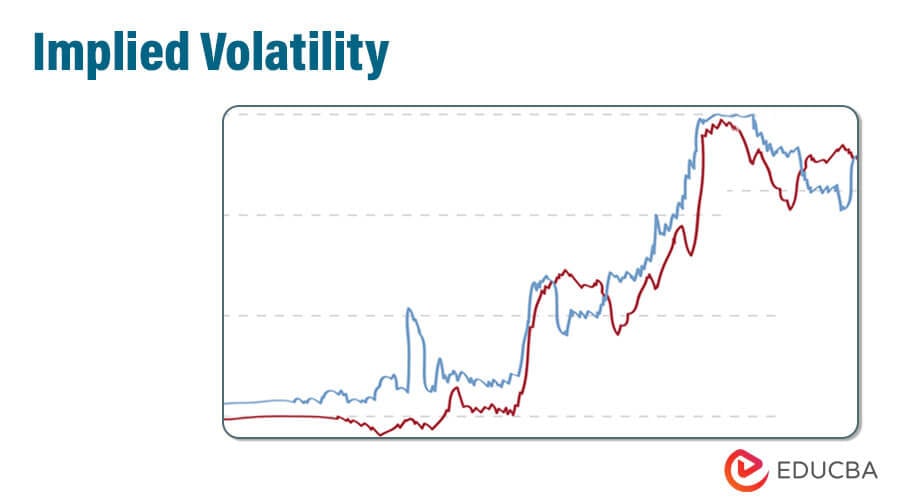

What Is Implied Volatility Iv The Motley Fool Four things to consider when forecasting implied volatility. 1. make sure you can determine whether implied volatility is high or low and whether it is rising or falling. remember, as implied. Volatility measures the amount of fluctuation or price movement in a stock over a given period. a higher volatility means a stock's price tends to fluctuate more over time. a lower volatility means that a stock's price tends to be more stable. the hypothetical case in the chart below shows the two stocks' historical pricing over 12 months. Implied volatility iv: implied volatility is the estimated volatility of a security's price. in general, implied volatility increases when the market is bearish , when investors believe that the. Formula to calculate the implied volatility percentile: implied volatility percentile = number of trading days under current implied volatility number of trading days in a year. calculating aapl implied volatility percentile: for example, if the number of days under the current implied volatility (30%) is 100.

What Is Implied Volatility Iv Options Explained Implied volatility iv: implied volatility is the estimated volatility of a security's price. in general, implied volatility increases when the market is bearish , when investors believe that the. Formula to calculate the implied volatility percentile: implied volatility percentile = number of trading days under current implied volatility number of trading days in a year. calculating aapl implied volatility percentile: for example, if the number of days under the current implied volatility (30%) is 100. Implied volatility. expressed as a percentage, implied volatility (iv) is computed using an options pricing model and reflects the market's expectations for the future volatility of the underlying stock. for example, if the iv of xyz 30 day options is 25% and similar options on zyx have iv of 50%, zyx shares are expected to see greater. Dive into the world of implied volatility for options trading through this comprehensive video series. learn the fundamentals of implied volatility, its significance in options trading, and how to leverage options and futures for volatility exposure. explore key concepts such as the vix index, expected move, and volatility trading strategies.

Comments are closed.