Implied Volatility Explained The Ultimate Guide

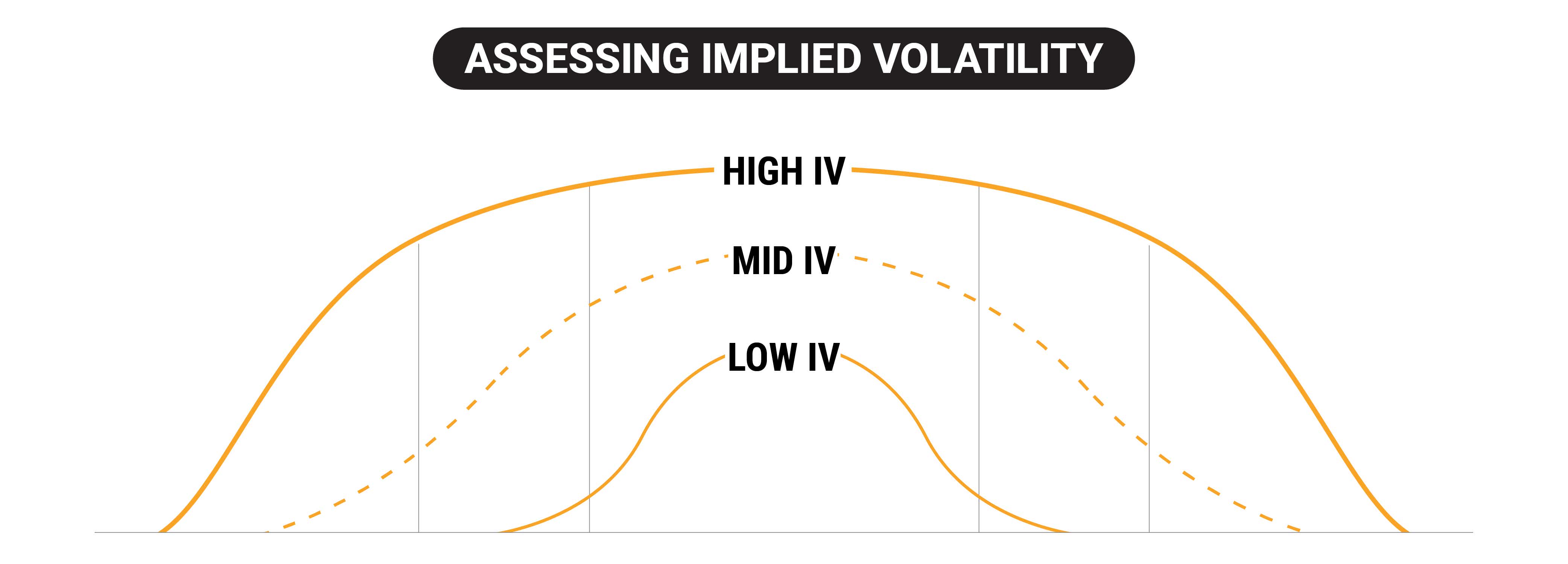

Implied Volatility Iv Rank Percentile Explained Tastylive Historical volatility measures past moves in a stock’s price over a predetermined time frame. 1 standard deviation includes 68% of outcomes; 2 standard deviations includes 95% of outcomes. iv (implied volatility) rank tells traders whether implied volatility is high or low based on iv data from the past year. Implied volatility is the market’s estimate of how far and fast the stock will move, and is completely subjective. this is where traders have the opportunity to gain an edge. if you think the market is underestimating volatility, you buy options. if you think the market is overestimating volatility, you sell options.

Implied Volatility Explained The Ultimate Guide Projectfinance New to options trading? master the essential options trading concepts with the free options trading for beginners pdf and email course: geni.us opt. Implied volatility is an essential ingredient to the option pricing equation, and the success of an options trade can be significantly enhanced by being on the right side of implied volatility. Implied volatility (iv) is a measure used in options trading that reflects the market's expectations for a stock's future volatility. in simple terms, implie. Implied volatility is the expected price movement in a security over a period of time. implied volatility is forward looking and represents the expected volatility in the future. iv estimates the potential price range for a defined time period. options traders reference several different types of volatility.

What Is Implied Volatility Iv Options Explained Implied volatility (iv) is a measure used in options trading that reflects the market's expectations for a stock's future volatility. in simple terms, implie. Implied volatility is the expected price movement in a security over a period of time. implied volatility is forward looking and represents the expected volatility in the future. iv estimates the potential price range for a defined time period. options traders reference several different types of volatility. Implied volatility is a statistical measurement that attempts to predict how much a stock price will move in the coming year. it’s expressed as a percentage. right now, for example, the microsoft $100 call option that expires in about a month has an iv of 34%. microsoft stock is currently trading at $100 per share. Implied volatility represents the expected magnitude of a stock's future price movements as implied by its option prices. option prices, not implied volatility, drive changes in implied volatility, as buying and selling pressure affects option prices. implied volatility is determined by the ex.

Comments are closed.