In House Banking Gtreasury

The Ins Outs Of In House Banking In house bank statements can be generated and automatically sent out on a configurable basis. reduce bank accounts for greater efficiency manage granular transaction activities for each banking unit within gtreasury, without the need to create external bank accounts and having to work in external reporting systems. Manage your in house bank like an external financial institution. with gtreasury, you can holistically view all your funds and allocate them to internal entities where required, without the associated fees. in addition, you can track multi level in house bank accounts and cash pooling, as well as intercompany account relationships.

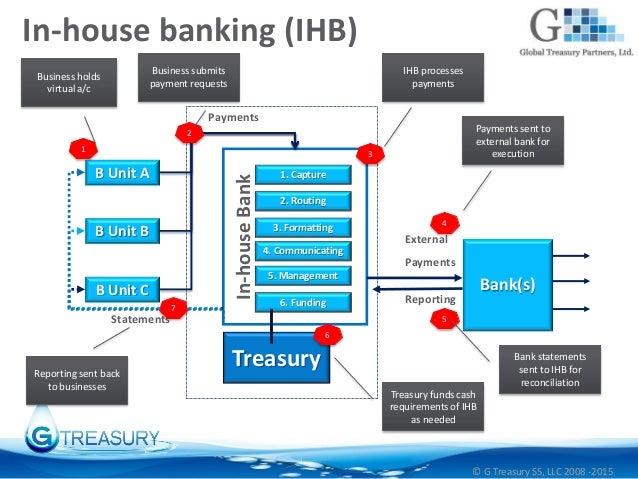

In House Bank Ihb The Workings Treasury Improvement An in house bank can be a formidable tool to help organizations optimize working capital. treasurers for organizations of all sizes can benefit from adopting some of the fundamentals of the in house banking model. businesses of all sizes need to execute a sound treasury strategy that ensures liquidity, safeguards financial assets and manages risk. See gtreasury in action. get connected with supportive experts, comprehensive solutions, and untapped possibility today. us: 847.847.3706 | emea (london): 44 (0) 203 787 4843 | apac (sydney): 61 02.9262.6969. a single source of truth and tools finance teams need to create connections, enabling growth and make informed business decisions. When an in house bank makes sense. by afp staff. published: 7 19 2022. using your company’s own resources for financing, an in house bank (ihb) is a cost effective way of consolidating your treasury functions — such as funding, fx and cash management — into one central entity rather than having each subsidiary work through a different. Cost and process efficiencies remain top priorities for the finance function, but some organizations are passing up the opportunity to gain better control of companywide cash through in house banking. ihb can help companies of all sizes improve process efficiency, reduce costs, and realize greater control over their cash.

In House Banking Gtreasury Youtube When an in house bank makes sense. by afp staff. published: 7 19 2022. using your company’s own resources for financing, an in house bank (ihb) is a cost effective way of consolidating your treasury functions — such as funding, fx and cash management — into one central entity rather than having each subsidiary work through a different. Cost and process efficiencies remain top priorities for the finance function, but some organizations are passing up the opportunity to gain better control of companywide cash through in house banking. ihb can help companies of all sizes improve process efficiency, reduce costs, and realize greater control over their cash. Join elire partner and treasury expert, karen willis, for an overview of what in–house banking can do for your organization, and how the function is taking a. For many treasurers, creating an in house bank is an intimidating prospect. but with robust planning, a clear phased approach, and some suitable technology from an experienced partner, it can be easier than you may think, says jouni kirjola, head of solutions, nomentia. corporates that have set up an in house bank (ihb) often discover greater.

In House Bank Treasury Corporate Treasury Gtreasury Join elire partner and treasury expert, karen willis, for an overview of what in–house banking can do for your organization, and how the function is taking a. For many treasurers, creating an in house bank is an intimidating prospect. but with robust planning, a clear phased approach, and some suitable technology from an experienced partner, it can be easier than you may think, says jouni kirjola, head of solutions, nomentia. corporates that have set up an in house bank (ihb) often discover greater.

Comments are closed.