Independent Contractor Misclassification How To Avoid The Risks

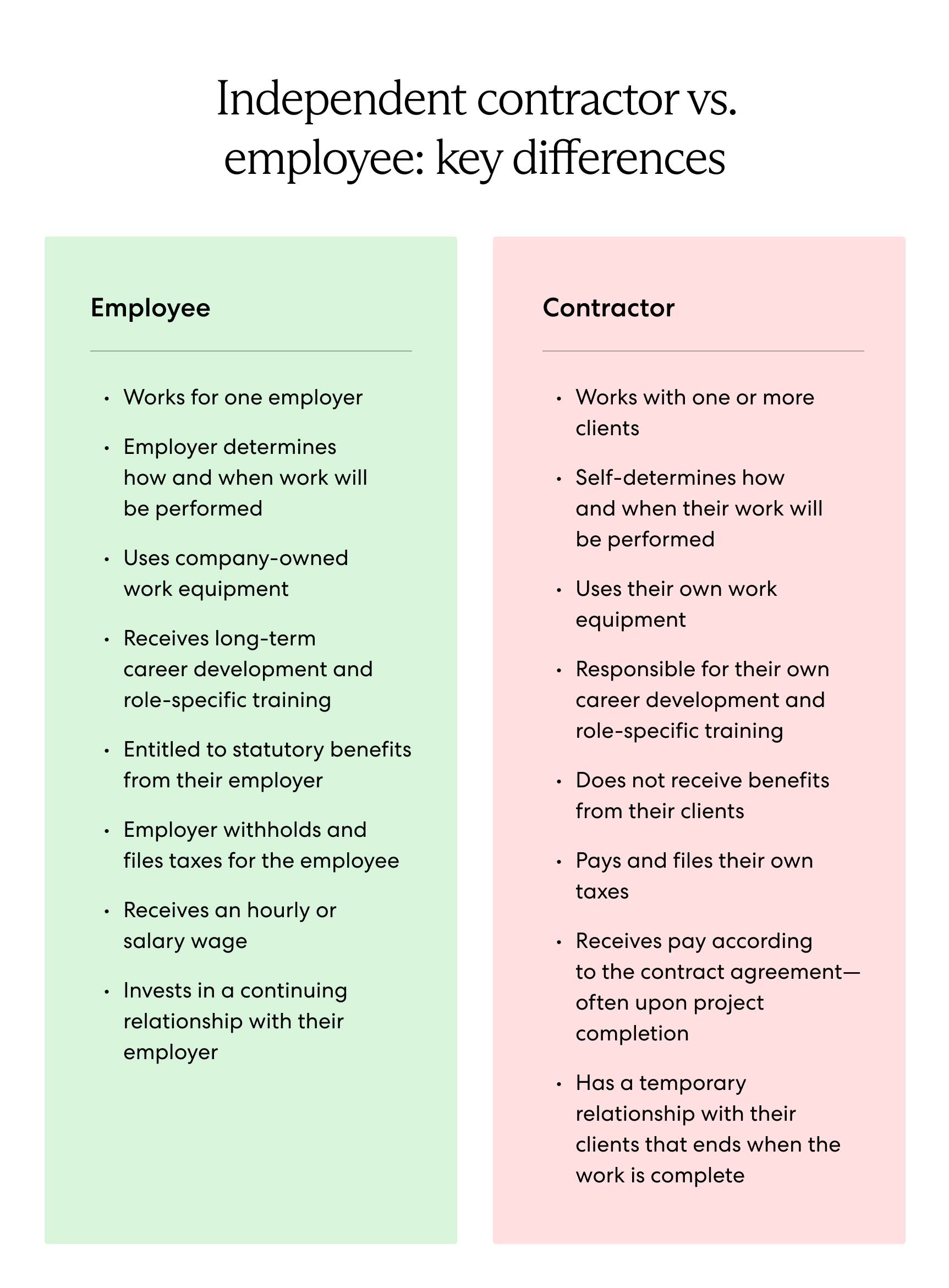

Independent Contractor Misclassification How To Avoid The Risks To avoid the risks of misclassifying independent contractors, consider converting your contractors into full time employees. converting contractors to employees provides the following benefits: compliance with international classification laws. intellectual property protection. top talent attraction via competitive benefits packages and perks. Typically, because independent contractors are cheaper—but only for the employer. anywhere from 10% to 30% of independent contractors might be misclassified —and the costs are enormous. on.

How To Avoid The Risk Of Independent Contractor Misclassification Misclassification of employees as independent contractors. D. costly consequences of misclassification. independent contractor misclassification liability can be devastating to many for profit and nonprofit organizations and those governmental entities that rely on the use of 1099 contractors, regardless of whether the employees have been mistakenly or intentionally misclassified. Prepare for audits in advance. 3.5 5. try pilot to simplify hiring. 4. get started with a free pilot demo. independent contractor misclassification happens when companies intentionally or mistakenly classify workers as independent contractors but treat them like employees. there are typically two reasons this happens — companies make an. Final rule: employee or independent contractor.

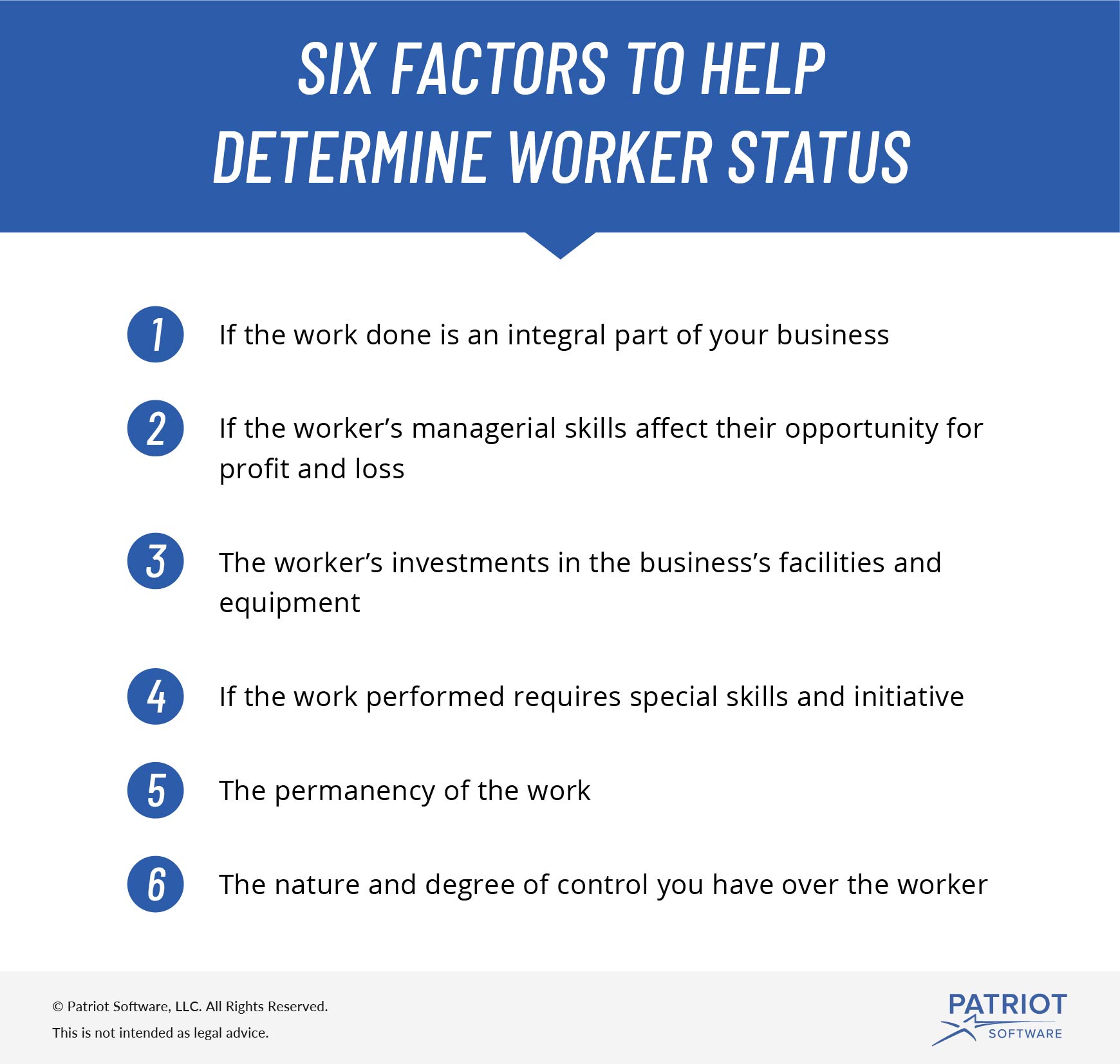

Independent Contractor Misclassification Guidelines Penalties More Prepare for audits in advance. 3.5 5. try pilot to simplify hiring. 4. get started with a free pilot demo. independent contractor misclassification happens when companies intentionally or mistakenly classify workers as independent contractors but treat them like employees. there are typically two reasons this happens — companies make an. Final rule: employee or independent contractor. These tools can analyse data points related to worker responsibilities, schedules and compensation to assess the independent contractor misclassification risks and flag potential compliance issues. by implementing these preventative measures, your business can reduce the risk of misclassification and avoid the associated costs and liabilities. These and other provisions in the 2021 independent contractor rule narrowed the economic reality test by limiting the facts that may be considered as part of the test—facts that the department believes are relevant in determining whether a worker is economically dependent on the employer for work (i.e., an employee under the flsa) or is in.

How To Avoid Employee Misclassification Risk These tools can analyse data points related to worker responsibilities, schedules and compensation to assess the independent contractor misclassification risks and flag potential compliance issues. by implementing these preventative measures, your business can reduce the risk of misclassification and avoid the associated costs and liabilities. These and other provisions in the 2021 independent contractor rule narrowed the economic reality test by limiting the facts that may be considered as part of the test—facts that the department believes are relevant in determining whether a worker is economically dependent on the employer for work (i.e., an employee under the flsa) or is in.

Comments are closed.