Independent Contractor Vs Employee Key Differences

Independent Contractor Vs Employee Key Differences Worker classification 101: employee or independent. Employee or independent contractor? a guide to the new rule.

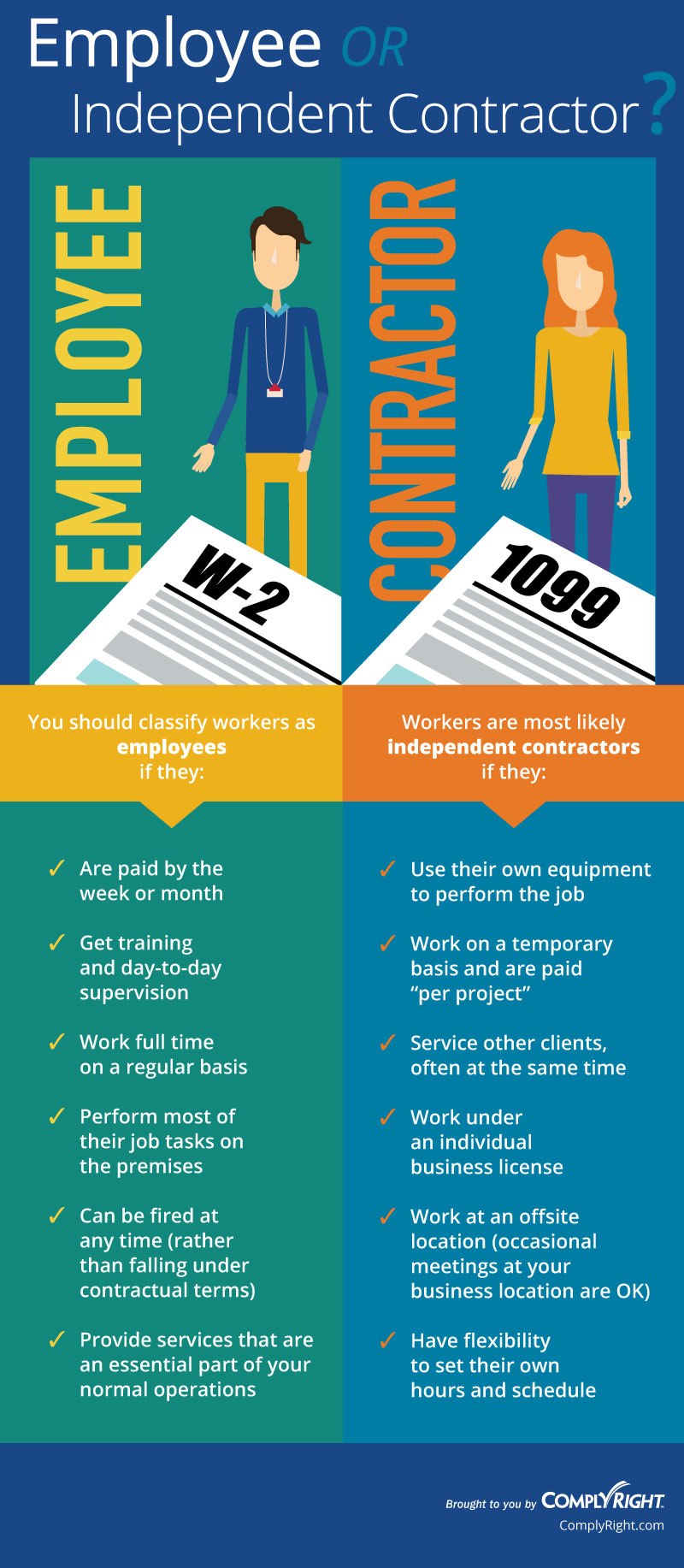

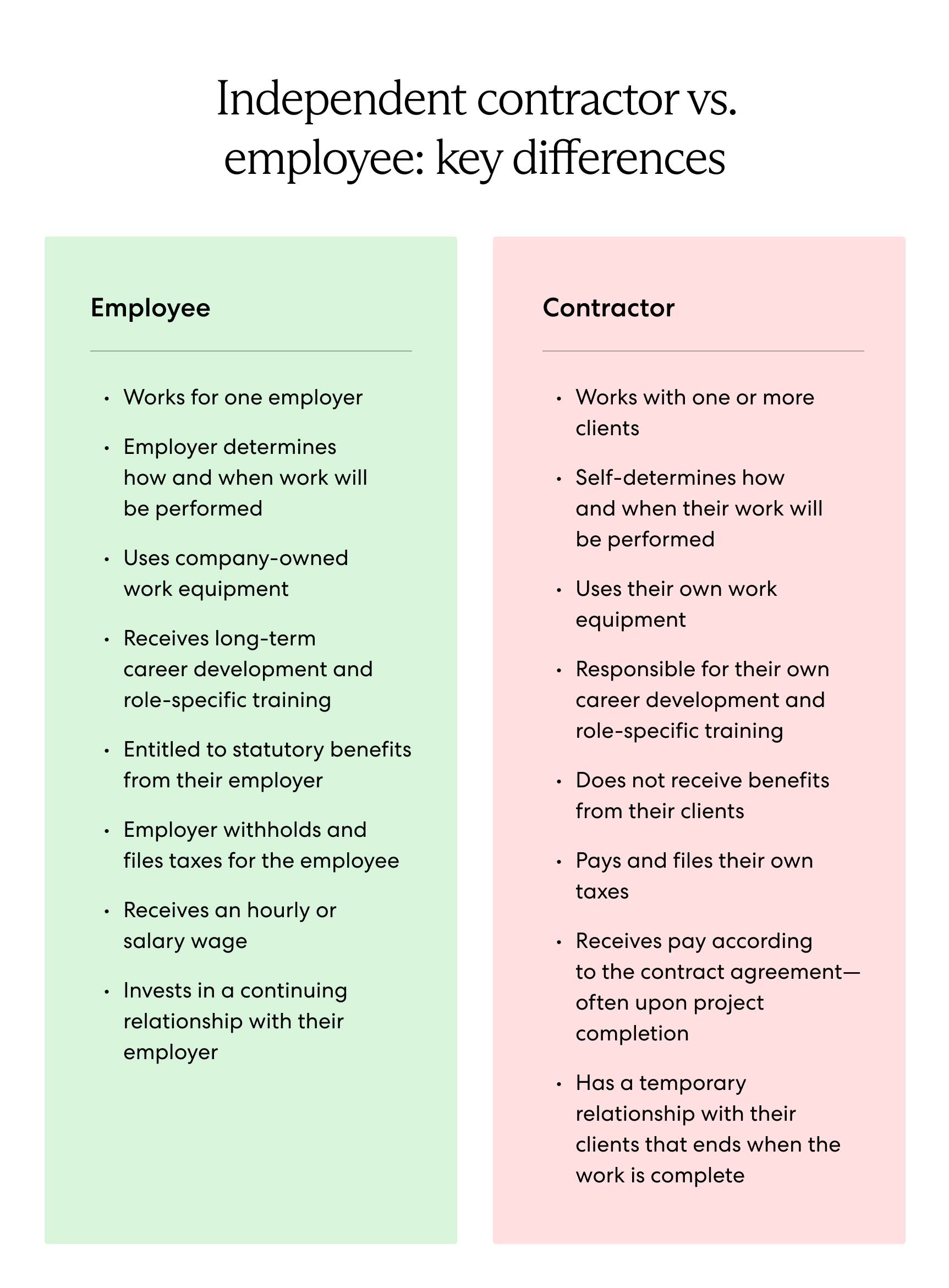

Independent Contractor Vs Employee Chart Key takeaways. while an independent contractor enjoys a higher level of flexibility, an employee is eligible for the benefits required by employment law. independent contractors and employees are taxed differently using different tax forms. misclassification of workers may be regarded as fraud and can have great repercussions. Key takeaways. an employee is a worker that gets hired and managed by an employer and receives mandatory employee benefits. an independent contractor is a self employed worker who provides services to a company and doesn’t receive employee benefits. an employer may face misclassification penalties if the authorities discover they’ve. While the independent contractor is his or her own boss, work stays within the definitions of oral or written contract and adheres to certain requirements. an employee, on the other hand, relies on the business for steady income, gives up elements of control and independence, is eligible for certain benefits and works within constraint of. Employers and employees each pay 50% of the fica taxes, while independent contractors are responsible for paying the full amount through self employment tax. self employment tax: this tax is paid by independent contractors and covers both the employee and employer shares of social security and medicare taxes.

Independent Contractor Misclassification How To Avoid The Risks While the independent contractor is his or her own boss, work stays within the definitions of oral or written contract and adheres to certain requirements. an employee, on the other hand, relies on the business for steady income, gives up elements of control and independence, is eligible for certain benefits and works within constraint of. Employers and employees each pay 50% of the fica taxes, while independent contractors are responsible for paying the full amount through self employment tax. self employment tax: this tax is paid by independent contractors and covers both the employee and employer shares of social security and medicare taxes. 2. economic and financial risk. if the worker faces financial risk by taking on work, bears all responsibility for profit or loss, and accounts for all costs incurred in the pursuit of that profit, then they are probably an independent contractor. 3. nature of the employment relationship. Independent contractor (self employed) or employee?.

Independent Contractor Vs Employee Key Differences 2. economic and financial risk. if the worker faces financial risk by taking on work, bears all responsibility for profit or loss, and accounts for all costs incurred in the pursuit of that profit, then they are probably an independent contractor. 3. nature of the employment relationship. Independent contractor (self employed) or employee?.

What S The Difference Between An Employee Vs Contractor Independent

Comments are closed.