Independent Contractor Vs Employee Top 8 Differences Infographic

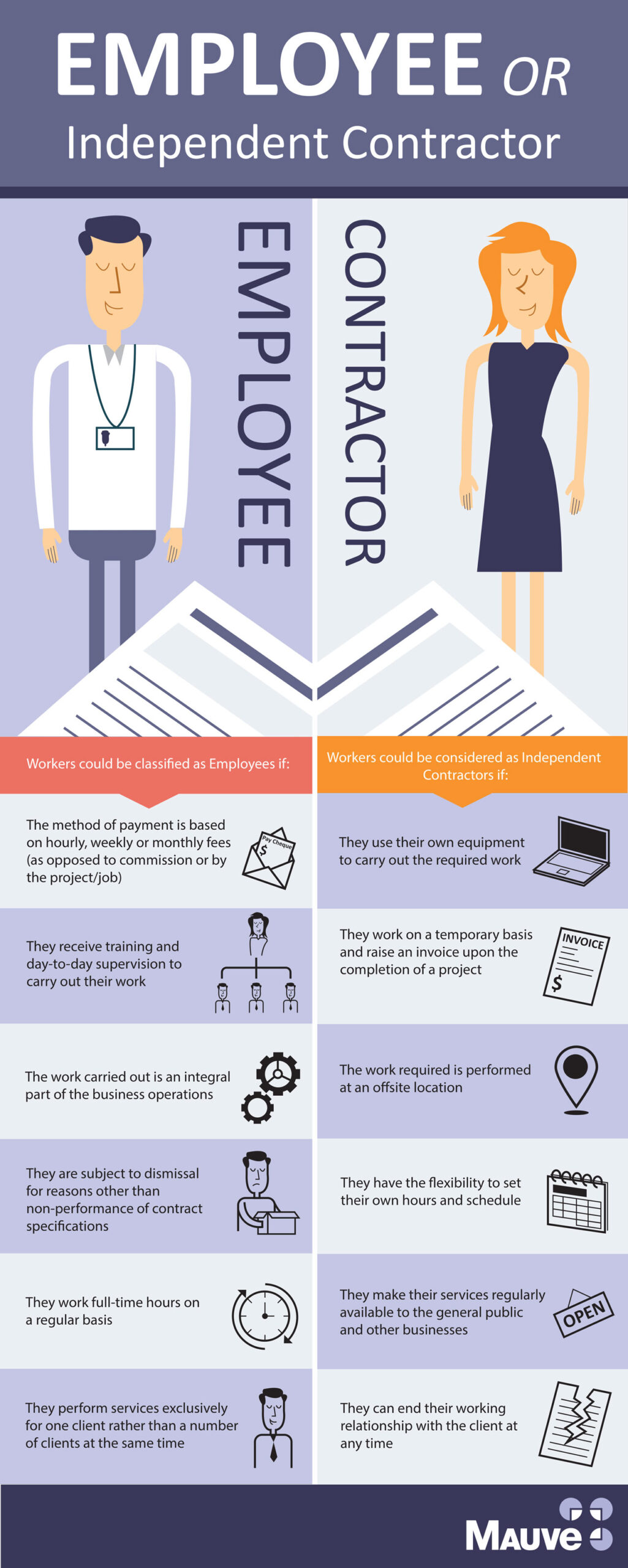

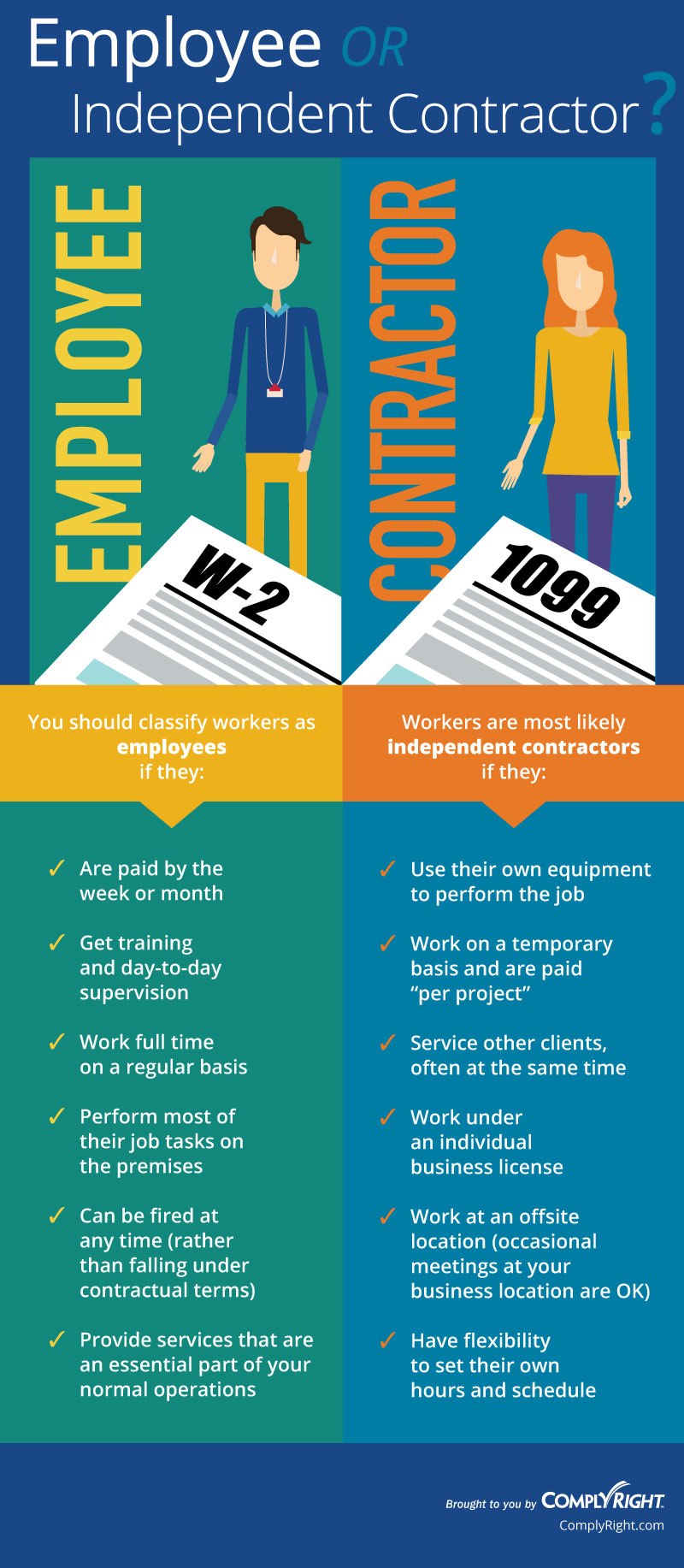

Independent Contractor Vs Employee Top 8 Differences Infographic Comparative table – independent contractor vs employee. employees receive a regular, fixed payment in a salary or an hourly wage. independent contractors are paid per project in the form of a project fee. employees receive various employer sponsored benefits such as sick leave, paid vacation, health insurance, pension, and severance. As of 2021, the department of labor (dol) emphasizes the two core factors for determining whether a worker is an independent contractor: the degree of control that the client exercises over the worker. this factor includes whether the client sets the worker’s hours, tells the worker what to do, and provides the worker with tools and equipment.

Independent Contractor Vs Employee Top 8 Differences Infographic Unlike an independent contractor, regular employees are legally bound to the company they work for. this means that you cannot be employed under a different company. moreover, regular employees are usually asked to do a specific task and do it repeatedly unless stated that the scope of the job has changed. Employee or independent contractor? a guide to the new rule. Worker classification 101: employee or independent. Independent contractor. an independent contractor is a person who agrees to do work for a company usually to fulfill a specific task but is not part of the company. often they are an alternative to hiring an employee. this allows each contractor agreement to fit the parties’ purposes rather than be broad or unclear.

What Are The Differences Between Employees And Independent Contractors Worker classification 101: employee or independent. Independent contractor. an independent contractor is a person who agrees to do work for a company usually to fulfill a specific task but is not part of the company. often they are an alternative to hiring an employee. this allows each contractor agreement to fit the parties’ purposes rather than be broad or unclear. While the independent contractor is his or her own boss, work stays within the definitions of oral or written contract and adheres to certain requirements. an employee, on the other hand, relies on the business for steady income, gives up elements of control and independence, is eligible for certain benefits and works within constraint of. Definition of an independent contractor. the irs defines an independent contractor as: "a worker who individually contracts with an employer to provide specialized or requested services on an as.

Independent Contractor Versus Employee Worker Classification While the independent contractor is his or her own boss, work stays within the definitions of oral or written contract and adheres to certain requirements. an employee, on the other hand, relies on the business for steady income, gives up elements of control and independence, is eligible for certain benefits and works within constraint of. Definition of an independent contractor. the irs defines an independent contractor as: "a worker who individually contracts with an employer to provide specialized or requested services on an as.

Comments are closed.