Independent Contractor Vs Employee What The Irs Says About It

Independent Contractor Vs Employee What The Irs Says About It Youtube Worker classification 101: employee or independent. An independent contractor. an employee (common law employee) a statutory employee. a statutory nonemployee. a government worker. in determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered.

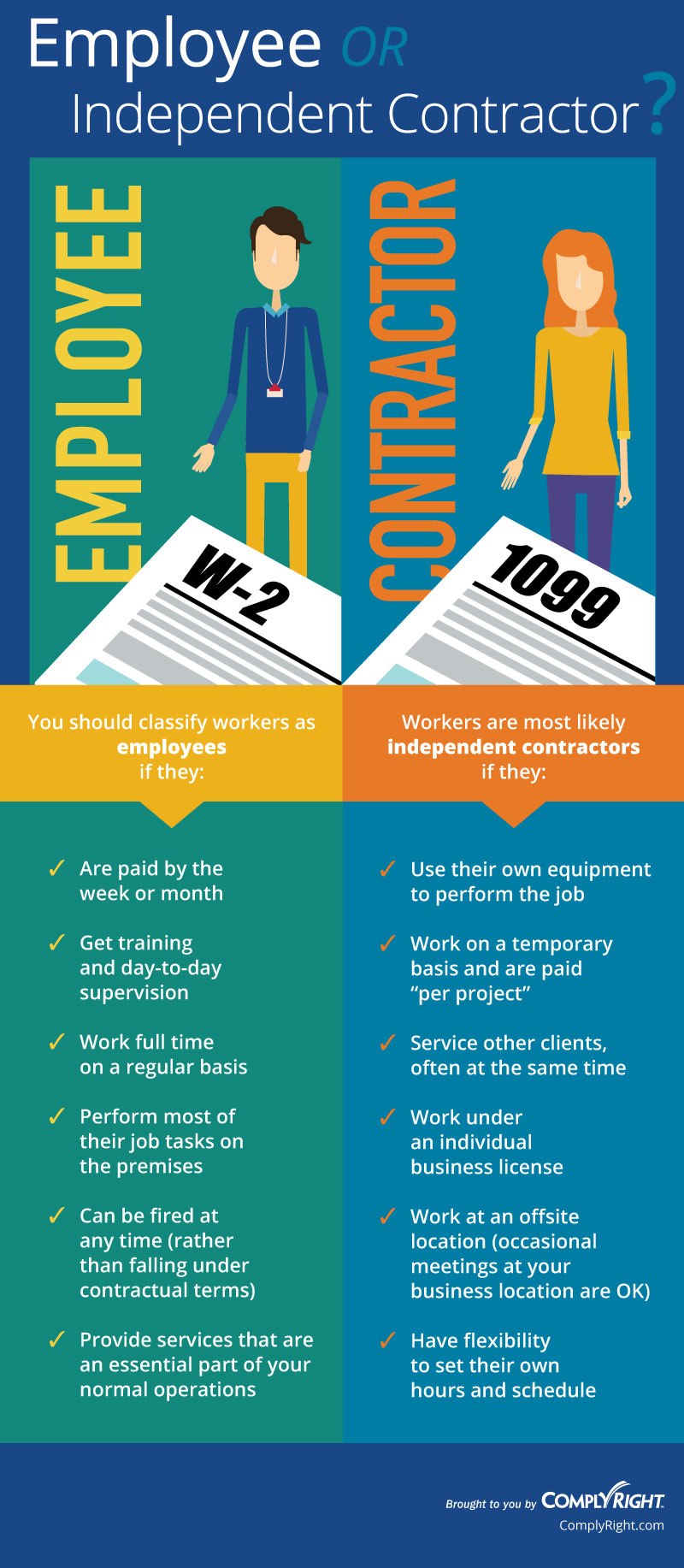

Independent Contractor Vs Employee Chart Employee or independent contractor? a guide to the new rule. Doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers or auctioneers are generally independent contractors. independent contractor vs. employee. whether a worker is an independent contractor or an employee depends on the relationship between the worker and the business. The following top 20 questions are what the irs uses to determine if a worker is an independent contractor or employee. while no single test, nor even the combination of a majority of tests, will necessarily be determinative, a “yes” answer to any one of the questions (except #16) may mean one of your workers is an employee and should be. In publication 15 a, employer's supplemental tax guide, the irs identified three categories of evidencethat are relevant in determining whether a worker is an employee or an independent contractor: behavioral control: whether the business has a right to direct and control how the worker does the task for which the worker is hired;.

Comments are closed.