Infographic The Growth Of Invoice Finance Lending 2016 Smeif

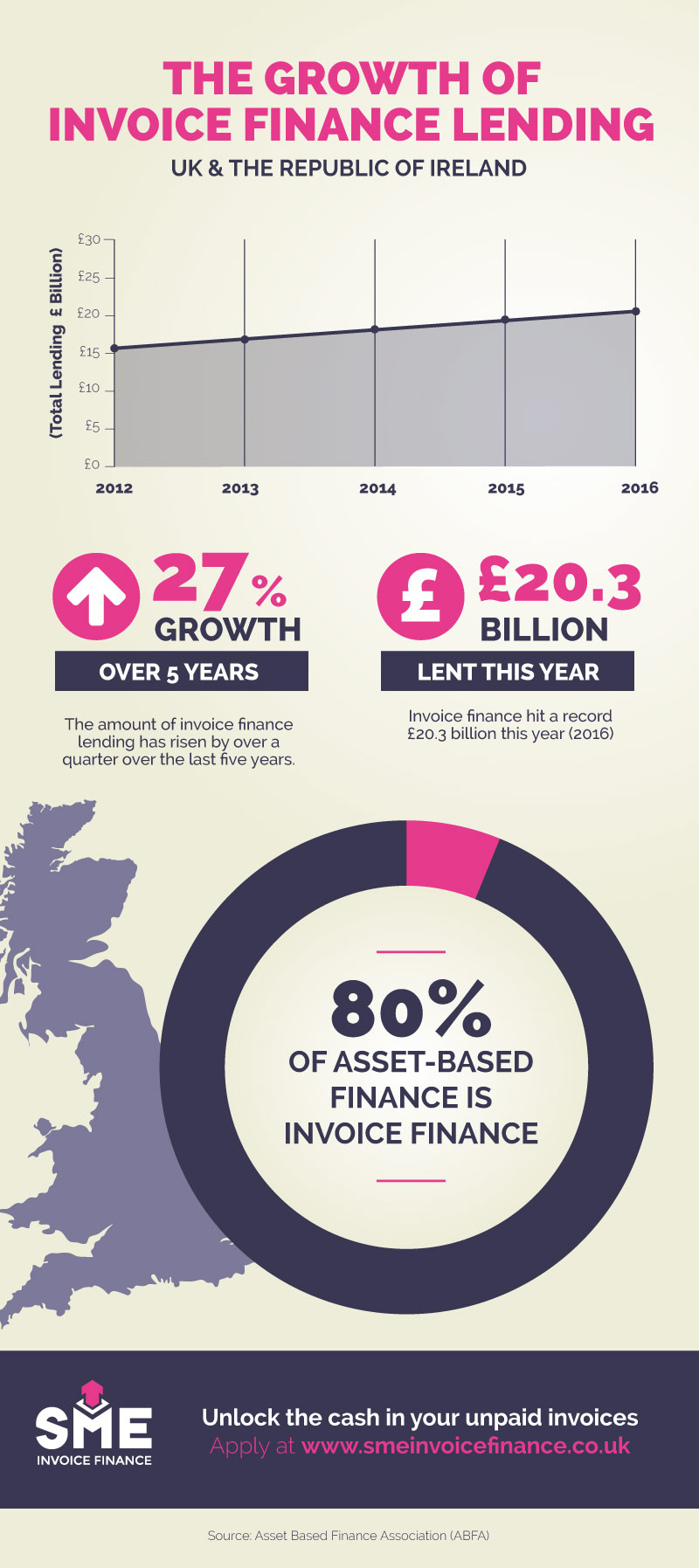

Infographic The Growth Of Invoice Finance Lending 2016 Smeif We take a look at the growth of invoice finance lending in uk and the republic of ireland over the last 5 years. the growth of invoice finance lending 2016. Sme invoice finance. april 11, 2016. 3 min read. invoice finance can help businesses release the cash value tied up in outstanding invoices. how it works: 1. choose a customer invoice or multiple invoices you would like to release cash against. 2. receive advance up to 90% of the value of your sales invoices in 24 hours.

Infographic The Growth Of Invoice Finance Lending 2016 Smeif Infographic – jan 04, 2016. invoice finance is an alternative form of financing where a business can get paid up to 95. % of the value of their outstanding invoices. payment is received in as little as 24 hours versus the traditional 30 90 days, allowing you to unlock cash in a timely manner. due to high demand, we have put together a. Advance your invoices on a pay as you go basis. more than a third of smes wait between 30 and 90 days to get paid, placing severe strain on cash flow and limiting opportunities for growth. invoice finance enables you to unlock £1m – £10m of cash tied up in these unpaid invoices by advancing you up to 90% of the invoice value, on a pay as. Incomlend is a global invoice financing marketplace for businesses and private capital. founded in 2016, the singapore based company has processed more than 6,000 transactions and provides invoice finance services in over 50 countries worldwide. as one of the first alternative cross border trade finance platforms globally, incomlend enables. The financing company approves your invoice submission and gives you an advance of 90% ($90,000). fees are charged and you collect payment. the company charges a 2% fee for each week it takes your.

Comments are closed.