Inherited Ira Strategies

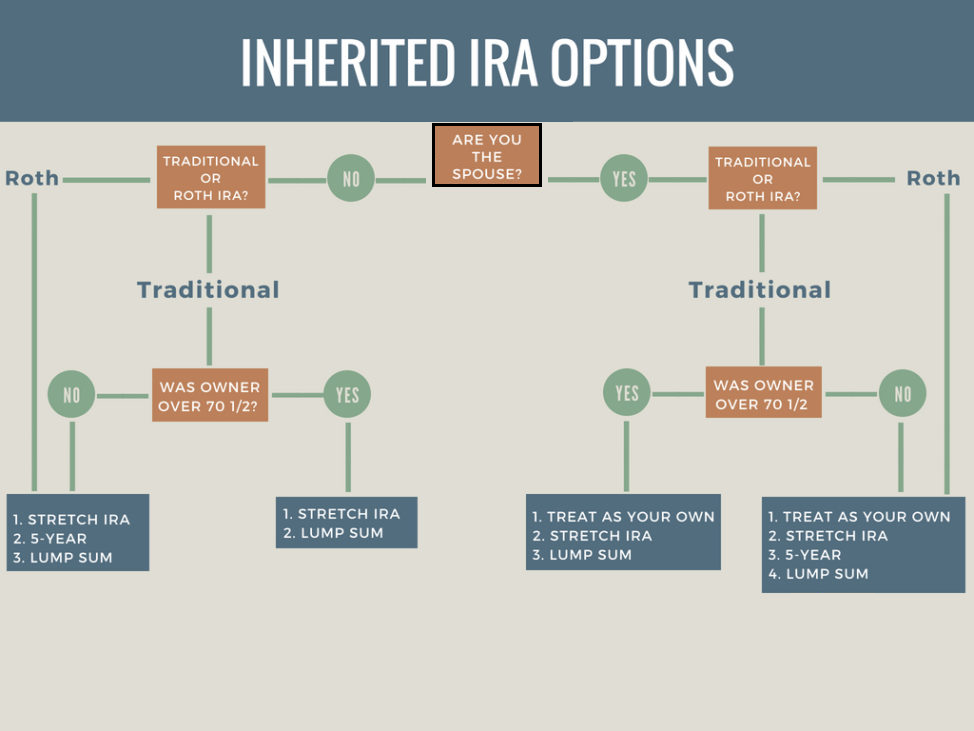

Year End Planning Rmd Inherited Ira Strategies Relative Value Partners There are two main options available to all designated beneficiaries when it comes to withdrawing money from an ira that you inherit. 1. first, you can choose to take a lump sum distribution, withdrawing the entire account balance at the same time. however, keep in mind that the withdrawal will be treated as taxable income, so it might not be a. One inherited ira tax management tip is to avoid immediately withdrawing a single lump sum from the ira. instead, wait until rmds are due or, if you got the ira from a non spouse, stretch withdrawals over 10 years. rmds are taxable and can change your tax bracket and increase your overall tax burden. but if, as is often the case, you are in a.

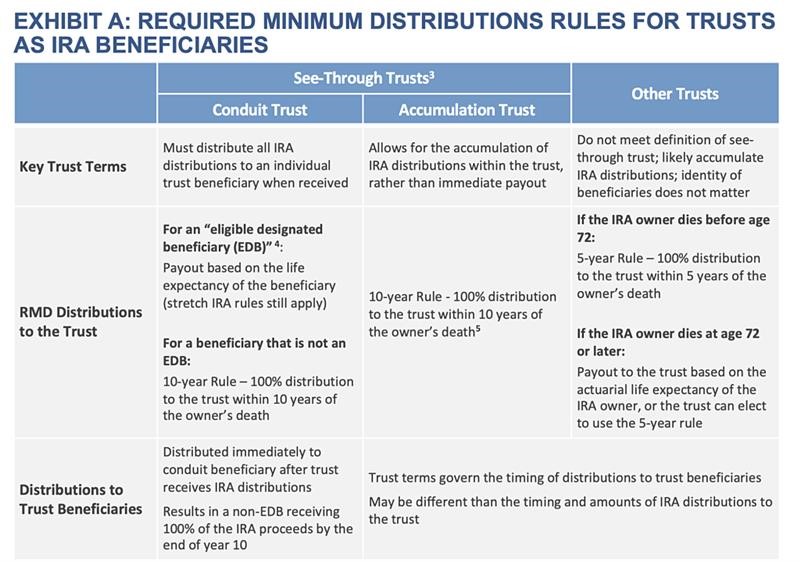

Inheriting An Ira From Your Spouse Know Your Options New Century The secure act changed the rmds for inherited traditional and roth iras when the death of the account holder occurred in 2020 or later. under the 10 year rule, the value of an ira that has been. In this scenario, it's often advantageous to withdraw assets from the inherited ira or 401(k) in equal installments over the entire 10 year period. the strategy is designed to smooth out the impact of additional taxable income and help lower the risk of bumping you into a higher marginal tax bracket by mistake. how to invest. New legislation. 1. inherited ira tax rules have changed. if you have inherited an ira or have any other retirement plan account, it's important to be aware of the secure 2.0 act. secure 2.0 is. Before 2020, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended deferral, and take rmds over your life expectancy based on.

Inherited Ira Distribution Rules 2024 Jess Hildebrant New legislation. 1. inherited ira tax rules have changed. if you have inherited an ira or have any other retirement plan account, it's important to be aware of the secure 2.0 act. secure 2.0 is. Before 2020, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended deferral, and take rmds over your life expectancy based on. An inherited ira is an individual retirement account opened when you founder of inheritedirahell and president of arizona based financial strategies, which specializes in inherited ira. The original secure act that went into effect in 2020 changed the rbd for ira owners to april 1 of the year the ira owner turns 72, but only for ira owners born on or after july 1, 1949. with the passage of secure 2.0, the rbd and required minimum distributions (rmds) moved to age 73 for those who reached that age in 2023.

Understanding Inherited Ira Strategies Make The Most Out Of Your Money An inherited ira is an individual retirement account opened when you founder of inheritedirahell and president of arizona based financial strategies, which specializes in inherited ira. The original secure act that went into effect in 2020 changed the rbd for ira owners to april 1 of the year the ira owner turns 72, but only for ira owners born on or after july 1, 1949. with the passage of secure 2.0, the rbd and required minimum distributions (rmds) moved to age 73 for those who reached that age in 2023.

Inherited Stretch Ira Strategies Ymyw Podcast Youtube

Comments are closed.