Internal Rate Of Return Irr Formula And Calculation Part 2 Of 2

Internal Rate Of Return Formula How To Calculate Irr Internal rate of return irr: internal rate of return (irr) is a metric used in capital budgeting to estimate the profitability of potential investments. internal rate of return is a discount. Irr – exit year 5 = 19.8%. if we were to calculate the irr using a calculator, the formula would take the future value ($210 million) and divide by the present value ( $85 million) and raise it to the inverse number of periods (1 ÷ 5 years), and then subtract out one – which again gets us 19.8% for the year 5 internal rate of return (irr).

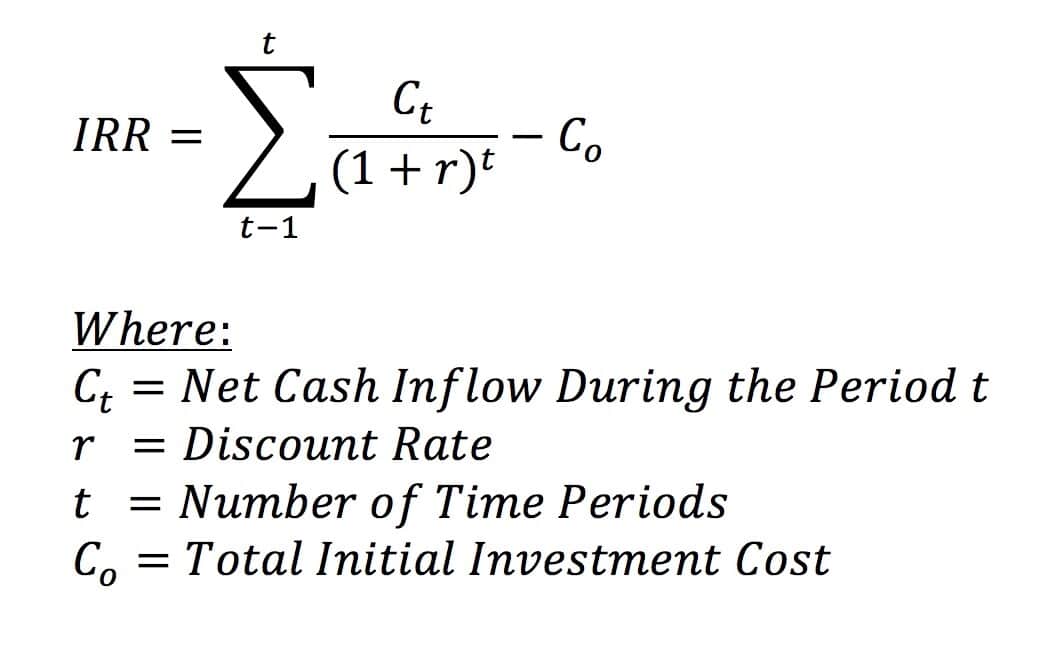

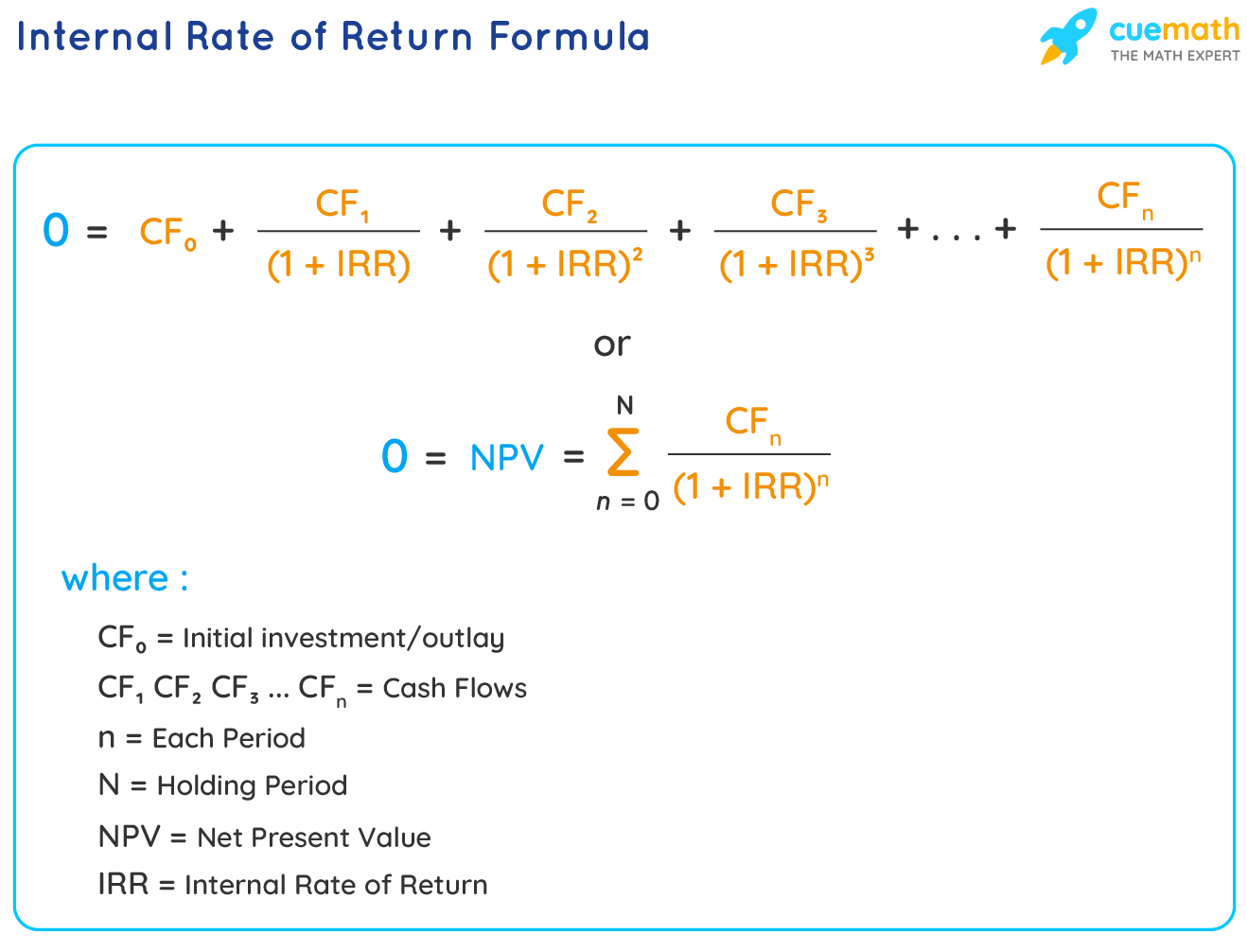

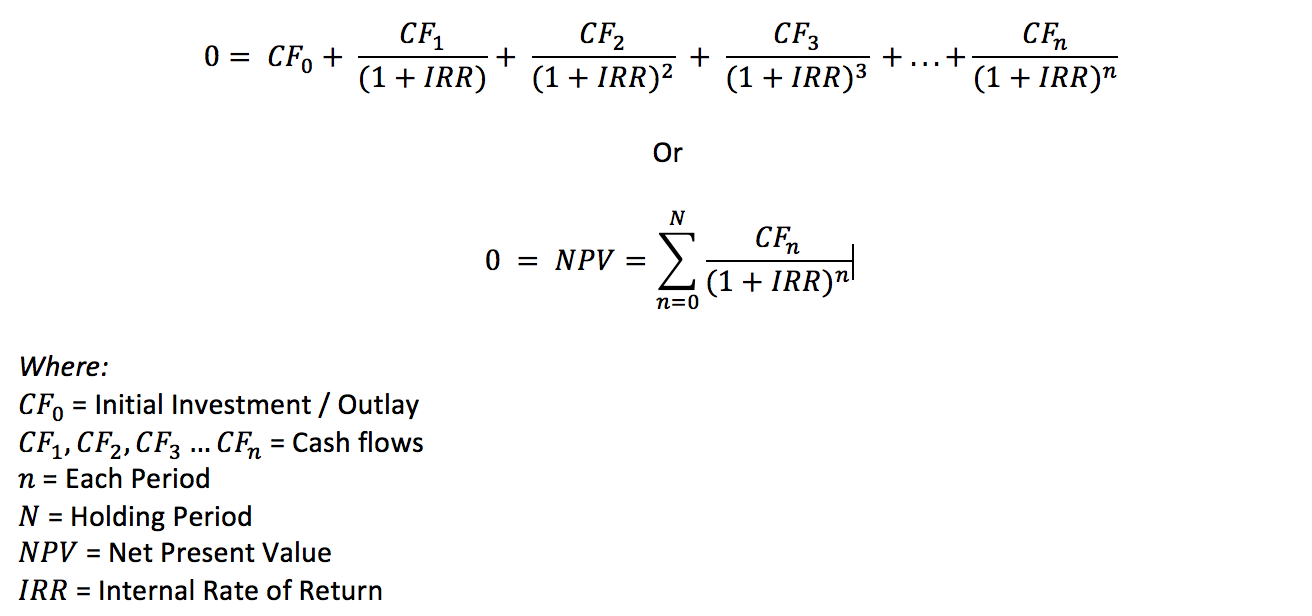

Internal Rate Of Return Irr Formula Stratafolio The internal rate of return (irr) is the discount rate that makes the net present value (npv) of a project zero. in other words, it is the expected compound annual rate of return that will be earned on a project or investment. when calculating irr, expected cash flows for a project or investment are given and the npv equals zero. put another. By definition, an internal rate of return (irr) is the interest rate at which all cash flows associated with a particular investment have a net present value equal to zero. in other words, a project's irr is the discount rate that makes the present value of the expected future cash flows equal to the initial investment. Return on investment, or roi, is the percentage increase or decrease of an investment over a given period of time, whereas irr is measured as an annual rate. the formula for calculating roi is. The purpose of the internal rate of return . the irr is the discount rate at which the net present value (npv) of future cash flows from an investment is equal to zero. functionally, the irr is.

Internal Rate Of Return Formula Derivations Formula Examples Return on investment, or roi, is the percentage increase or decrease of an investment over a given period of time, whereas irr is measured as an annual rate. the formula for calculating roi is. The purpose of the internal rate of return . the irr is the discount rate at which the net present value (npv) of future cash flows from an investment is equal to zero. functionally, the irr is. Using the irr calculator; what is internal rate of return? irr formula; irr calculation example; financial caution using the irr calculator. using the irr calculation tool is straightforward: simply enter the initial investment (tool says dollars, but it can be in any currency like eur, swiss francs, etc.) then select the number of years of cash flow you want to analyze (could be any period. The internal rate of return is used to evaluate projects or investments. the irr estimates a project’s breakeven discount rate (or rate of return) which indicates the project’s potential for profitability. based on irr, a company will decide to either accept or reject a project. if the irr of a new project exceeds a company’s required.

Internal Rate Of Return Irr Formula And Excel Calculator Using the irr calculator; what is internal rate of return? irr formula; irr calculation example; financial caution using the irr calculator. using the irr calculation tool is straightforward: simply enter the initial investment (tool says dollars, but it can be in any currency like eur, swiss francs, etc.) then select the number of years of cash flow you want to analyze (could be any period. The internal rate of return is used to evaluate projects or investments. the irr estimates a project’s breakeven discount rate (or rate of return) which indicates the project’s potential for profitability. based on irr, a company will decide to either accept or reject a project. if the irr of a new project exceeds a company’s required.

Internal Rate Of Return Irr Definition Examples And Formula

Comments are closed.