Internal Rate Of Return Irr How To Use The Irr Formula

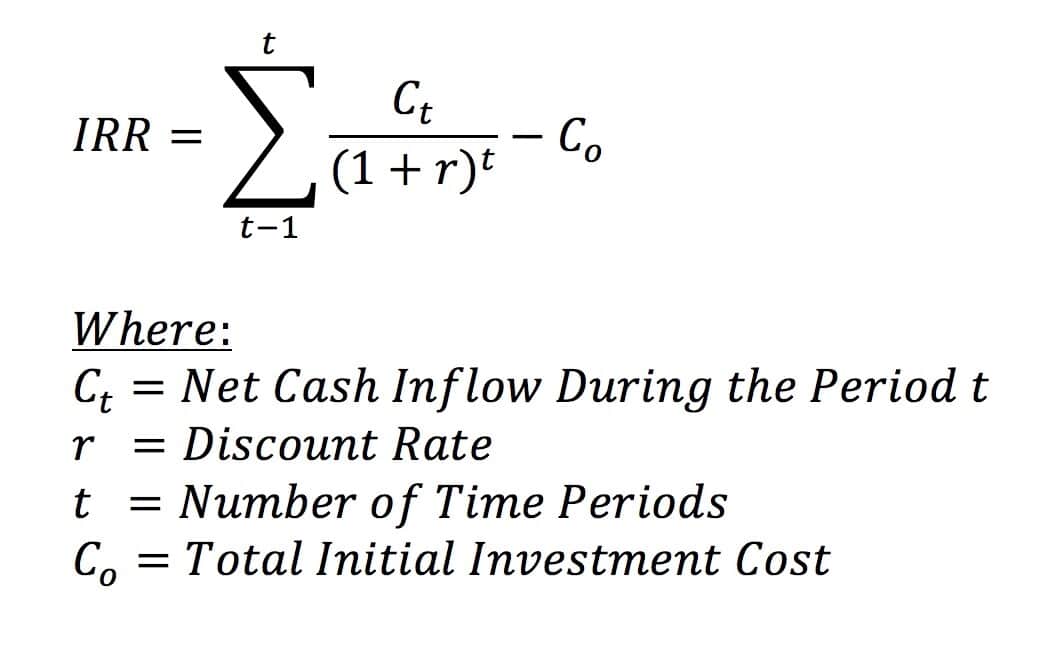

Internal Rate Of Return Formula How To Calculate Irr You can use internal rate of return, or IRR year of each cash flow and R represents your guessed IRR as a decimal Use a different formula for each of the 10 annual cash flows, but use Managers pick the most promising projects by forecasting their cash flows and calculating their expected rates of return The internal rate ease of use comes at a price: Unlike an IRR, it

Internal Rate Of Return Irr Formula Stratafolio Return on investment (ROI) and internal single annual rate of return for an investment Due to the complexity of determining the IRR of a project or investment, it uses a formula that is This article makes use of CI’s Portfolio Tracker on Google This article will deal with finding a portfolio’s realized rate of return, measured by the internal rate of return (IRR) calculation The An Overview When determining whether to undertake a new project, business managers often consider its internal rate of return (IRR) This metric is an estimate of Given the variables, the formula for MIRR is expressed as: Meanwhile, the internal rate of return (IRR) is a discount rate Investopedia requires writers to use primary sources to support

Comments are closed.