Investment Risks What Your Clients Need To Know

Investment Risk Definition Types Factors And How To Mitigate For example, a client with a high income and few financial obligations may have a higher risk capacity than risk tolerance. advisors can assess a client’s risk capacity by examining their family situation and financial status, including their net worth, income stability and future obligations. 6. explain risk return tradeoff. Know your client kyc: the know your client form is a standard form in the investment industry that ensures investment advisors know detailed information about their clients' risk tolerance.

Here Are The Risks And Strategies To Be Aware Of Before Investing Money Risk tolerance questionnaire template to give to your clients. risk tolerance questionnaires can help advisors better understand what their clients need when developing a financial plan. clients may complete this questionnaire during the onboarding process and the answers they provide can inform your decision making when offering financial advice. Completing a risk assessment enables a financial advisor to determine general classes of assets and specific types of investments that are most appropriate for a given client. both risk tolerance. According to a kiplinger article, financial advisors need to be both disciplined and objective when it comes to accurately determining the risk tolerance level of their clients. in addition, advisors need to utilize the right resources and tools. the right risk tolerance assessment tool will analyze the client’s willingness and ability to. Financial advisors need to recommend investments that align with the client's willingness and ability to take on risk. risk tolerance considers aspects of a client's personality, background with.

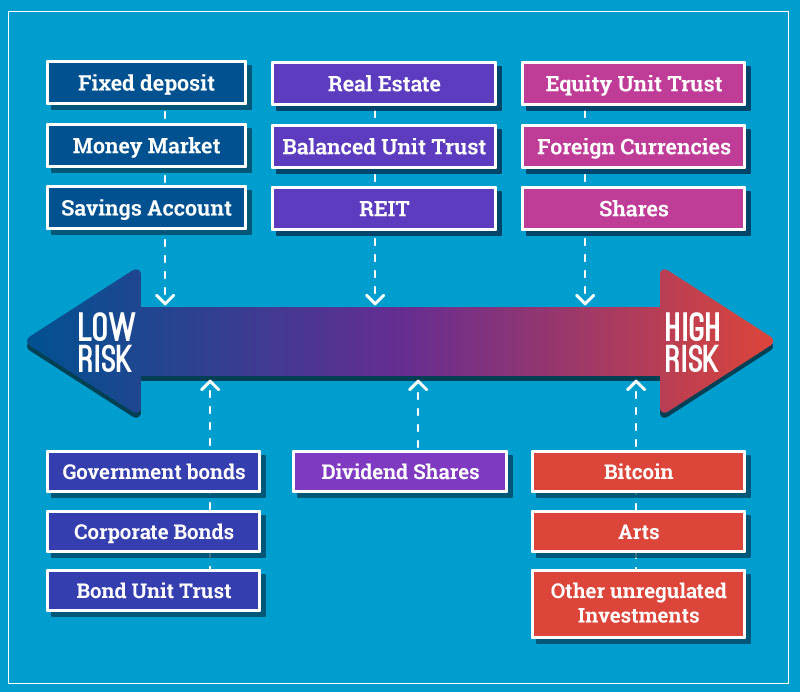

What Are The Risks Associated With Your Investments Accredited Investor According to a kiplinger article, financial advisors need to be both disciplined and objective when it comes to accurately determining the risk tolerance level of their clients. in addition, advisors need to utilize the right resources and tools. the right risk tolerance assessment tool will analyze the client’s willingness and ability to. Financial advisors need to recommend investments that align with the client's willingness and ability to take on risk. risk tolerance considers aspects of a client's personality, background with. When determining your risk tolerance, it's also important to understand your goals so you don't make a costly mistake. your time horizon, or when you plan to withdraw the money you've invested, can greatly influence your approach to risk. your time horizon depends on what you're saving for, when you expect to begin withdrawing the money and how. Explaining financial risk tolerance to clients. before making any assumptions about what your client does or doesn’t know, simply ask them if they’re familiar with the concept of risk tolerance and how comfortable they are discussing their own position on the risk tolerance scale. if they give you a confused look or admit they aren’t.

So You Think You Know Investment Risks Imoney When determining your risk tolerance, it's also important to understand your goals so you don't make a costly mistake. your time horizon, or when you plan to withdraw the money you've invested, can greatly influence your approach to risk. your time horizon depends on what you're saving for, when you expect to begin withdrawing the money and how. Explaining financial risk tolerance to clients. before making any assumptions about what your client does or doesn’t know, simply ask them if they’re familiar with the concept of risk tolerance and how comfortable they are discussing their own position on the risk tolerance scale. if they give you a confused look or admit they aren’t.

Comments are closed.