Invoice Discounting Or Bill Discounting Or Purchasing Bills

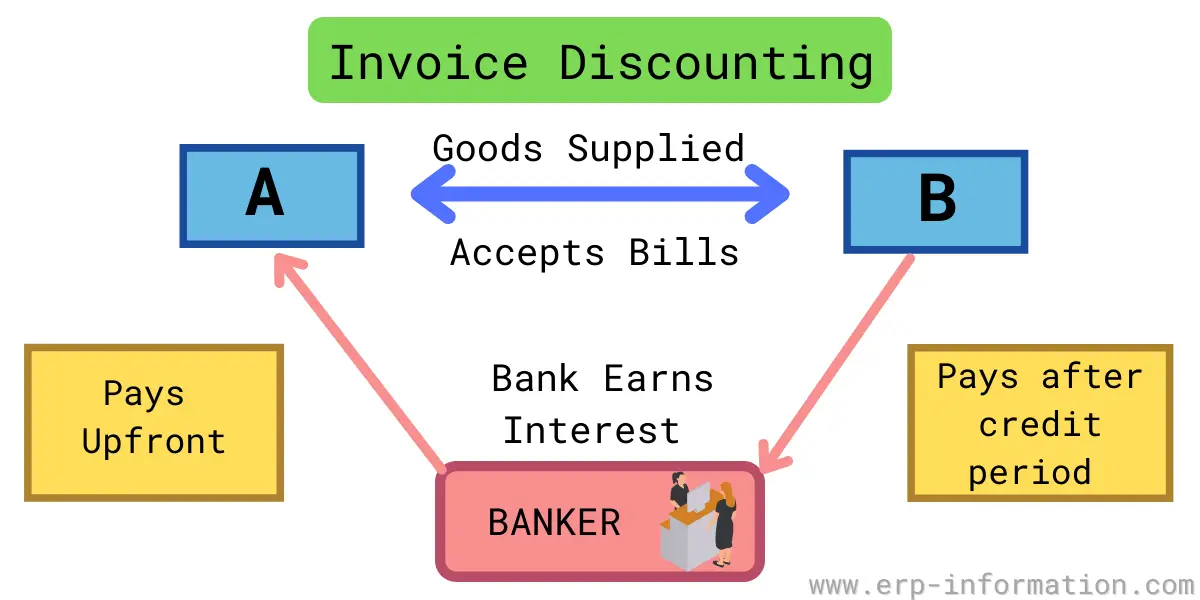

Invoice Discounting Or Bill Discounting Or Purchasing Bills The terms ‘invoice discounting’ or ‘bills discounting’ or ‘purchase of bills’ are all same. invoice discounting is a source of working capital finance for the seller of goods on credit. bill discounting is an arrangement whereby the seller recovers an amount of the sales bill from the financial intermediaries before it is due. Invoice discounting is a loan, whereas bill discounting acts as a bill of exchange. when you pursue invoice discounting, you can only do so for unpaid invoices that will be paid in 90 days, whereas bill discounting offers more flexibility and can work for bills due anywhere from 30 to 120 days.

What Is The Bill Discounting Procedure Example And Formula Bill purchasing is a financial transaction where a party, often a financial institution or a third party entity, outright buys a trade bill from the original holder. in this arrangement, the purchaser becomes the new owner of the bill, assuming both control and credit risk. the primary purpose of bill purchasing is to provide immediate. Bill discounting. bill purchase. the details of the unpaid invoices is shared with the lender. the unpaid invoices are sold to the factor. invoice value is assessed after which a short term loan is given based on the value. the factor makes the payment of the invoices after deducting their fees. credit control lies with the business. Bill discounting and bill purchase both offer the business a method of obtaining funds as they await the outstanding dues from customers. the purpose they serve is similar in nature. however, there are a couple of factors to consider to choose the best alternative: customer relationship. in the case of bill discounting, the responsibility to. Bill discounting has several benefits that make it the go to financing option for businesses; some of which include . 1. quick cash in hand – bill discounting process is relatively fast when compared with other means of financing, and because of that, it is opted by businesses in a recurring manner. 2.

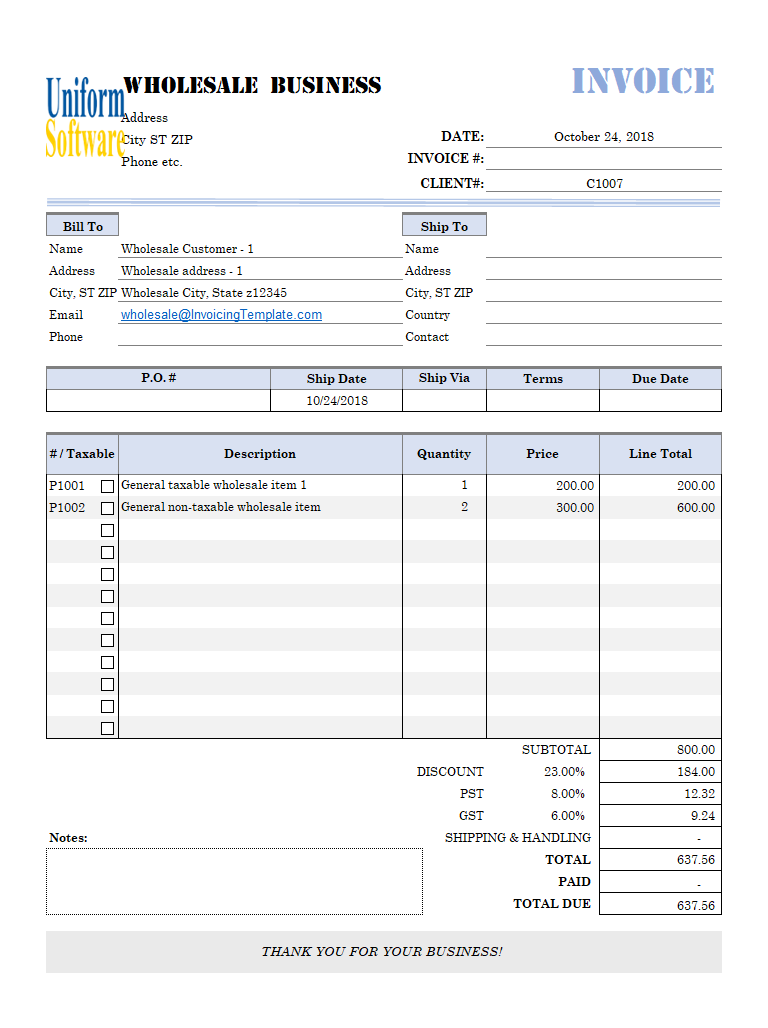

Wholesale Invoice Format With Per Customer Discount Rate Bill discounting and bill purchase both offer the business a method of obtaining funds as they await the outstanding dues from customers. the purpose they serve is similar in nature. however, there are a couple of factors to consider to choose the best alternative: customer relationship. in the case of bill discounting, the responsibility to. Bill discounting has several benefits that make it the go to financing option for businesses; some of which include . 1. quick cash in hand – bill discounting process is relatively fast when compared with other means of financing, and because of that, it is opted by businesses in a recurring manner. 2. Key differences between bill purchase and bill discounting. bill discounting involves the bank providing funds to the seller based on the discounted value, while bill purchase involves the bank purchasing the bill from the seller for the purchase price. in bill discounting, the seller is still responsible for collecting payment from the buyer. Bills purchase are similar to bill discounting with the difference being that the financial institution retains the right to recoup the receivables from the businesses customers. eseentially the difference lies in the collection mechanism. uncertainty is part of running a business. despite their most sincere efforts, companies cannot control.

What Is Invoice Discounting And How You Can Benefit From It Key differences between bill purchase and bill discounting. bill discounting involves the bank providing funds to the seller based on the discounted value, while bill purchase involves the bank purchasing the bill from the seller for the purchase price. in bill discounting, the seller is still responsible for collecting payment from the buyer. Bills purchase are similar to bill discounting with the difference being that the financial institution retains the right to recoup the receivables from the businesses customers. eseentially the difference lies in the collection mechanism. uncertainty is part of running a business. despite their most sincere efforts, companies cannot control.

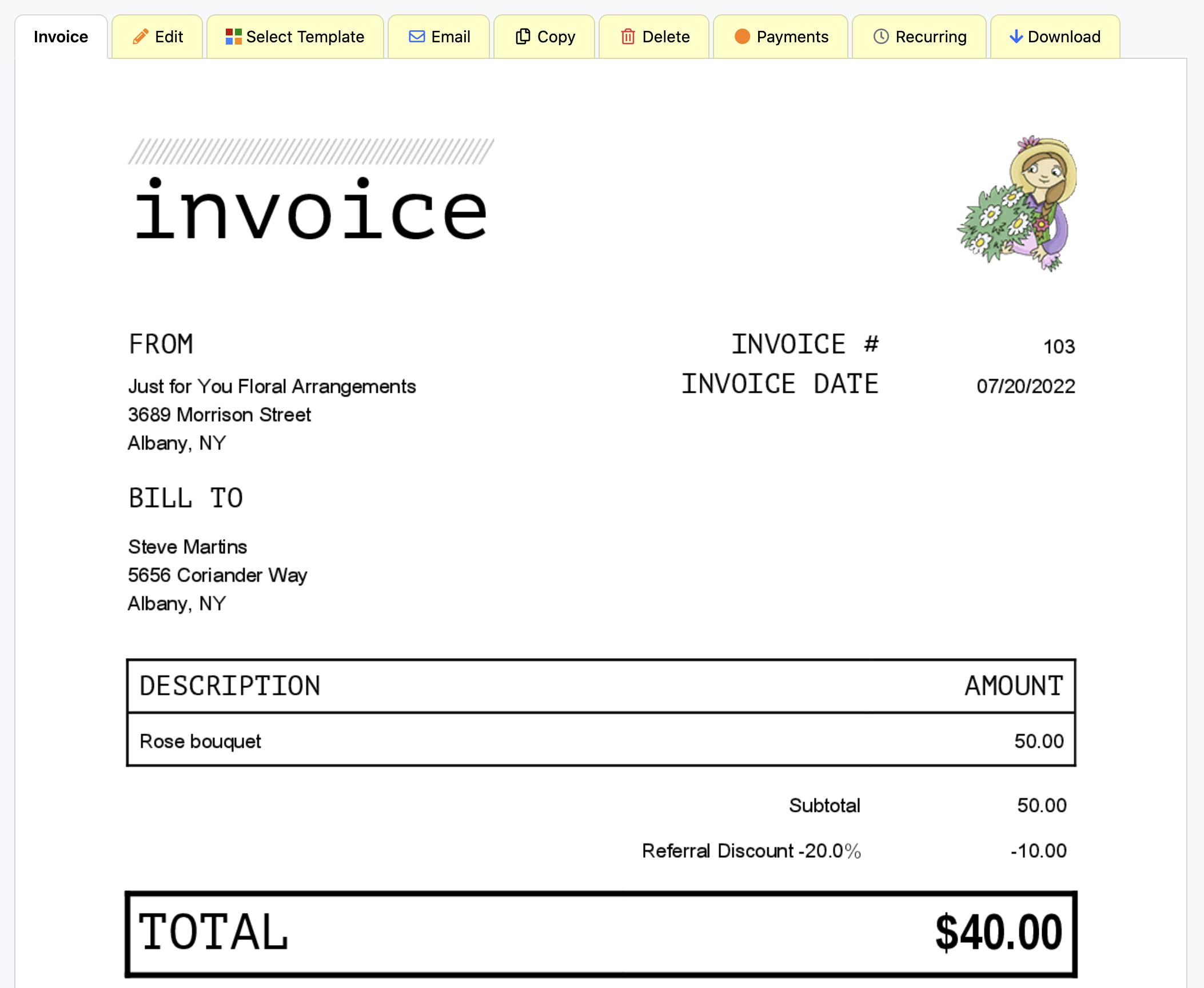

How To Offer A Discount On An Invoice With Invoice Home

Comments are closed.