Invoice Discounting What Are The Advantages Of Invoice Discounting

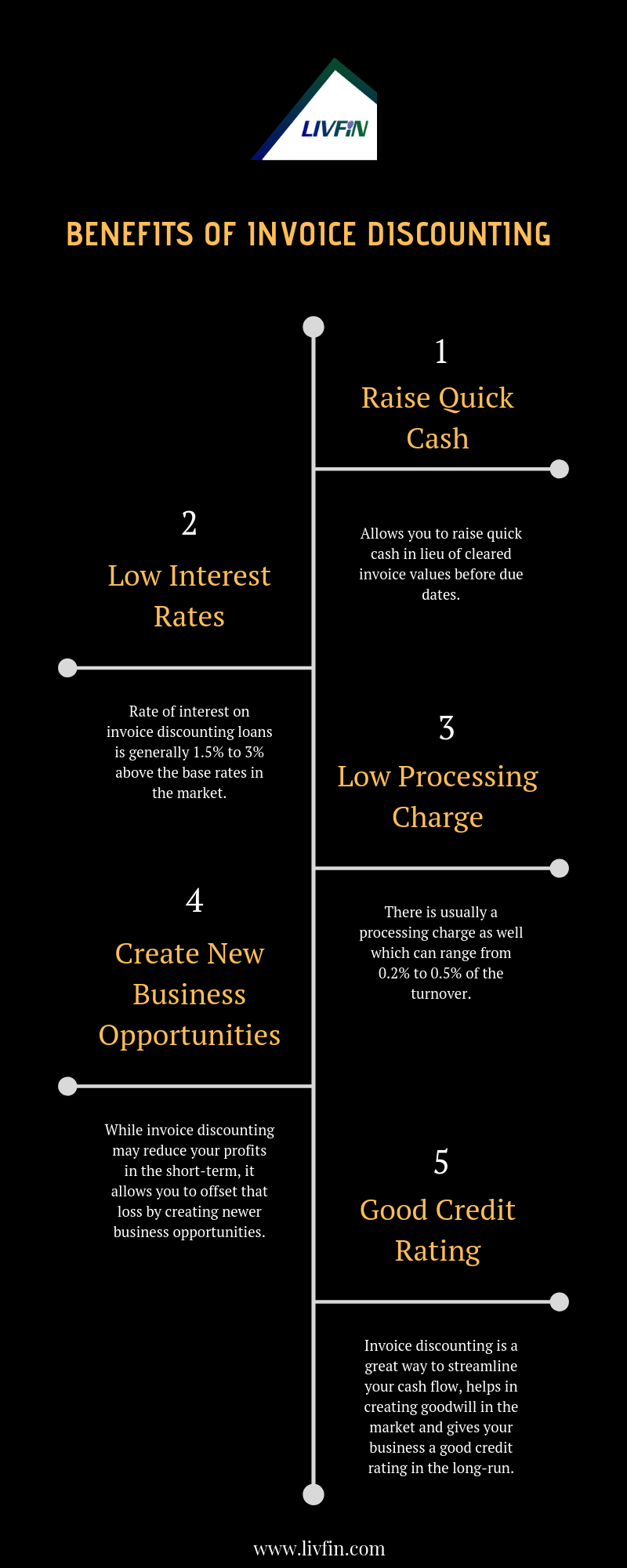

Invoice Discounting What Are The Advantages Of Invoice Discounting What are the advantages of invoice discounting? increased cash flow. invoice discounting providers generally work much faster than banks in assessing the viability of the lender. many lenders are able to generate cash in as little as 48 hours meaning discounting has significant speed advantages over traditional finance. It is important to know the advantages and disadvantages of the invoice discounting technique in order to use it effectively. quick cash. invoice discounting is a comparatively quicker and faster method to procure cash than applying for a cash credit in which credit institutions or banks take quite a lot of time in credit appraisal of the borrower.

What Is Invoice Discounting Types Process Benefits Invoice discounting, or invoice financing, is a method of debt financing for small businesses. because it relies on customer invoices to fund, invoice discounting is specifically for b2b. Invoice discounting offers plenty of benefits for businesses struggling due to unpaid invoices. here are some of the key benefits. invoice discounting offers a business fast access to its accounts receivable ledger. this invoice financing service secures a more stable cash flow stream. Invoice discounting is a financing technique where a business sells its outstanding invoices to a third party at a discounted rate in exchange for immediate cash. in this type of financing, the third party is a financial institution that provides the loan based on the invoice’s value. this helps businesses to receive a portion of the invoice. Below are some of the advantages of invoice discounting: availability of cash by using this type of financing, one can easily avail funds within 72 hours of applying. it is beneficial for businesses generating high value invoices. a single unpaid invoice keeps a huge fund tied up.

What Is Invoice Discounting Features And Benefits For Small Businesses Invoice discounting is a financing technique where a business sells its outstanding invoices to a third party at a discounted rate in exchange for immediate cash. in this type of financing, the third party is a financial institution that provides the loan based on the invoice’s value. this helps businesses to receive a portion of the invoice. Below are some of the advantages of invoice discounting: availability of cash by using this type of financing, one can easily avail funds within 72 hours of applying. it is beneficial for businesses generating high value invoices. a single unpaid invoice keeps a huge fund tied up. Invoice discounting helps you receive a percentage of the total from the lender when you invoice a customer or client, providing your business with a cash flow boost. in short, invoice discounting help you in many ways like: improves your business cash flow. providing flexibility in getting quick cash. Advantages. the various advantages related to the invoice discounting finance are as follows: using the invoice discounting approach, the company can improve its cash flow, and using that money, it can pay its supplier, and employees, or can reinvest the same in some other operations of the business.

Comments are closed.