Invoice Discounting What Is It Vs Factoring Advantages

Invoice Discounting Vs Factoring Need To Know Info Penny Advantages. the various advantages related to the invoice discounting finance are as follows: using the invoice discounting approach, the company can improve its cash flow, and using that money, it can pay its supplier, and employees, or can reinvest the same in some other operations of the business. The benefits of invoice factoring and invoice discounting. there are some major benefits to both invoice factoring and invoice discounting: 1. quick access to cash upfront. both the factoring process and discounting process are quick and simple, with monies provided within a couple of working days for approved invoices.

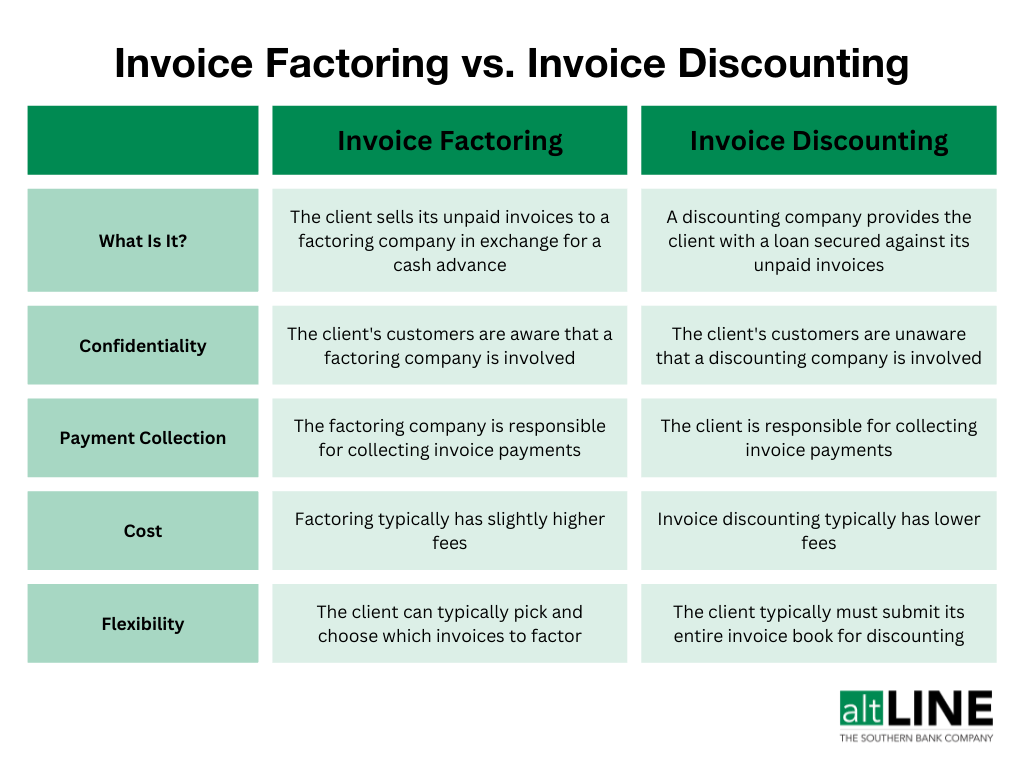

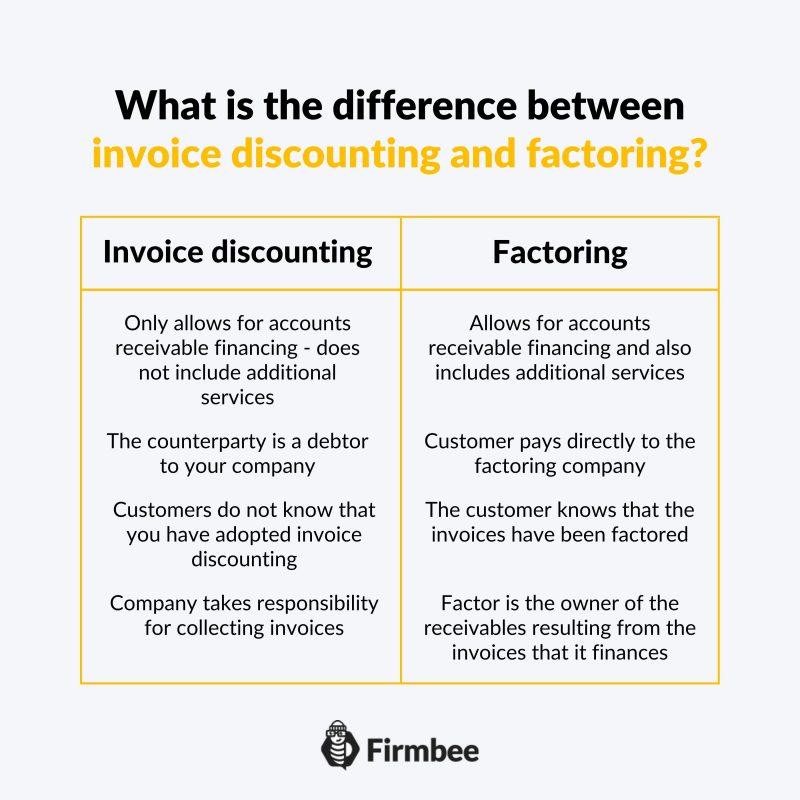

Understanding Invoice Discounting How It Works Altline Difference between invoicing discounting and invoice factoring. invoice discounting and invoice factoring are two different forms of financing that businesses can use to improve their cash flow by using their outstanding invoices. while they share similarities, they also have notable differences, each with its own set of advantages and. Factoring involves selling your unpaid invoices to a third party. it has several key differences from invoice discounting. the biggest difference is that factoring allows you to collect nearly all of your unpaid balances. this means there are no percentages taken out of the money paid by the collecting company. Differences between invoice discounting and invoice factoring. both of these invoice financing services offer an advance against outstanding invoices. still, invoice discounting differs from invoice factoring in several ways. for starters, invoice discounting is a loan. it keeps the supplier in charge of credit control. Pros of invoice discounting. improved cash flow similar to factoring, invoice discounting provides businesses with quicker access to cash by using unpaid invoices as collateral. retain control unlike factoring, with discounting, businesses retain control over the collection process and customer relationships. confidentiality invoice discounting.

Invoice Discounting What Are The Advantages Of Invoice Discounting Differences between invoice discounting and invoice factoring. both of these invoice financing services offer an advance against outstanding invoices. still, invoice discounting differs from invoice factoring in several ways. for starters, invoice discounting is a loan. it keeps the supplier in charge of credit control. Pros of invoice discounting. improved cash flow similar to factoring, invoice discounting provides businesses with quicker access to cash by using unpaid invoices as collateral. retain control unlike factoring, with discounting, businesses retain control over the collection process and customer relationships. confidentiality invoice discounting. Risks of factoring vs invoice discounting. factoring is less risky for the lender because the factor manages the credit control and collection processes. acceptance is virtually guaranteed. this is why factoring is a popular form of finance for businesses that are hard up or threatened with insolvency. invoice discounting is riskier for the. Key differences between invoice discounting and factoring. while both invoice discounting and factoring aim to improve cash flow, they differ in some key aspects: ownership of debt: in invoice discounting, you retain control of collecting payments, while factoring involves transferring the responsibility to the factor.

Comments are closed.