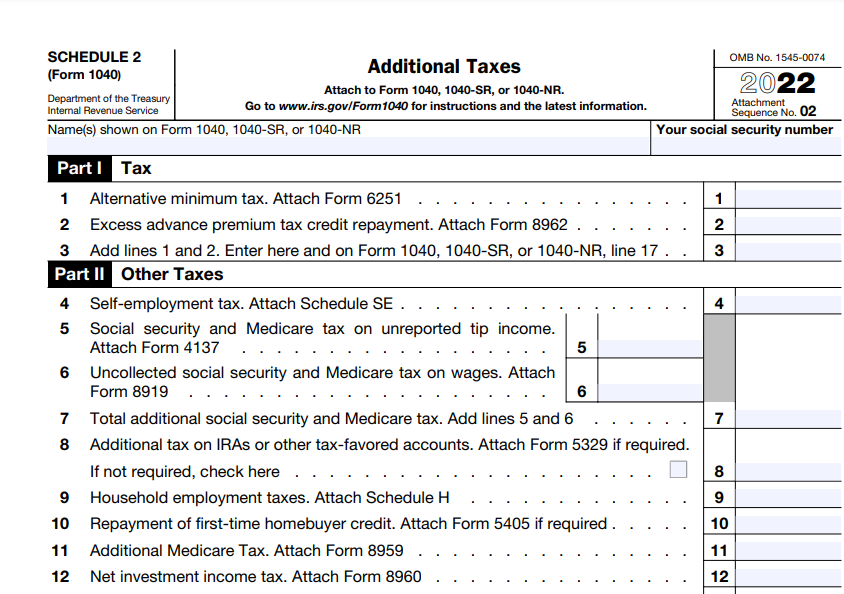

Irs Form 1040 Schedule 2 Additional Taxes Forms Docs 2023

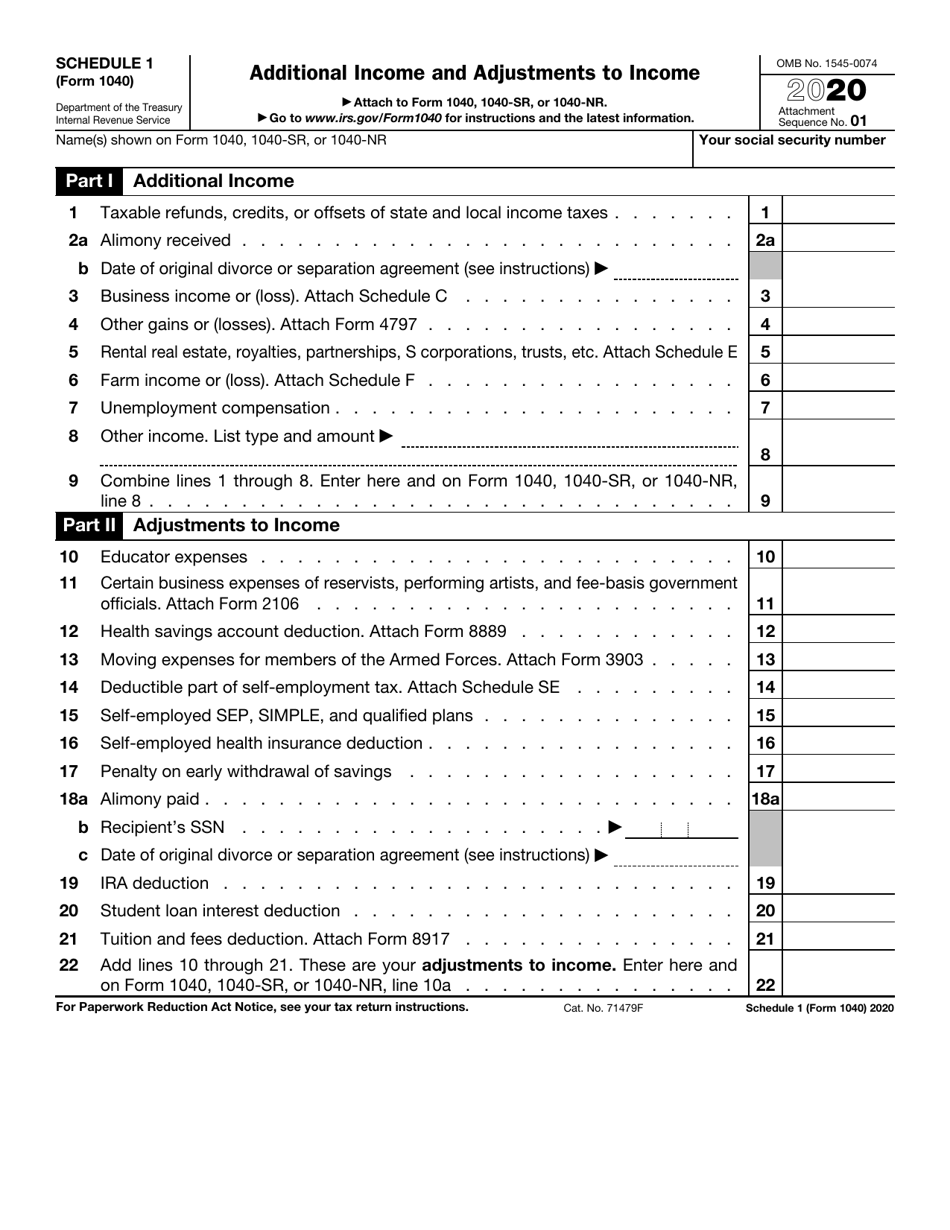

Schedule 2 Tax Form 2024 Berta Celinka Schedule 2 (form 1040) 2023. page . 2. part ii other taxes (continued) 17. other additional taxes: a. recapture of other credits. list type, form number, and amount:. Form 1040 schedule 1 pdf. form 1040 schedule 2 pdf. form 1040 schedule 3 pdf. tax table from instructions for form 1040 pdf. schedules for form 1040. form 1040 sr pdf. form w 4. employee's withholding certificate. complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

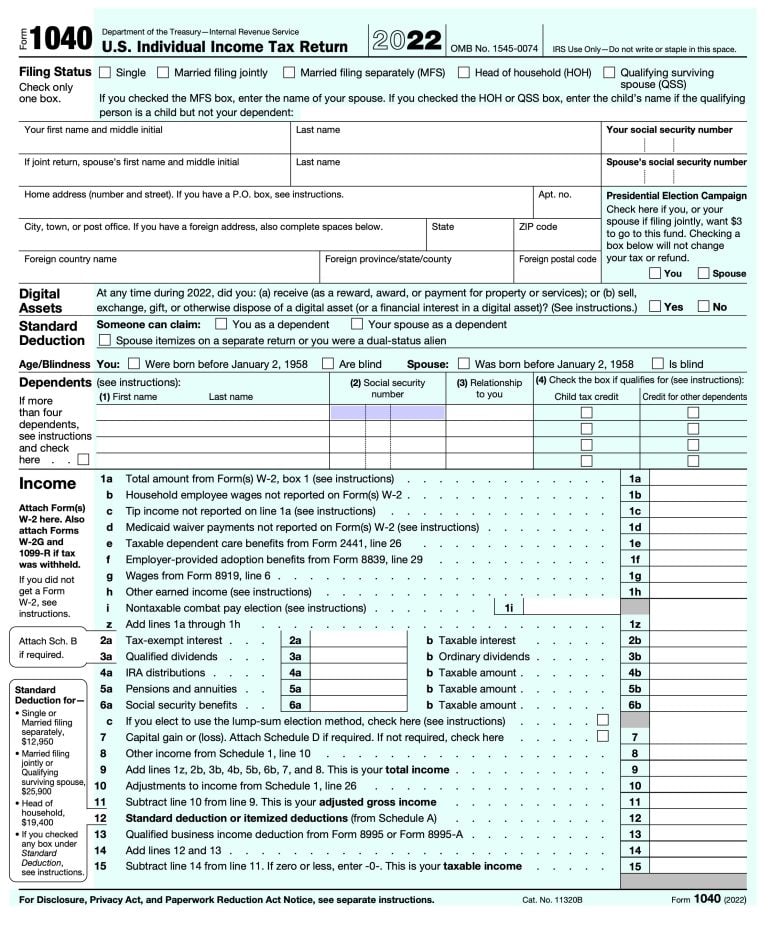

Irs Form 1040 2023 For 2022 Taxes Instructions Printable Forms F Form 1040 u.s. individual income tax return 2023 department of the treasury—internal revenue service . omb no. 1545 0074. irs use only—do not write or staple in this space. for the year jan. 1–dec. 31, 2023, or other tax year beginning , 2023, ending , 20 . see separate instructions. your first name and middle initial . last name. Irs form 1040 schedule 2 (2023) additional taxes. this form is used to calculate and address the alternative minimum tax (amt) to ensure taxpayer's compliance with this specific tax requirement. it is also used for the repayment of excess premium tax credits received by taxpayers. to use the upload pdf endpoint for this document, you must use. This form is used to report additional taxes such as medicare or rrta tax, or a tax credit previously received, as collected on schedule 4. also, if you have retirement plans or installment income from a sale, you must also complete and attach form 9650a. ensure accurate completion of lines 13, 14, and 15. 2023 form 1040 schedule 2 additional taxes. some common reasons for using schedule 2 include: additional taxes: if you owe additional taxes that aren't reported on the main form 1040, you may need to use schedule 2 to provide details on the amount and the type of tax owed. alternative minimum tax (amt): if you are subject to the alternative.

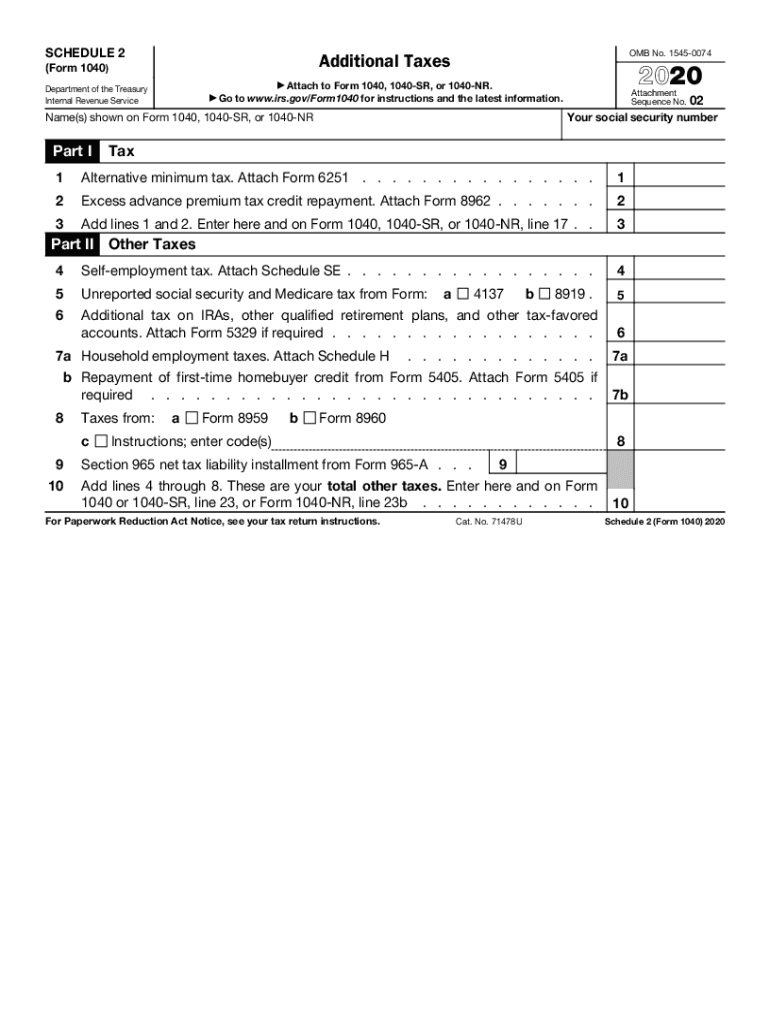

2024 Form 1040 Schedule 2 Form 1040 Kiele Merissa This form is used to report additional taxes such as medicare or rrta tax, or a tax credit previously received, as collected on schedule 4. also, if you have retirement plans or installment income from a sale, you must also complete and attach form 9650a. ensure accurate completion of lines 13, 14, and 15. 2023 form 1040 schedule 2 additional taxes. some common reasons for using schedule 2 include: additional taxes: if you owe additional taxes that aren't reported on the main form 1040, you may need to use schedule 2 to provide details on the amount and the type of tax owed. alternative minimum tax (amt): if you are subject to the alternative. The part ii portion of schedule 2 includes information that was previously collected on schedule 4 in tax year 2018. prior to that, this information was collected on lines 57 through 62 of form 1040. this part has seven lines: if you're self employed, this line is where you'll enter the amount you owe in self employment taxes. Irs form 1040 schedule 2 is used to report certain non traditional taxes not covered by the standard form 1040. you may need to file schedule 2 if: you earn a high income and owe alternative minimum tax (amt), net investment income tax (niit), or the additional medicare tax. you need to repay health insurance tax credits.

2023 Irs Tax Forms 1040 Printable Forms Free Online The part ii portion of schedule 2 includes information that was previously collected on schedule 4 in tax year 2018. prior to that, this information was collected on lines 57 through 62 of form 1040. this part has seven lines: if you're self employed, this line is where you'll enter the amount you owe in self employment taxes. Irs form 1040 schedule 2 is used to report certain non traditional taxes not covered by the standard form 1040. you may need to file schedule 2 if: you earn a high income and owe alternative minimum tax (amt), net investment income tax (niit), or the additional medicare tax. you need to repay health insurance tax credits.

Irs 1040 Form Download Lkakgl

Comments are closed.