Irs Form 14039 How To Fill It With The Best Form Filler

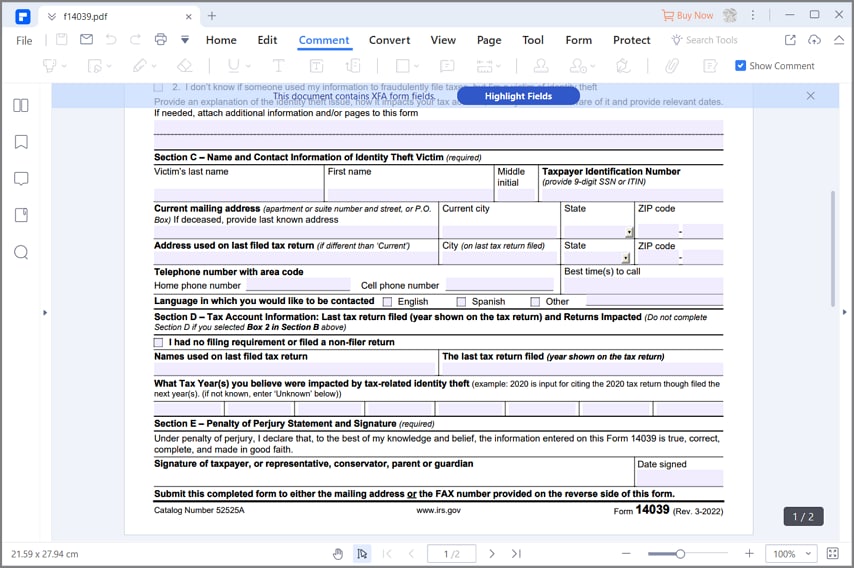

Irs Form 14039 How To Fill It With The Best Form Filler Individual tax return form 1040 instructions; instructions for form 1040 form 14039 page last reviewed or updated: 03 sep 2024 share. facebook; twitter. Irs.gov form . 14039 (rev. 5 2024) form . 14039 (may 2024) department of the treasury internal revenue service. identity theft affidavit. omb number 1545 2139. this affidavit is for . victims. of identity theft. to avoid delays do not use this form if you have already filed a form 14039 for this incident.

Irs Form 14039 2017 2019 Printable Fillable Sample In Pdf Fs 2022 25, april 2022 — when a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a form 14039, identity theft affidavit, to the irs. but in most cases, taxpayers do not need to complete this form. only victims of tax related identity theft should submit the form 14039, and only if. Irs.gov newsroom taxpayer guide to identity theft irs.gov pub irs pdf f14039.pdf identitytheft.gov #identitytheft #unemploy. Post notice steps. when the irs notice arrives, you must do two things: call the irs phone number provided on the notice. complete form 14039 affidavit of identity theft. the form is downloadable from the irs website (irs.gov), and you can type directly onto it. check the first box to indicate identity theft as the reason behind the notice you. Form 14039 is how a taxpayer can inform the irs of a fraudulent tax return filed with their ssn. form 14039, or the identity theft affidavit let the irs know of this issue, and prompts an investigation to resolve the tax issue. neglecting to address a case of tax related identity theft can result in a lost tax return, additional taxes owed by.

Irs Form 14039 Pdf Download 2023 How To Fill Out Irs Form 140 Post notice steps. when the irs notice arrives, you must do two things: call the irs phone number provided on the notice. complete form 14039 affidavit of identity theft. the form is downloadable from the irs website (irs.gov), and you can type directly onto it. check the first box to indicate identity theft as the reason behind the notice you. Form 14039 is how a taxpayer can inform the irs of a fraudulent tax return filed with their ssn. form 14039, or the identity theft affidavit let the irs know of this issue, and prompts an investigation to resolve the tax issue. neglecting to address a case of tax related identity theft can result in a lost tax return, additional taxes owed by. Step action; 1. determine if you need to file form 14039: you should file form 14039 if you have been a victim of tax related identity theft. this includes if you have received an irs notice or letter stating that you filed a tax return using your social security number (ssn) when you did not, or if you have been notified that a tax return was filed in your name using your ssn without your. The federal trade commission created the online form that can help victims make an identity theft affidavit — a sworn, written statement — and begin the process of recovery. the first step: go to the ftc’s identitytheft.gov site and choose the “get started” tab. every identity theft case is unique — the one similarity being that the.

Irs 14039 B Sp 2020 Fill And Sign Printable Template Online Us Step action; 1. determine if you need to file form 14039: you should file form 14039 if you have been a victim of tax related identity theft. this includes if you have received an irs notice or letter stating that you filed a tax return using your social security number (ssn) when you did not, or if you have been notified that a tax return was filed in your name using your ssn without your. The federal trade commission created the online form that can help victims make an identity theft affidavit — a sworn, written statement — and begin the process of recovery. the first step: go to the ftc’s identitytheft.gov site and choose the “get started” tab. every identity theft case is unique — the one similarity being that the.

Comments are closed.