Irs Form 14039 Instructions Your Identity Theft Affidavit

Irs Form 14039 Instructions Your Identity Theft Affidavit Fs 2022 25, april 2022 — when a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a form 14039, identity theft affidavit, to the irs. but in most cases, taxpayers do not need to complete this form. only victims of tax related identity theft should submit the form 14039, and only if. Irs.gov form . 14039 (rev. 5 2024) form . 14039 (may 2024) department of the treasury internal revenue service. identity theft affidavit. omb number 1545 2139. this affidavit is for . victims. of identity theft. to avoid delays do not use this form if you have already filed a form 14039 for this incident.

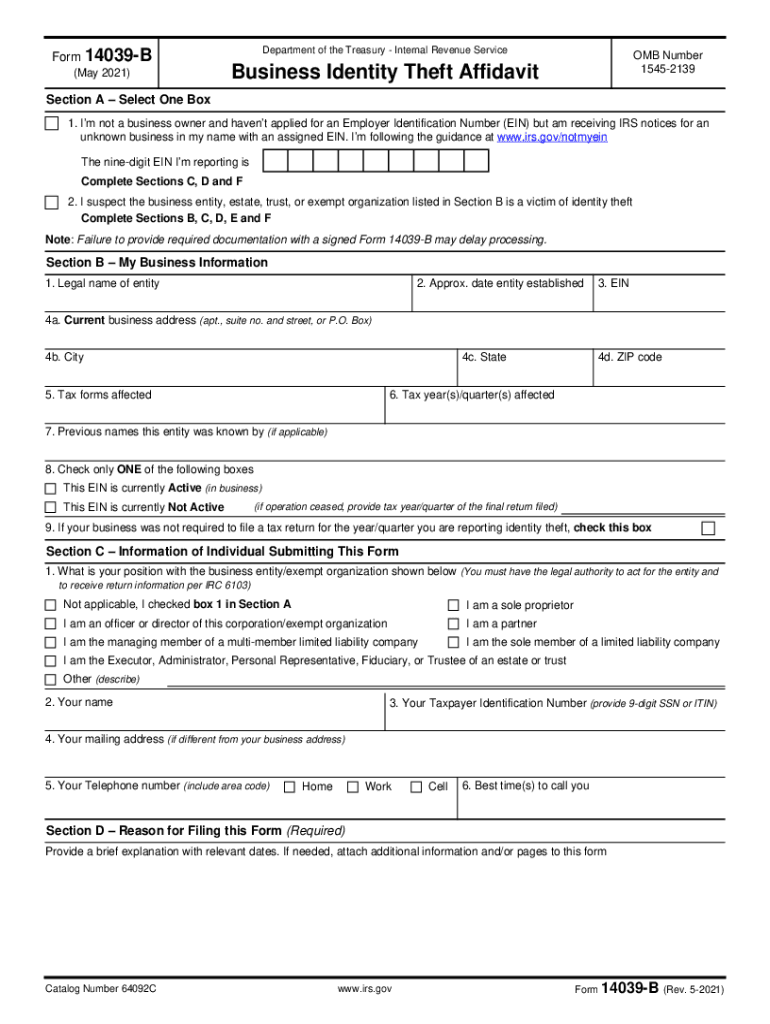

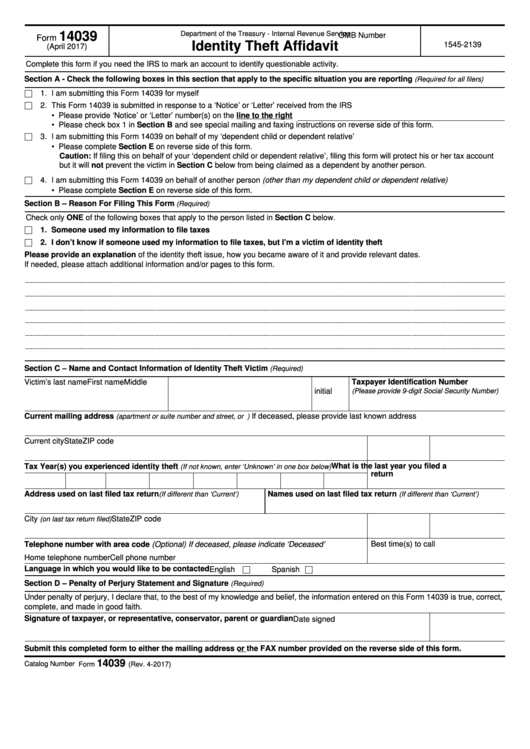

Form 14039 B Rev 5 2021 Business Identity Theft Affidavit Fill Popular forms & instructions; form 1040; individual tax return form 1040 instructions; instructions for form 1040 form w 9; request for taxpayer identification number (tin) and certification. Post notice steps. when the irs notice arrives, you must do two things: call the irs phone number provided on the notice. complete form 14039 affidavit of identity theft. the form is downloadable from the irs website (irs.gov), and you can type directly onto it. check the first box to indicate identity theft as the reason behind the notice you. Taxpayers use irs form 14039 in the case of tax related identity theft so that the irs may: document cases of tax related identity theft for public awareness. determine the taxpayer’s proper tax liability if a suspicious tax return is filed by identity thieves. relieve the taxpayer’s burden in such identity theft cases. If you are a victim, you need to fill out the irs identity theft affidavit, form 14039. identity theft victims should submit a form 14039 in the following cases: if your ssn has been compromised and your e file return was rejected as a duplicate. irs has informed you that you may be a victim of tax related identity theft.

Complete Irs Form 14039 Identity Theft Affidavit Affidavitform N Taxpayers use irs form 14039 in the case of tax related identity theft so that the irs may: document cases of tax related identity theft for public awareness. determine the taxpayer’s proper tax liability if a suspicious tax return is filed by identity thieves. relieve the taxpayer’s burden in such identity theft cases. If you are a victim, you need to fill out the irs identity theft affidavit, form 14039. identity theft victims should submit a form 14039 in the following cases: if your ssn has been compromised and your e file return was rejected as a duplicate. irs has informed you that you may be a victim of tax related identity theft. The irs will send you a notice. first, the irs will acknowledge your reported tax identity theft. within 30 days after the irs gets your form 14039, you’ll get a letter telling you that the irs received your affidavit. during this time, the irs may ask you to prove your identity, typically with letter 5071c. This form 14039 is submitted in response to a ‘notice’ or ‘letter’ received from the irs. provide ‘notice’ or ‘letter’ number(s) on the line to the right. check box 1 in section b and see special mailing and faxing instructions on reverse side of this form. i am submitting this form 14039 on behalf of my ‘dependent child or.

Comments are closed.