Irs Form 14039 Walkthrough Identity Theft Affidavit

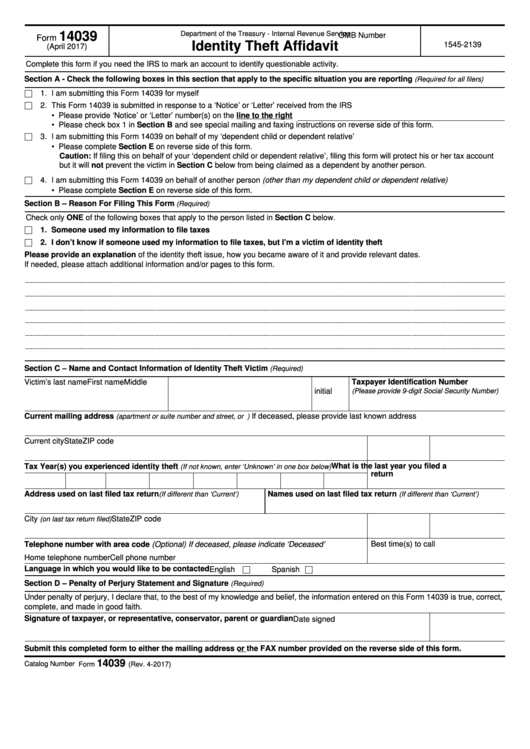

Irs Form 14039 Walkthrough Identity Theft Affidavit Youtube Irs.gov form . 14039 (rev. 5 2024) form . 14039 (may 2024) department of the treasury internal revenue service. identity theft affidavit. omb number 1545 2139. this affidavit is for . victims. of identity theft. to avoid delays do not use this form if you have already filed a form 14039 for this incident. Fs 2022 25, april 2022 — when a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a form 14039, identity theft affidavit, to the irs. but in most cases, taxpayers do not need to complete this form. only victims of tax related identity theft should submit the form 14039, and only if.

Complete Irs Form 14039 Identity Theft Affidavit Affidavitform N This affidavit is for victims of identity theft. to avoid delays do not use this form if you have already filed a form 14039 for this incident.the irs proces. Form 1040; individual tax return form 14039 page last reviewed or updated: 03 sep 2024 irs notices and letters; identity theft; tax scams; tax fraud;. When the irs notice arrives, you must do two things: call the irs phone number provided on the notice. complete form 14039 affidavit of identity theft. the form is downloadable from the irs website (irs.gov), and you can type directly onto it. check the first box to indicate identity theft as the reason behind the notice you received. Form 14039, the identity theft affidavit, serves as a critical tool in notifying the irs that your identity has been compromised. by submitting this form, you inform the irs of the fraudulent activity, which is the first step in resolving the issues related to tax identity theft and preventing further misuse of your information in future tax.

Irs Form 14039 Download Fillable Pdf Or Fill Online Identity Theft When the irs notice arrives, you must do two things: call the irs phone number provided on the notice. complete form 14039 affidavit of identity theft. the form is downloadable from the irs website (irs.gov), and you can type directly onto it. check the first box to indicate identity theft as the reason behind the notice you received. Form 14039, the identity theft affidavit, serves as a critical tool in notifying the irs that your identity has been compromised. by submitting this form, you inform the irs of the fraudulent activity, which is the first step in resolving the issues related to tax identity theft and preventing further misuse of your information in future tax. Taxpayers use irs form 14039 in the case of tax related identity theft so that the irs may: document cases of tax related identity theft for public awareness. determine the taxpayer’s proper tax liability if a suspicious tax return is filed by identity thieves. relieve the taxpayer’s burden in such identity theft cases. The federal trade commission created the online form that can help victims make an identity theft affidavit — a sworn, written statement — and begin the process of recovery. the first step: go to the ftc’s identitytheft.gov site and choose the “get started” tab. every identity theft case is unique — the one similarity being that the.

Fillable Online Irs Form 14039 Identity Theft Affidavit Internal Taxpayers use irs form 14039 in the case of tax related identity theft so that the irs may: document cases of tax related identity theft for public awareness. determine the taxpayer’s proper tax liability if a suspicious tax return is filed by identity thieves. relieve the taxpayer’s burden in such identity theft cases. The federal trade commission created the online form that can help victims make an identity theft affidavit — a sworn, written statement — and begin the process of recovery. the first step: go to the ftc’s identitytheft.gov site and choose the “get started” tab. every identity theft case is unique — the one similarity being that the.

Comments are closed.