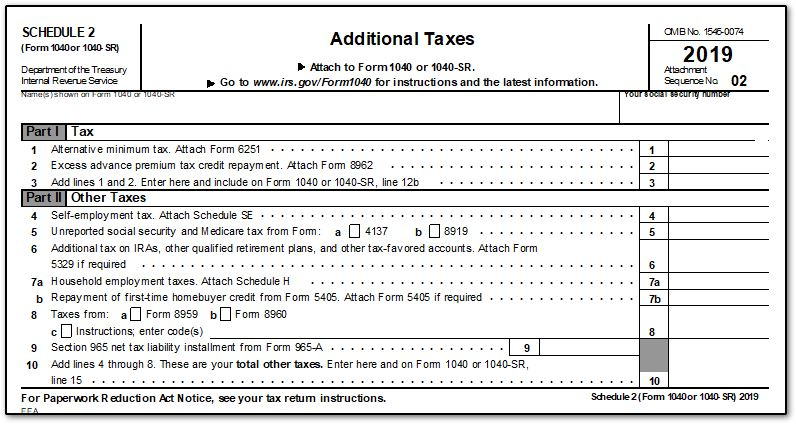

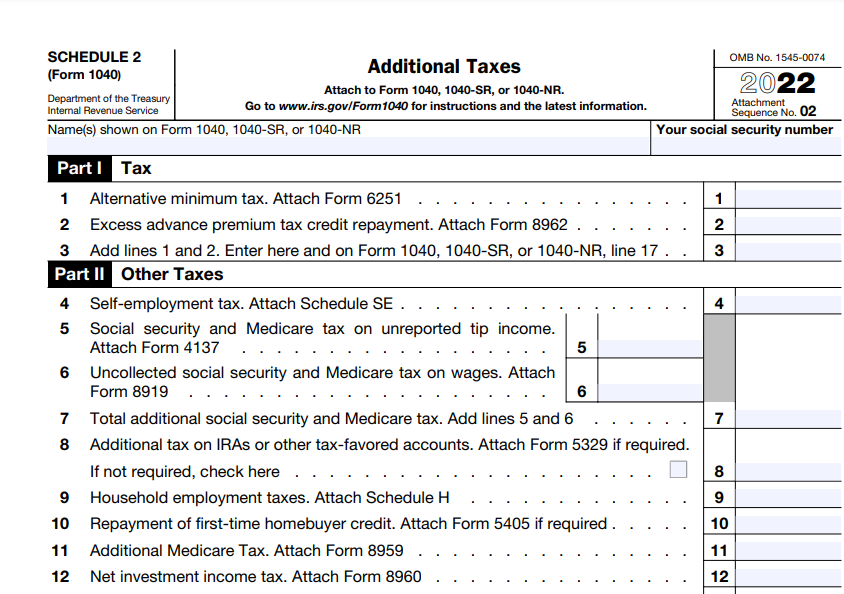

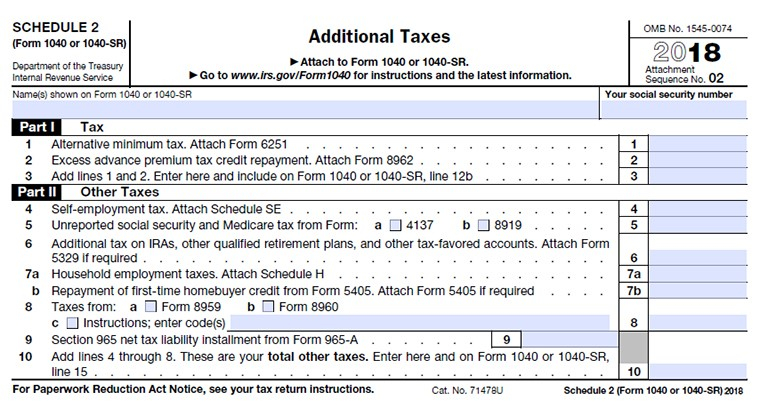

Irs Schedule 2 Walkthrough Additional Taxes

2021 Form Irs 1040 Schedule 2 Fill Online Printable Fillable Blank Subscribe to our channel: channel ucpqfix80n8 a3mc6gx9if2g?sub confirmation=1 please feel free to check out our article, whe. Schedule 2 (form 1040) 2023 additional taxes department of the treasury internal revenue service attach to form 1040, 1040 sr, or 1040 nr. go to.

2019 Form 1040 Schedule C Download Jnrflyer Line 11: additional medicare tax. you may need to file irs form 8959 for additional medicare taxes if your total wage and self employment compensation was more than the following, based upon tax filing status: $125,000 if married filing separately. $250,000 if married filing jointly, or. See the links below for more detailed tutorials on each line item.schedule 2 (additional taxes) is included with a taxpayer's form 1040 to report additional. The taxpayer will then need to complete the schedule by providing information about their income, deductions, credits, and any additional taxes they owe. in summary, schedule 2 is a document used to report certain additional taxes that an individual may owe, including the alternative minimum tax (amt), the additional tax on a qualified plan or. This form is used to report additional taxes such as medicare or rrta tax, or a tax credit previously received, as collected on schedule 4. also, if you have retirement plans or installment income from a sale, you must also complete and attach form 9650a. ensure accurate completion of lines 13, 14, and 15.

Irs Form 1040 Schedule 2 Additional Taxes Forms Docs 2023 The taxpayer will then need to complete the schedule by providing information about their income, deductions, credits, and any additional taxes they owe. in summary, schedule 2 is a document used to report certain additional taxes that an individual may owe, including the alternative minimum tax (amt), the additional tax on a qualified plan or. This form is used to report additional taxes such as medicare or rrta tax, or a tax credit previously received, as collected on schedule 4. also, if you have retirement plans or installment income from a sale, you must also complete and attach form 9650a. ensure accurate completion of lines 13, 14, and 15. Schedule 2 (form 1040) 2020 additional taxes department of the treasury internal revenue service attach to form 1040, 1040 sr, or 1040 nr. Key takeaways. irs form 1040 schedule 2 is used to report certain non traditional taxes not covered by the standard form 1040. you may need to file schedule 2 if: you earn a high income and owe alternative minimum tax (amt), net investment income tax (niit), or the additional medicare tax. you need to repay health insurance tax credits.

What Is A Schedule A Form Printable Form 2024 Schedule 2 (form 1040) 2020 additional taxes department of the treasury internal revenue service attach to form 1040, 1040 sr, or 1040 nr. Key takeaways. irs form 1040 schedule 2 is used to report certain non traditional taxes not covered by the standard form 1040. you may need to file schedule 2 if: you earn a high income and owe alternative minimum tax (amt), net investment income tax (niit), or the additional medicare tax. you need to repay health insurance tax credits.

Comments are closed.