Market Structure Shows Direction Stock Trading Strategies Forex

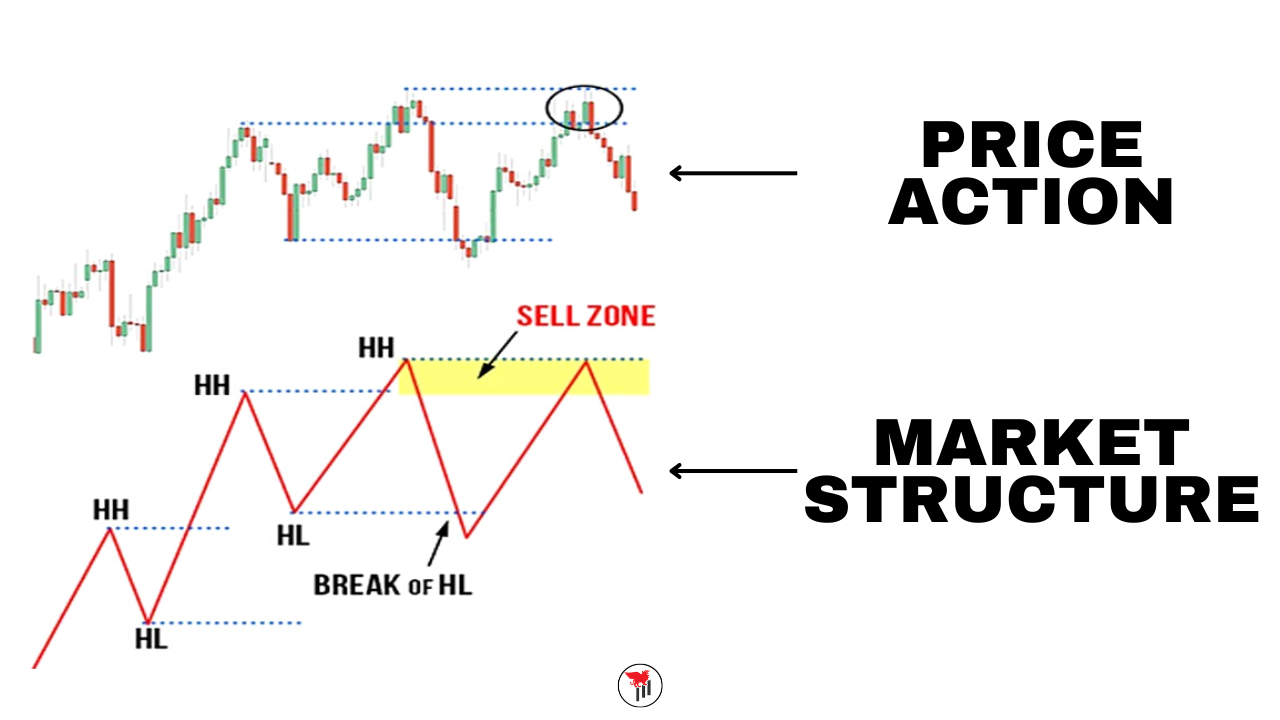

How To Use Basic Market Structure Forex Traders Smc Fx Trading Assess market trends: identify the direction the market is moving in and its strength. use technical indicators: indicators such as moving averages, rsi, and macd can provide insight into the market structure. consider market volatility: high volatility indicates structural changes in the market. A market structure trading strategy involves analyzing and interpreting various elements that shape price movements, such as swing highs and lows, support and resistance levels, and trendlines. many traders use market structures to pinpoint lows and highs. in this article, we show you a few methods you can use for a market structure trading.

Understanding Market Structure In Trading A Comprehensive Guide Step 2: identify peaks and troughs. to analyze market structure, you need to identify and mark the peaks and troughs on your price chart. peaks are formed when the price reaches a high point and starts to decline, while troughs are formed when the price reaches a low point and starts to rise. by connecting these highs and lows, you can. Forex market structure is the framework created by buying and selling a currency pair within a specific timeframe and a defined time period. the foreign exchange market structure analysis aims to. Market structure acts as a guide for understanding upward, downward, and sideways trends. the same principles can be used in any type of market, from stocks, futures, forex, and commodities, to digital assets like cryptocurrencies or even physical assets like real estate. if you’re wondering why market structure is so relevant or how you can. What “market structure” means depends on the context. in forex trading, it first refers to the market’s logistical organization, including order execution and liquidity providers. second, market structure encompasses the market’s current state, including trends, reversal patterns, and the “market personality.”.

Comments are closed.