Mortgage Credit Report Fico Score Vs Credit Karma Why Are My Scores Different

Why Is My Fico Score So Low Compared To Credit Karma Leia Aqui о Fico defines the following credit ranges based on fico® score 8 credit scores: exceptional: 800 . very good: 740 to 799. good: 670 to 739. fair: 580 to 669. poor: 579 and below. industry specific fico® scores — including fico® auto score 8 and fico® bankcard score 8 — have a broader range of 250 to 900. When mortgage lenders check a prospective borrower’s credit, they’ll typically see one mortgage credit score from each of the three credit bureaus and use the median score. often, the result is that a score you see online may differ from the score you see when financing a mortgage, which could be different still from a score that an auto.

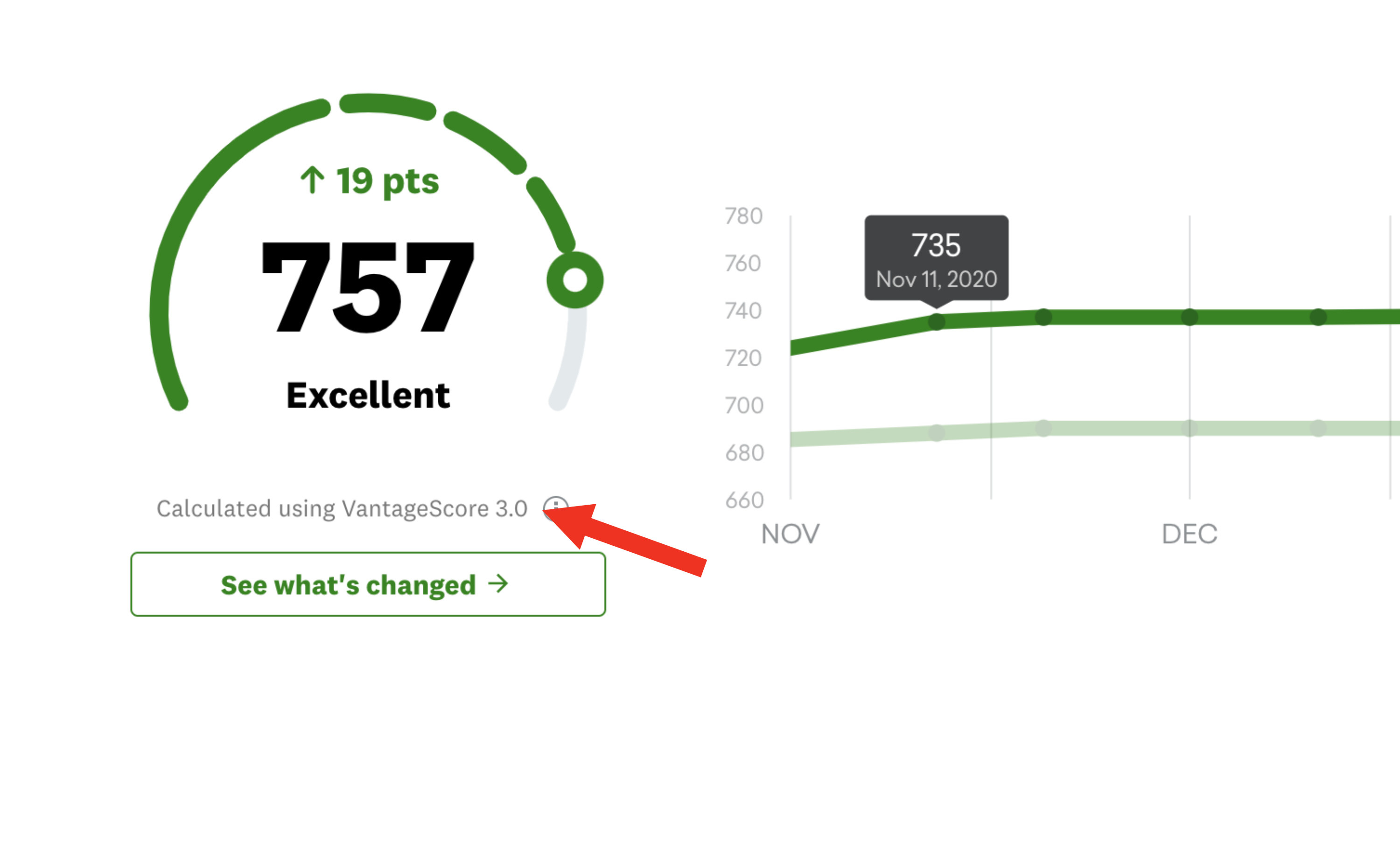

Credit Score Ranges What They Mean And Why They Matter The vantage algorithm being used by credit karma is typically 50 points or so higher than a mortgage fico score.”. mortgage fico scores analyze your payment history, the number of years you’ve had credit, types of credit accounts you have, and more. these tend to be much more detailed than the reports pulled by credit karma and other. General fico ® scores range from 300 to 850, and so do vantagescore 3.0 and 4.0 scores. but industry focused fico ® scores range from 250 to 900, and vantagescores 1.0 and 2.0 range from 501 to 990. even though the precise number of the ranges might vary, in practice, the differences aren't major: the higher your credit score, the better. While there’s no exact answer to which credit score matters most, lenders have a clear favorite: fico® scores are used in over 90% of lending decisions. while that can help you narrow down. For this reason, vantagescore and fico® scores tend to vary from one another. your vantagescore® 3.0 on credit karma will likely be different from your fico score that lenders often use. if you.

Is Credit Karma Your Fico Score Leia Aqui Is My Fico Score While there’s no exact answer to which credit score matters most, lenders have a clear favorite: fico® scores are used in over 90% of lending decisions. while that can help you narrow down. For this reason, vantagescore and fico® scores tend to vary from one another. your vantagescore® 3.0 on credit karma will likely be different from your fico score that lenders often use. if you. Your fico® scores (an acronym for fair isaac corp., the company behind the fico® score) are credit scores. it’s a sort of grade based on the information contained in your credit reports. unlike the grades you were given in school — a through f — base fico® scores generally range from 300 to 850. and the higher, the better. Consumer credit scores, also known as educational credit scores, are credit scores that can be accessed by consumers. typically, consumer credit scores only use information from one of the credit bureaus. additionally, they’re calculated using consumer scoring models, rather than mortgage credit scoring models.

Comments are closed.