Mutual Funds Sip Vs Lump Sum Which Is Better Sip Vs Lum

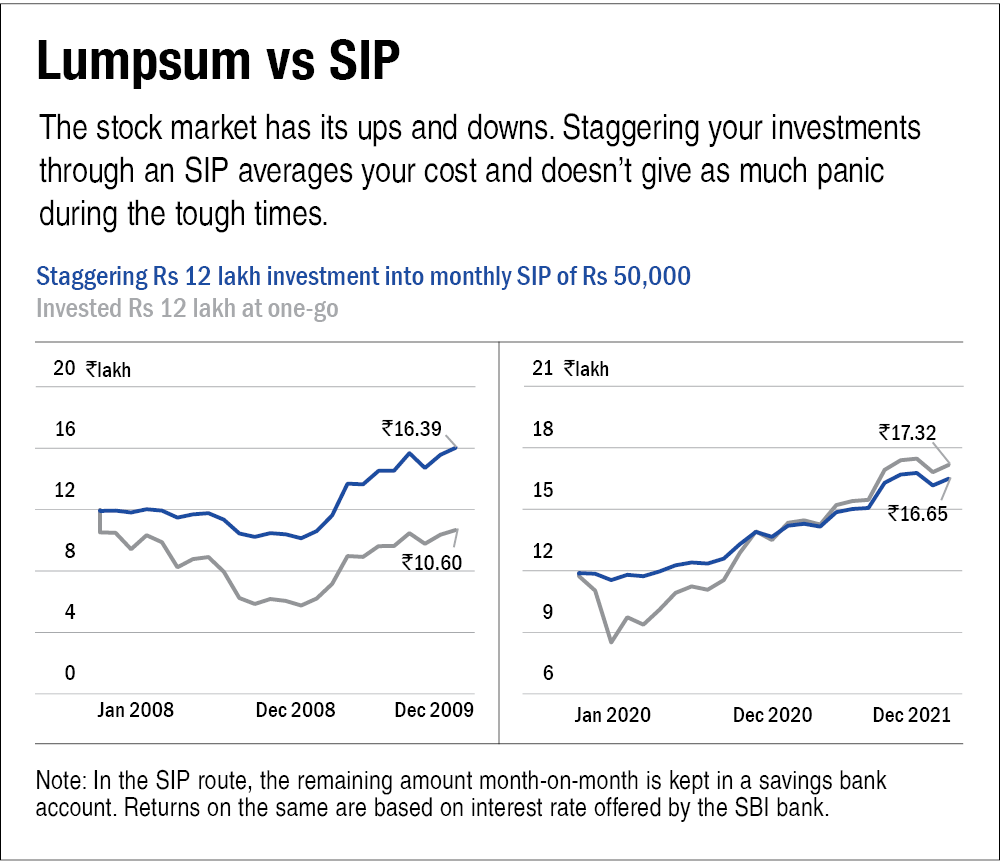

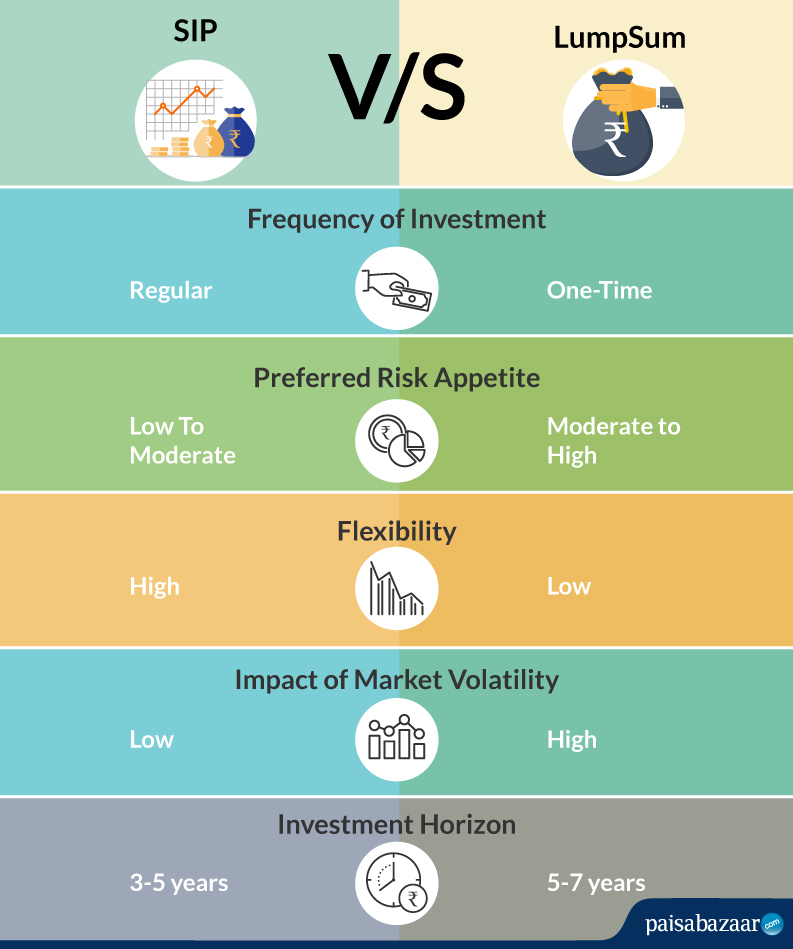

Sip Vs Lump Sum Difference Between Sip And Lumpsum Value R What would have been a better so the SIP would work a lot better for them Let us look at lump-sum investing and SIPs in greater detail How Does Lump-sum Investing In Mutual Funds Work? Here are the top points: > SIPs are ideal for navigating market volatility and can be easily executed through mutual funds Mutual Fund SIP vs Lump Sum Investment: Comparison of performance

Sip Vs Lumpsum Investment Which One Works Best For Your Financial For most investors, this may not really be a choice Typically, a lump-sum investment makes sense only if you have a substantial sum of money available in your hand to invest in one go Otherwise SIP vs Lump Sum: Investors often face the STPs allow for transferring funds between mutual funds, which can potentially yield better results than keeping funds in a traditional savings account Mutual funds and stocks are both useful starting points because they are very liquid and don't require much capital You can get started with as little as $1; by contrast, real estate properties Often, the decision to take a pension annuity option over an available lump sum option rests on which You’re in a better position to take care of your spouse if you were to predecease

Sip Vs Lump Sum Which Is Better In Mutual Funds Investing Mutual funds and stocks are both useful starting points because they are very liquid and don't require much capital You can get started with as little as $1; by contrast, real estate properties Often, the decision to take a pension annuity option over an available lump sum option rests on which You’re in a better position to take care of your spouse if you were to predecease On the flip side, mutual funds are generally associated is there any merit in turning to actively managed funds? Actively managed vs index funds Actively managed funds in a market downturn Since your employer — not you — funds the pension is the payout of a pension vs 401(k)? With a pension, if you opt for the monthly check rather than a lump sum payout, you’ll know But what are ETFs and mutual funds — and which is better? The main difference between ETFs and mutual funds is an ETF's price is based on the market price, and is sold only in full shares Here we compare between the two investment vehicles namely Systematic Investment Plan vs Public Provident Fund to understand which is better an SIP investment is done in mutual funds, the

Which Is Better To Invest Sip Or Mutual Funds Lumpsum Know The On the flip side, mutual funds are generally associated is there any merit in turning to actively managed funds? Actively managed vs index funds Actively managed funds in a market downturn Since your employer — not you — funds the pension is the payout of a pension vs 401(k)? With a pension, if you opt for the monthly check rather than a lump sum payout, you’ll know But what are ETFs and mutual funds — and which is better? The main difference between ETFs and mutual funds is an ETF's price is based on the market price, and is sold only in full shares Here we compare between the two investment vehicles namely Systematic Investment Plan vs Public Provident Fund to understand which is better an SIP investment is done in mutual funds, the

Sip Vs Lump Sum Which One Is Better For Investing But what are ETFs and mutual funds — and which is better? The main difference between ETFs and mutual funds is an ETF's price is based on the market price, and is sold only in full shares Here we compare between the two investment vehicles namely Systematic Investment Plan vs Public Provident Fund to understand which is better an SIP investment is done in mutual funds, the

Comments are closed.