News A Helpful Guide To The Investor Retired At 37

The Ultimate Guide To Investing In Retirement Youtube Jan 27, 2021, 6:45 am pst. dustin heiner is a real estate investor who was able to retire at 37 thanks to passive income from rental properties. dustin heiner. on an episode of the podcast " the. Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return.

The Complete Guide To Investing During Retirement Ebook By Thomas Your investment identity can influence the way you allocate your portfolio among stocks, bonds, cash, and other investments. some recommend portfolio asset allocation by age, under the assumption that the younger you are, the more aggressive you should be with your retirement asset allocation. that may be true to some degree, but some investors. Rather, our hypothetical investor starts saving 6% at age 25 and ramps up savings by one percentage point each year until reaching an appropriate level. we found that 15% of income per year (including any employer contributions) is an appropriate savings level for many people, but we recommend that higher earners aim beyond 15%. The latest personal finance news, analysis and insights, covering retirement, how to manage your savings, tax guidance and more. Fire calculates your savings goal as 25 times your annual expenses. if your monthly expenses are $6,500, you would multiple $5,000 x 12 to get an annual expense of $60,000. then, multiply $60,000.

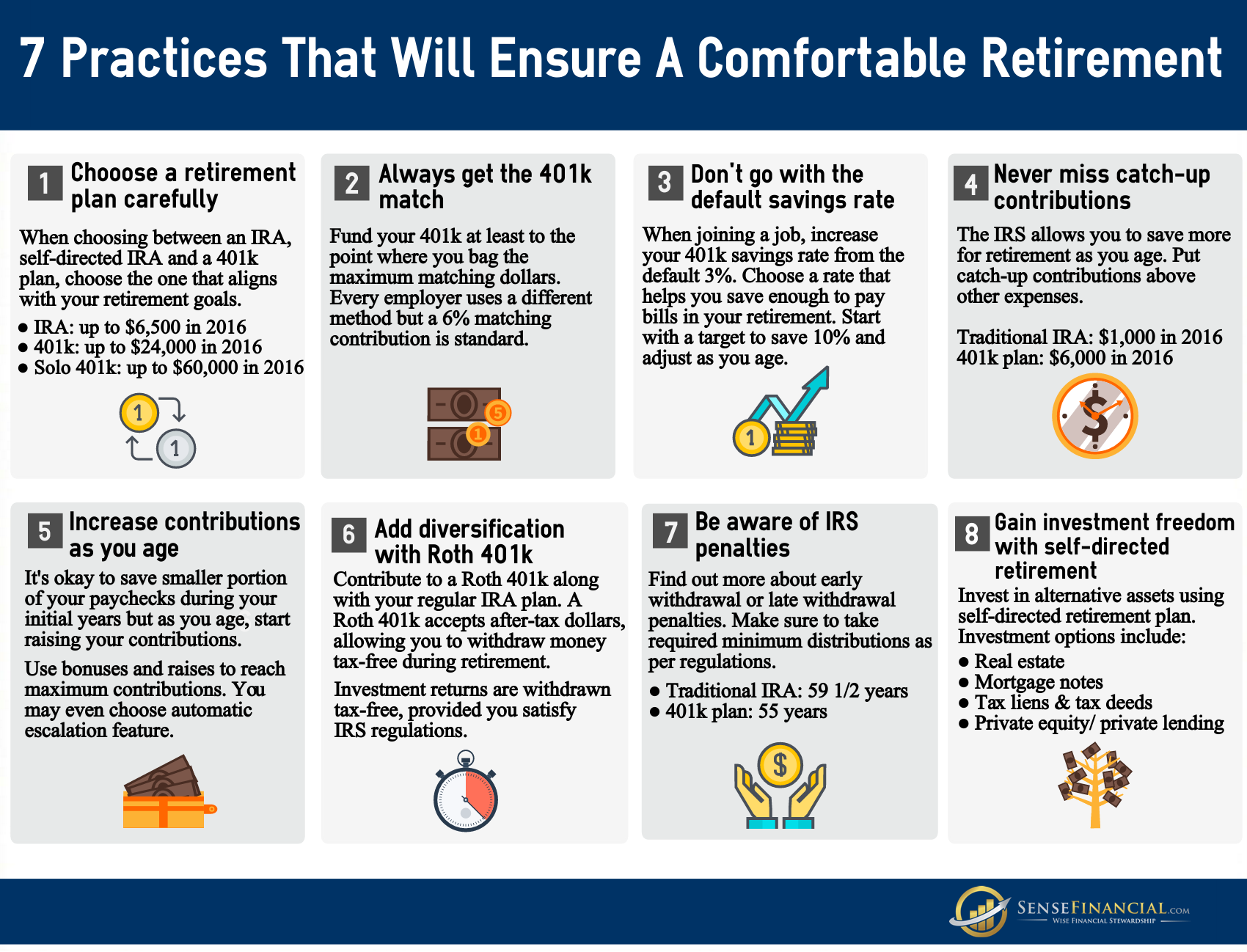

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement The latest personal finance news, analysis and insights, covering retirement, how to manage your savings, tax guidance and more. Fire calculates your savings goal as 25 times your annual expenses. if your monthly expenses are $6,500, you would multiple $5,000 x 12 to get an annual expense of $60,000. then, multiply $60,000. Consult an attorney or tax professional regarding your specific situation. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1080142.3.1. learn how to take your retirement planning to the next level with these retirement strategies. Here are the steps to take to customize your own retirement asset allocation framework. (note that this exercise will be less useful if retirement is many years in the future.) determine in.

A Beginnerтащs юааguideюаб To Investing After Retirement Dennis Marshall And Consult an attorney or tax professional regarding your specific situation. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1080142.3.1. learn how to take your retirement planning to the next level with these retirement strategies. Here are the steps to take to customize your own retirement asset allocation framework. (note that this exercise will be less useful if retirement is many years in the future.) determine in.

Investor Loss Recovery Guide

Comments are closed.