Our Guide To Credit Score Ranges In Canada Good Credit Explained

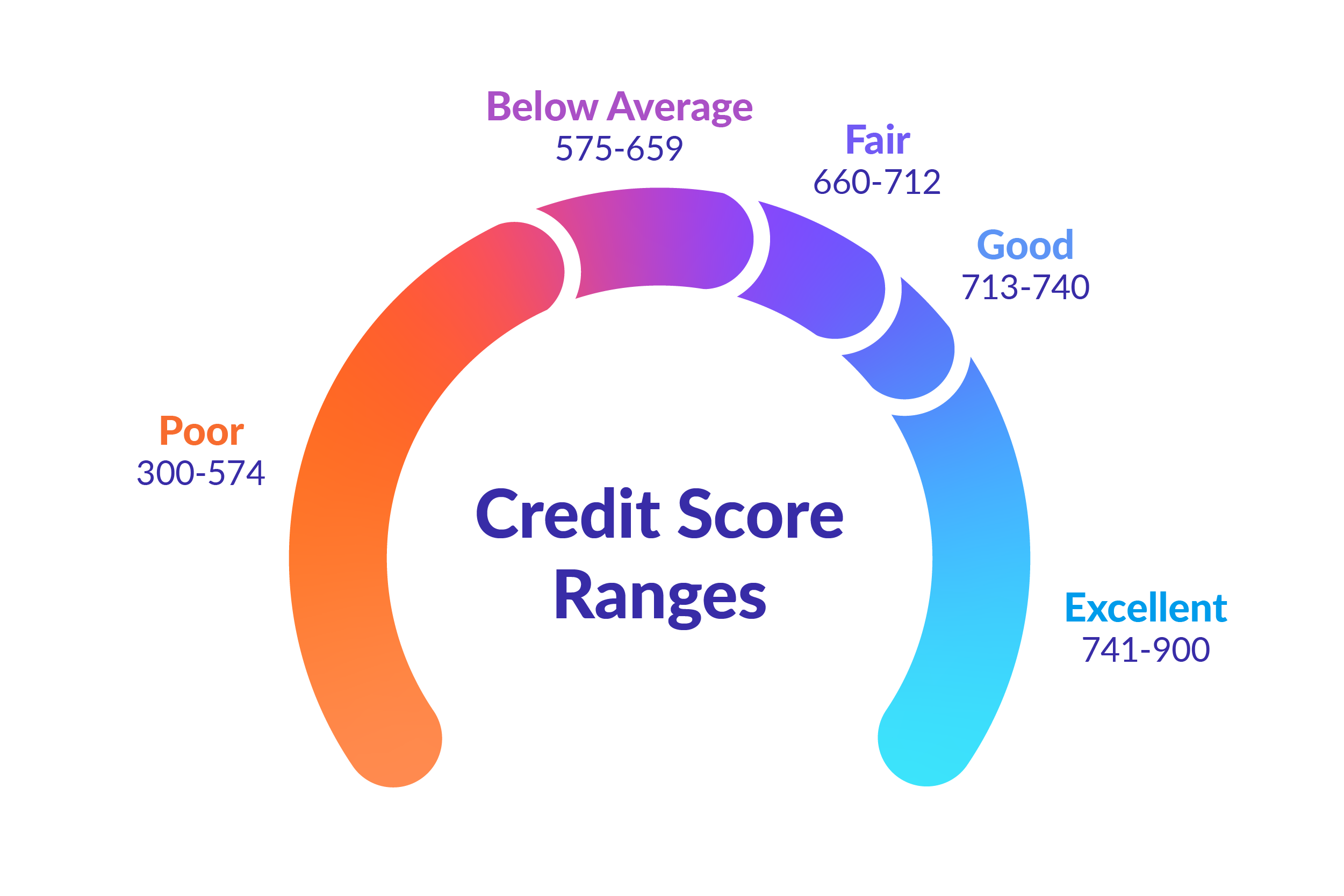

Our Guide To Credit Score Ranges In Canada Good Credit Explained Guide to credit score ranges in canada. credit scores in canada are three digit numbers that range from 300 900, and are rated from poor to excellent. credit score ranges in canada vary based on. Canada operates with a credit score range between 300 and 900. the lower your score, the less likely you are to be approved for a credit card or loan. if you do manage to qualify for a credit card.

Our Guide To Credit Score Ranges In Canada Good Credit Explained Your credit score is a three digit number between 300 and 900 that represents your credit risk. credit risk is the likelihood you’ll pay your bills on time, or pay back a loan on the terms agreed upon. in canada, credit scores range from 300 (very poor) to 900 (excellent) with the average canadian credit score sitting at 650. A good credit score starts at 660. a credit score is a three digit number that falls somewhere between 300 and 900. in canada, scores above 660 are generally considered “good.”. the higher. There are some differences around how the various data elements on a credit report factor into the score calculations. although credit scoring models vary, generally, credit scores from 660 to 724 are considered good; 725 to 759 are considered very good; and 760 and up are considered excellent. higher credit scores mean you have demonstrated. In canada, your credit score is a number that ranges from 300 900. the higher the number, the better. this number reflects your creditworthiness to potential lenders, who use your credit score to estimate the likelihood that you will make your payments on time. the two credit reporting agencies in canada are equifax and transunion.

The Ultimate Guide To Credit Scores In Canada Borrowellв ў There are some differences around how the various data elements on a credit report factor into the score calculations. although credit scoring models vary, generally, credit scores from 660 to 724 are considered good; 725 to 759 are considered very good; and 760 and up are considered excellent. higher credit scores mean you have demonstrated. In canada, your credit score is a number that ranges from 300 900. the higher the number, the better. this number reflects your creditworthiness to potential lenders, who use your credit score to estimate the likelihood that you will make your payments on time. the two credit reporting agencies in canada are equifax and transunion. Credit score ranges according to equifax. generally, a credit score of 660 and over is considered good in canada. anything in the 300 to 559 range is usually seen as a poor credit score. take this with a grain of salt, though. credit bureaus use different credit scoring models, which means there's a high chance your equifax credit score is not. Generally, a poor credit score is considered poor by fico if it’s 579 and below. fair is seen as 580 to 669, good is marked as 670 to 739, very good reaches heights of 740 to 799 and excellent.

What Is A Credit Score How Is It Calculated In Canada My Money Coach Credit score ranges according to equifax. generally, a credit score of 660 and over is considered good in canada. anything in the 300 to 559 range is usually seen as a poor credit score. take this with a grain of salt, though. credit bureaus use different credit scoring models, which means there's a high chance your equifax credit score is not. Generally, a poor credit score is considered poor by fico if it’s 579 and below. fair is seen as 580 to 669, good is marked as 670 to 739, very good reaches heights of 740 to 799 and excellent.

What Your Credit Score Range Really Means Loans Canada

Comments are closed.