Overtime For Tipped Employees Recap Steps More

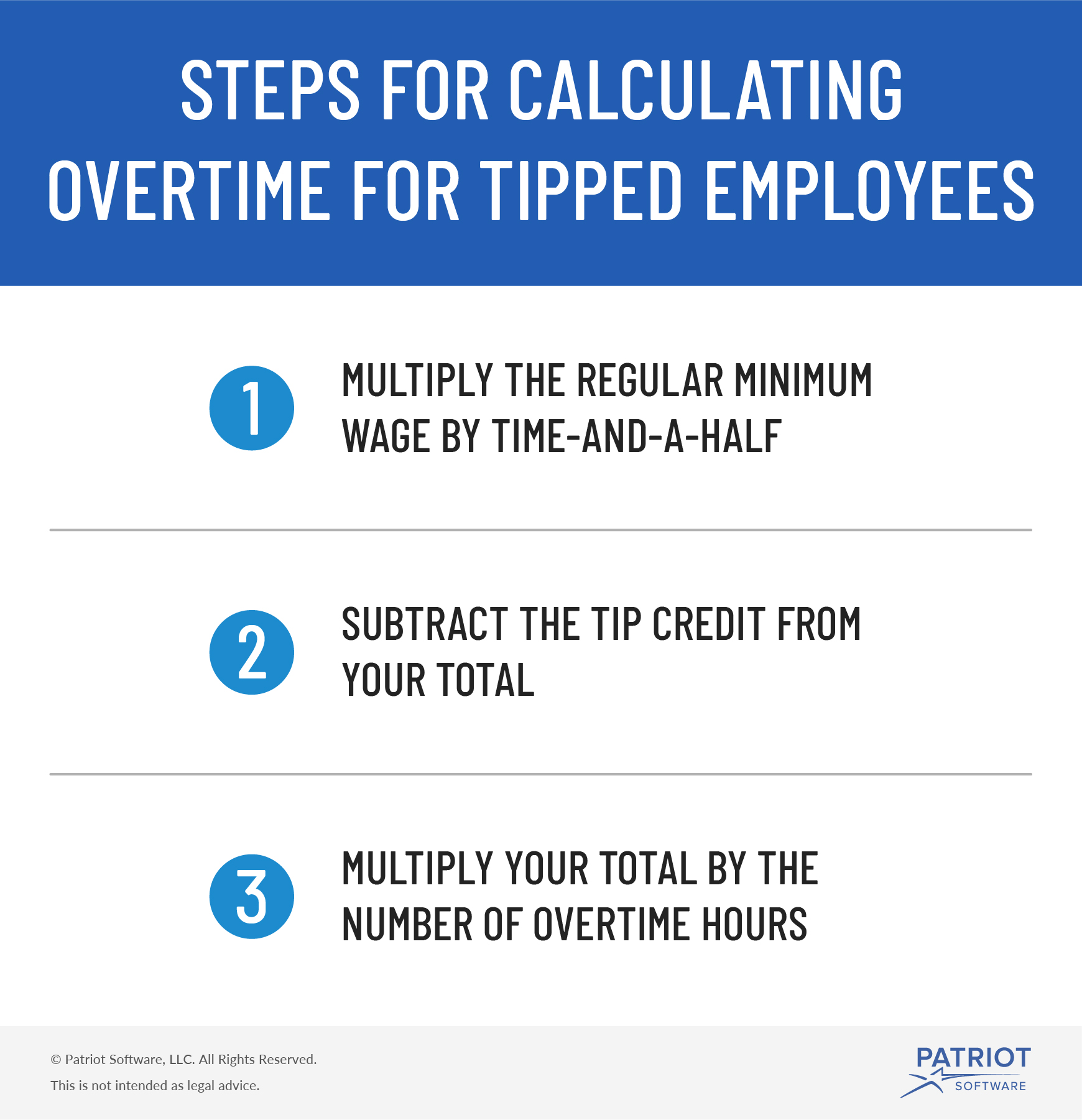

Overtime For Tipped Employees Recap Steps More Take a look at the steps for calculating overtime for tipped employees below: multiply the regular minimum wage by time and a half (1.5) subtract the tip credit from your total. multiply your total by the number of overtime hours. after you find the overtime pay total for your tipped employee, be sure to add it to their regular wage total. Tip credit: the flsa permits an employer to take a tip credit toward its minimum wage and overtime obligation(s) for tipped employees per section 3(m)(2)(a). an employer that claims a tip credit must ensure that the employee receives enough tips from customers, and direct (or cash) wages per workweek to equal at least the minimum wage and.

Overtime For Tipped Employees Recap Steps More On january 15, 2021, the dol published three new opinion letters that provide compliance assistance related to the fair labor standards act (flsa). the third opinion letter addressed how to properly calculate the overtime pay for tipped employees receiving tips and amounts as automatic gratuities or service charges under the fair labor standards act (flsa). Effective july 1, 2024, to be considered exempt from overtime, an eap employee needs to make at least $43,888 a year and then at least $58,656 on jan. 1, 2025. in addition, the rule will adjust the threshold for highly compensated employees (hce), now requiring a minimum annual compensation of $132,964 to be considered exempt. Overtime for tipped employees. nonexempt employees who work overtime are entitled to 1.5 times their hourly rate for each hour of overtime. but if a tipped employee works overtime, the calculation is a little bit different. tipped employee overtime requires a bit more math. here are the steps for calculating overtime for tipped employees:. Employees are responsible for reporting to their employer any tipped income of $20 or more (including cash, debit, and credit card tips as well as tips from other employees) and the cash value of non monetary tips (such as a bottle of wine) each month. instructions and forms for reporting tips to employers are found in publication 1244.

Overtime For Tipped Employees Recap Steps More Finansdirekt24 Se Overtime for tipped employees. nonexempt employees who work overtime are entitled to 1.5 times their hourly rate for each hour of overtime. but if a tipped employee works overtime, the calculation is a little bit different. tipped employee overtime requires a bit more math. here are the steps for calculating overtime for tipped employees:. Employees are responsible for reporting to their employer any tipped income of $20 or more (including cash, debit, and credit card tips as well as tips from other employees) and the cash value of non monetary tips (such as a bottle of wine) each month. instructions and forms for reporting tips to employers are found in publication 1244. Your request asked how to calculate overtime pay in the following situation: during a single workweek, an employee worked 42 hours as a server and bartender. the employee received a cash wage of $2.13 for each hour worked as a server and $75.00 for each shift worked as a bartender. during the workweek in question, the employee worked 18 hours as. Under the flsa overtime is paid at a rate of time and a half of an employee’s regular rate, but with tipped employees this calculation often leads to various errors. for example, some employers attempt to calculate their tipped employee’s overtime pay based on their tip credit rate of $2.13 an hour.

Overtime Guidelines For Tipped Employees Workforce Payhub Your request asked how to calculate overtime pay in the following situation: during a single workweek, an employee worked 42 hours as a server and bartender. the employee received a cash wage of $2.13 for each hour worked as a server and $75.00 for each shift worked as a bartender. during the workweek in question, the employee worked 18 hours as. Under the flsa overtime is paid at a rate of time and a half of an employee’s regular rate, but with tipped employees this calculation often leads to various errors. for example, some employers attempt to calculate their tipped employee’s overtime pay based on their tip credit rate of $2.13 an hour.

Overtime For Tipped Employees Recap Steps More

Comments are closed.