Pin On 2015 Irs 1040 Form

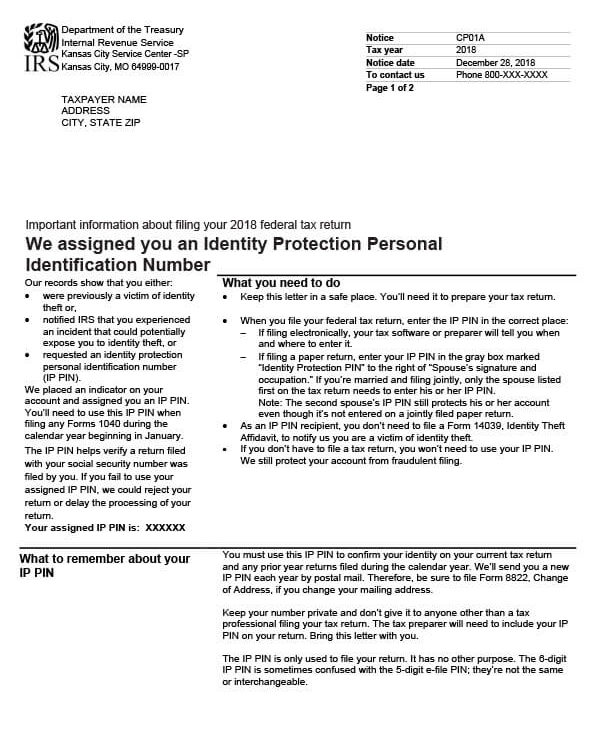

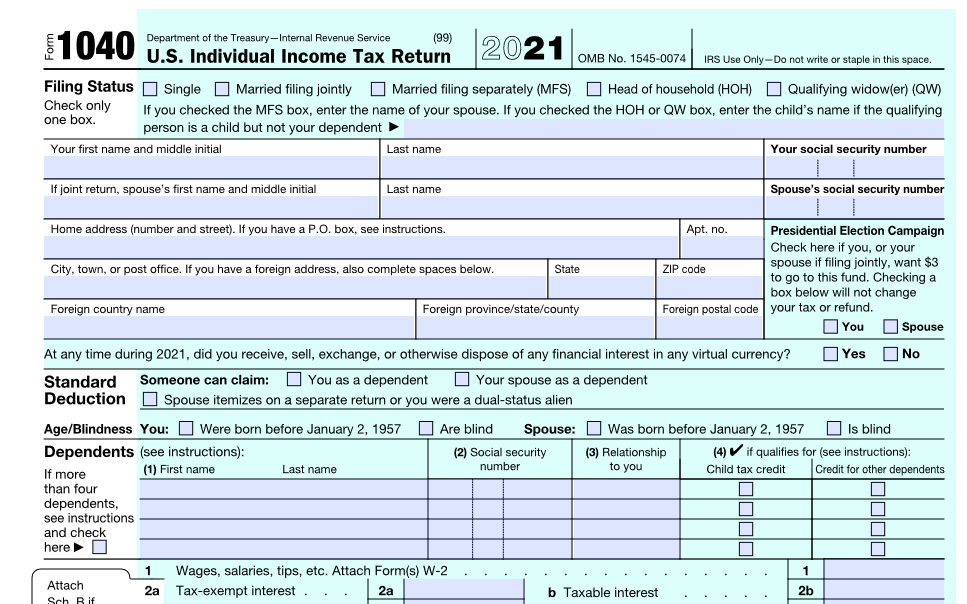

Irs Notice Cp01a Tax Defense Network The self select pin method ( personal identification number ) is one option for taxpayers to use when signing their electronic form 1040 and form 4868. the pin is any five numbers (except all zeros) the taxpayer chooses to enter as their electronic signature. taxpayers are required to use a pin when they file an electronic tax return using an. Using an ip pin to file. enter the six digit ip pin when prompted by your tax software product or provide it to your trusted tax professional preparing your tax return. the ip pin is used only on forms 1040, 1040 nr, 1040 pr, 1040 sr, and 1040 ss. correct ip pins must be entered on electronic and paper tax returns to avoid rejections and delays.

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal The regular efiling pin is 5 digits and will be encountered during the process of efiling. if you have a 6 digit ip pin to enter, here's where to enter it. · federal taxes tab. (or personal tab in home and business) · then sub tab " other tax situations ." · scroll down to " other return info ". 42 exemptions. if line 38 is $154,950 or less, multiply $4,000 by the number on line 6d. otherwise, see instructions. 43 taxable income. subtract line 42 from line 41. if line 42 is more than line 41, enter 0 . . 44 tax (see instructions). check if any from: a form(s) 8814 b form 4972 c. Only you have access to that number. the irs is asking for your last year's adjusted gross income (agi) in lieu of that pin number. you can use last year's agi. the original agi is the amount from your prior year originally filed return as accepted by irs. the amount can be located on: form 1040 line 38; form 1040a line 21; form 1040ez line 4. The irs self select pin is a five digit number of your choosing. any combination except all zeroes is allowed. you will find it on line 37 on form 1040 for the 2015 tax year that you filed in.

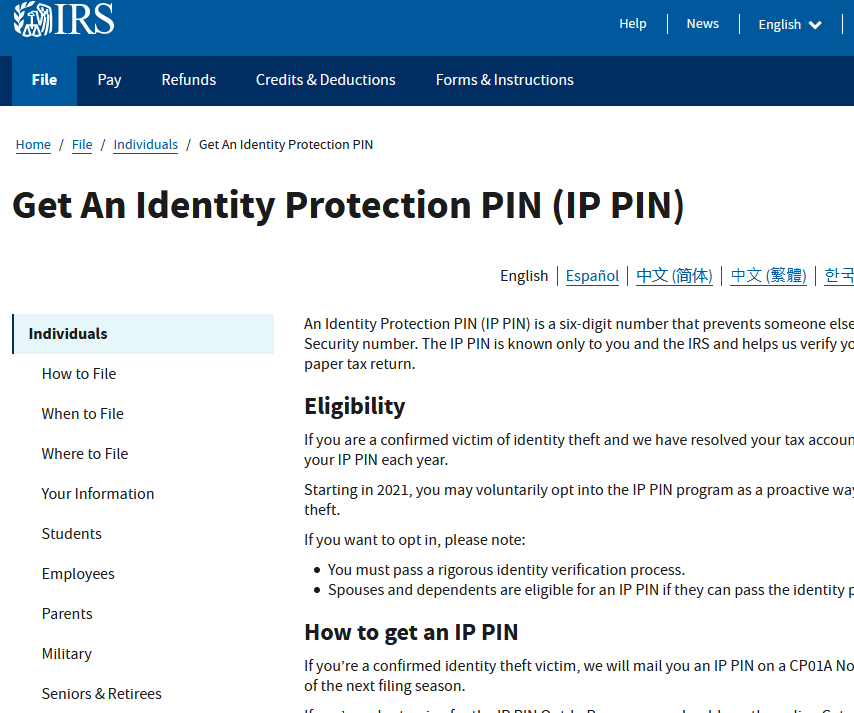

All Taxpayers Can Now Get An Irs Identity Protection Pin Only you have access to that number. the irs is asking for your last year's adjusted gross income (agi) in lieu of that pin number. you can use last year's agi. the original agi is the amount from your prior year originally filed return as accepted by irs. the amount can be located on: form 1040 line 38; form 1040a line 21; form 1040ez line 4. The irs self select pin is a five digit number of your choosing. any combination except all zeroes is allowed. you will find it on line 37 on form 1040 for the 2015 tax year that you filed in. The irs will use the telephone number provided on the form 15227 to call you, validate your identity, and assign you an ip pin for the next filing season. (for security reasons, the ip pin cannot be used for the current filing season. Self select pin. the self select pin allows taxpayers to electronically sign their e file return by entering a five digit pin into the tax software. the pin is any five numbers taxpayers choose to enter as their electronic signature. (volunteers may suggest taxpayers use their zip code.) the number cannot be all zeros. taxpayers do not need to.

Taxpayers With Balances Due Have Been Put On Notice By The Irs Cpa The irs will use the telephone number provided on the form 15227 to call you, validate your identity, and assign you an ip pin for the next filing season. (for security reasons, the ip pin cannot be used for the current filing season. Self select pin. the self select pin allows taxpayers to electronically sign their e file return by entering a five digit pin into the tax software. the pin is any five numbers taxpayers choose to enter as their electronic signature. (volunteers may suggest taxpayers use their zip code.) the number cannot be all zeros. taxpayers do not need to.

Comments are closed.