Pin On Rules Of Debit And Credit

Rules Of Debit And Credit Accounting Basics Accounting Education The rules of debits and credits. some accounts are increased by a debit and some are increased by a credit. an increase to an account on the left side of the equation (assets) is shown by an entry on the left side of the account (debit). therefore, those accounts are decreased by a credit. an increase to an account on the right side of the. Debit means left and credit means right. do not associate any of them with plus or minus yet. debit simply means left and credit means right – that's just it! "debit" is abbreviated as "dr." and "credit", "cr.". the terms originated from the latin terms "debere" or "debitum" which means "what is due", and "credere" or "creditum" which means.

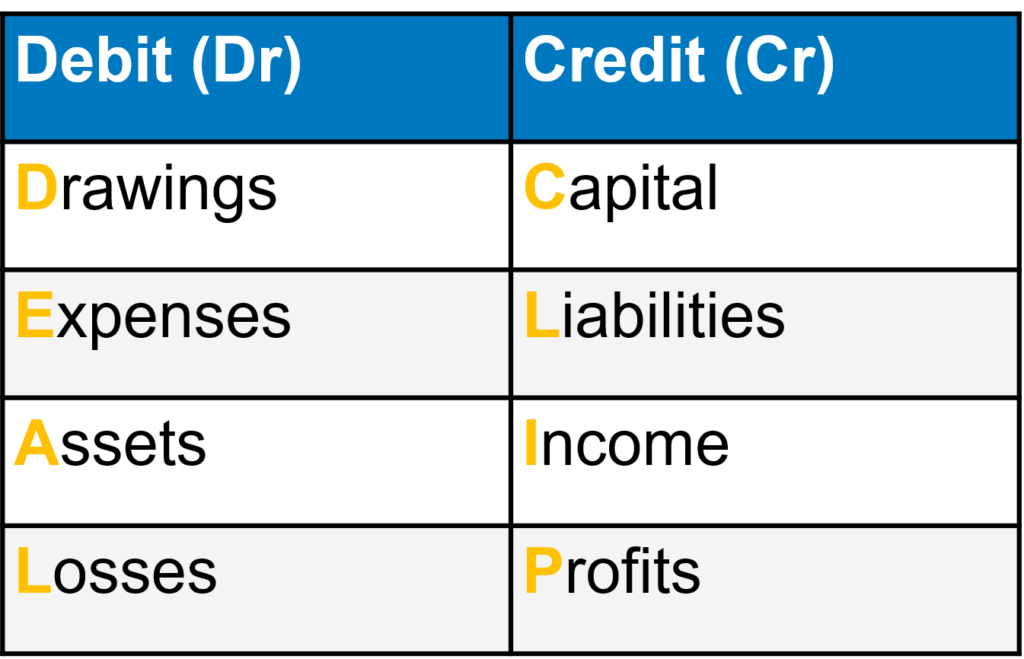

Rules Of Debit And Credit 8 Download Scientific Diagram The basic rules of debit and credit applicable to various classifications of accounts are listed below: (1). asset accounts: normal balance: debit. rule: an increase is recorded on the debit side and a decrease is recorded on the credit side of all asset accounts. (2). Rule 1: debits increase expenses, assets, and dividends. all accounts that normally contain a debit balance will increase in amount when a debit (left column) is added to them, and reduced when a credit (right column) is added to them. the types of accounts to which this rule applies are expenses, assets, and dividends. Debit and credit are simply additions to or subtraction from an account. in accounting, debit refers to the left hand side of any account and credit refers to the right hand side. asset, expenses and losses accounts normally have debit balances; liability, income and capital accounts normally have credit balances. Assets = liabilities equity the accounting equation must always be in balance and the rules of debit and credit enforce this balance. in each business transaction we record, the total dollar amount of debits must equal the total dollar amount of credits. when we debit one account (or accounts) for $100, we must credit another account (or.

1 Rules Of Debit And Credit Onlinestudy Guru Debit and credit are simply additions to or subtraction from an account. in accounting, debit refers to the left hand side of any account and credit refers to the right hand side. asset, expenses and losses accounts normally have debit balances; liability, income and capital accounts normally have credit balances. Assets = liabilities equity the accounting equation must always be in balance and the rules of debit and credit enforce this balance. in each business transaction we record, the total dollar amount of debits must equal the total dollar amount of credits. when we debit one account (or accounts) for $100, we must credit another account (or. Revenues, liabilities, and equity: credit to increase: adding a credit here boosts the balance. for example, to record a sales revenue, a credit entry will be made to your revenue account, showing an increase in the revenue. debit to decrease: debits reduce the balance in these accounts. Debit and credit represent two sides (columns) of an account (i.e., a debit column and a credit column). debit (dr.) involves making an entry on the left side and credit (cr.) involves making an entry on the right side. today, accountants adopt practices like the use of these columns to keep records that are used on a long term basis. they are.

Comments are closed.