Portfolio Recovery Time Definition Importance Strategies

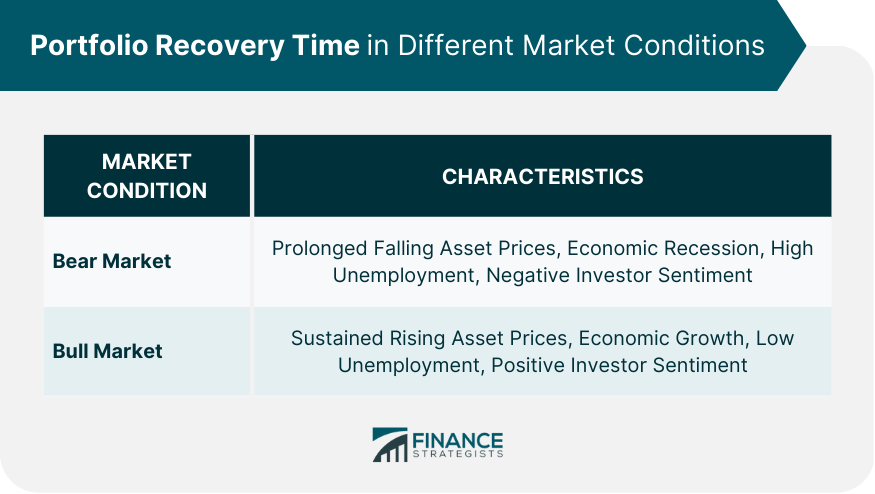

Portfolio Recovery Time Definition Importance Strategies Portfolio recovery time refers to the period it takes for an investment portfolio to regain its value after a significant decline, such as during a market downturn. understanding portfolio recovery time is important for investors, as it helps them make informed decisions on asset allocation, risk management, and investment strategies to. How long will it take the market to recover?.

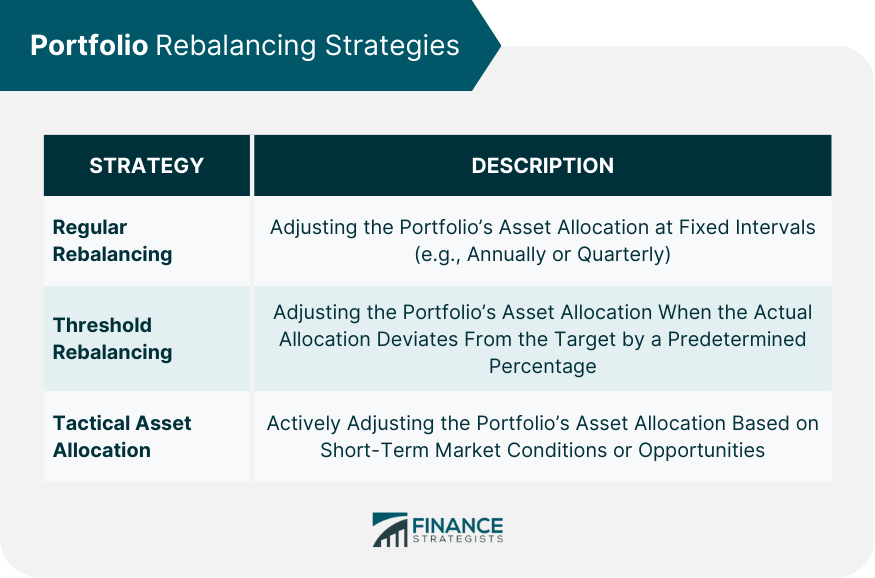

Portfolio Recovery Time Definition Importance Strategies Rebalancing: definition, why it's important, types and. Rebalancing in action. 1) financial stability: portfolio recovery is vital to maintain financial stability. if your portfolio is declining, it can interrupt your overall financial well being. recovering a portfolio supports financial stability by addressing underperforming assets. 2) maximize investment return: with the help of portfolio recovery, you can maximize. Six strategies to protect against loss: 1. limit downside risk while maintaining equity market exposure through a market linked cd 10 2. protect stock positions by buying puts 10 3. limit downside risk with an equity collar 11 4. review and rebalance fixed income portfolio 12 5. hedge against inflation and rising interest rates 12 6.

Portfolio Recovery Time Definition Importance Strategies 1) financial stability: portfolio recovery is vital to maintain financial stability. if your portfolio is declining, it can interrupt your overall financial well being. recovering a portfolio supports financial stability by addressing underperforming assets. 2) maximize investment return: with the help of portfolio recovery, you can maximize. Six strategies to protect against loss: 1. limit downside risk while maintaining equity market exposure through a market linked cd 10 2. protect stock positions by buying puts 10 3. limit downside risk with an equity collar 11 4. review and rebalance fixed income portfolio 12 5. hedge against inflation and rising interest rates 12 6. Portfolio management: definition, types, and strategies. Portfolio management is the process of making decisions about investment mix, asset allocation, and balancing risk versus performance. the goal is to optimize the return on investment (roi) while minimizing the risks associated with investments. it involves analyzing the investor’s financial goals, market conditions, and risk tolerance to.

Comments are closed.