Ppt What Is Invoice Finance How Does It Work Myndfin Powerpoint

Ppt What Is Invoice Discounting And How Does It Work Mynd Fintech This procedure is known as invoice financing. invoice finance refers to various invoice based lending methods, including invoice discounting, selective invoice discounting, invoice factoring, and spot factoring. invoice finance obtains advances against unpaid bills invoices from clients customers, accelerating the cash flow. Invoice finance is one of the best options for businesses to boost their cash flow. invoice finance obtains advances against unpaid invoices from clients, accelerating the cash flow. – a free powerpoint ppt presentation (displayed as an html5 slide show) on powershow id: 95152c n2njz.

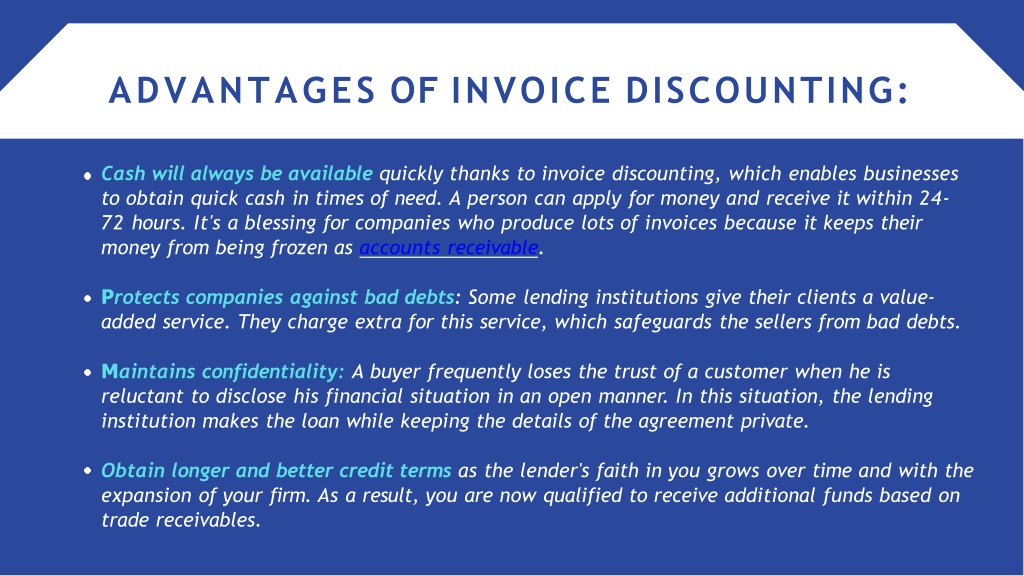

Ppt What Is Invoice Finance How Does It Work Myndfin Powerpoint Invoice finance is one of the best options for businesses to boost their cash flow. invoice finance obtains advances against unpaid invoices from clients, accelerating the cash flow. slideshow 11417308 by digi7. Invoice financing, sometimes referred to as debtor finance or accounts receivable finance, allows businesses to borrow money against their outstanding invoices. if approved, businesses generally receive up to 85 per cent of the value of their invoices, with the remaining 15 per cent paid upon receipt of payment from the customer. Invoice discounting is a financial practice adopted by businesses to support their working capital requirements in a hassle free and cost effective manner. when a business offers its goods or services for sale to a buyer, it raises an invoice against it. the buyer promises to settle the invoice later, which could be anything from 1 month to 6. Invoice factoring. invoice factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third party financial company, known as a factor, at a discount. the factor advances a significant portion of the invoice value upfront, typically around 70 90%, and then collects payments directly from the business’s.

Comments are closed.